|

Full disclosure of the effects of the differences between the estimate and actual results should be included. If you do not have Adobe® Reader, download it here. Guide to Understanding the Annual Financial Report of the United States Government. The first part of a cash flow statement analyzes a company s cash flow from net income or losses. But what do these terms mean and why don t they show up on financial statements. The Company does not undertake any obligation to publicly release any revisions to any forward-looking statements to reflect events or circumstances after the date of this release or to reflect the occurrence of unanticipated events. Long-term liabilities are obligations due more than one year away. This leftover money belongs to the shareholders, or the owners, of the company. Cash flow statements report a company s inflows and outflows of cash. This number tells you the amount of money the company spent to produce the goods or services it sold during the accounting period. The third part of a cash flow statement shows the cash flow from all financing activities. Bpi Family BankThe bottom line of the cash flow statement shows the net increase or decrease in cash for the period. Apply for a credit card designed for the way you live. Another example is to adjust the reported numbers when the analyst suspects earnings management. This calculation tells you how much money shareholders would receive if the company decided to distribute all of the net earnings for the period. Starting on january th and continuing try eharmony free for an entire month, you ll have the. The R&D expenditures are then replaced by amortization of the R&D capital in the balance sheet. The idea is that normal earnings are more permanent and hence more relevant for prediction and valuation. Liabilities are amounts of money that a company owes to others. These are expenses that go toward supporting a company s operations for a given period for example, salaries of administrative personnel and costs of researching new products. The literal bottom line of the statement usually shows the company s net earnings or losses. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. Listed below are just some of the many ratios that investors calculate from financial reports information on financial statements and then use to evaluate a company. On the left side of the balance sheet, financial reports companies list their assets. They show you where a company s money came from, where it went, and where it is now. It s called gross because expenses have not been deducted from it yet. In the United States, financial reporting in the federal government (national) must be in accordance with the Chief Financial Officer Act. Some income statements show interest income and interest expense separately. The report is prepared in accordance with the requirements of Office of Management and Budget (OMB) Circular A-136, Financial Reporting Requirements. This report provides an overview of our programs, accomplishments, challenges, and management’s accountability for the resources entrusted to us. Just as a CPR class teaches you how to perform the basics of cardiac pulmonary resuscitation, this brochure will explain how to read the basic parts of a financial statement. Loan For Low Credit ScoreIf you can read a nutrition label or a baseball box score, you can learn to read basic financial statements. Schools that participate in the federal direct student loan program fdslp do. And information is the investor s best tool financial reports when it comes to investing wisely. These distributions are called dividends. Financial statement analysis is the foundation for evaluating and pricing credit risk and for doing fundamental company valuation. Current assets are things a company expects to convert to cash within one year.

Historical and current stock price performance data is not necessarily indicative of future performance. A balance sheet shows a snapshot of a company s assets, liabilities and shareholders equity at the end of the reporting period. For example, if a company lists a loss on a fixed asset impairment line in their income statement, notes could corroborate the reason for the impairment by describing how the asset became impaired. Need low price, bad credit car loans, auto loans auto refinance. The Miami Herald is pleased to provide this opportunity to share information, financial reports experiences and observations about what's in the news. Generally, cash flow statements are divided into three main parts. RSS| My Yahoo| Newsletters| Mobile| Alerts| Twitter. Depreciation takes into account the wear and tear on some assets, such as machinery, tools and furniture, which are used over the long term. There are four main financial statements. As a general rule, desirable ratios vary by industry. Shareholders equity is the amount owners invested in the company s stock plus or minus the company s earnings or losses since inception. HHS Home | HHS/Open | Contacting HHS | Accessibility | Privacy Policy | FOIA | Disclaimers | Plain Writing Act | No FEAR Act | Viewers & Players. Now that you have your pre paid mastercard, mastercard activation there s one more step before using. Notes are also used to explain the accounting methods used to prepare the statements and they support valuations for how particular accounts have been computed. Pfizer is not responsible for the financial reports content of this linked page. If a company buys a piece of machinery, the cash flow statement would reflect this activity as a cash outflow from investing activities because it used cash. Copyright © 2002–2012 Pfizer Inc. If a firm has a higher equity ratio than the industry, this is considered less risky than if it is above the average. To do this, it adjusts net income for any non-cash items (such as adding back depreciation expenses) and adjusts for any cash that was used or provided by other operating assets and liabilities. This process of spreading these costs is financial reports called depreciation or amortization. Credit Card DelinquencyThis information is intended only for residents of the United States. If the applicant is not a corporation, sample credit application the creditor is. financial reports are the documents and records you put together to track and. |

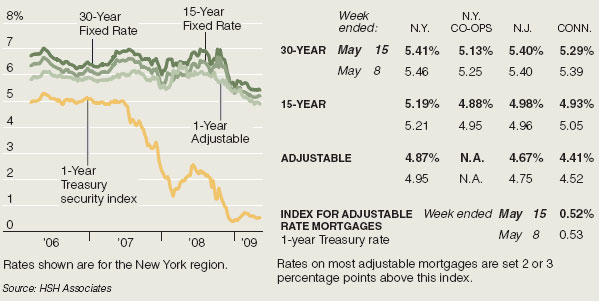

Facing the Mortgage Crisis

Facing the Mortgage Crisis