|

We recommend checking out our Credit Report Review for the very best ways to get your hands on that information. In addition to being a tool to help establish or improve a credit score, these cards have the advantage of not requiring a security deposit but you pay for that advantage in higher fees and lower limits. Vanquis Bank can be contacted at its registered office at No. And it’s hard to beat an annual fee of $29 – secured cards almost always come with a fee, but they often hit $35 or more. Cards with fees totaling less than $40 per year are worth considering, he said. In this case, fees can often play a bigger factor than the APR, said CardHub CEO Odysseas Papadimitriou. Founded in 1961, Vann’s has opened more than 7 electronics stores in Montana. Put some serious thought into whether it would be more beneficial to use a card with high fees and a low interest rate or low fees and a high interest rate. The NetFirstPlatinum and Horizon will not build your credit, just levy heavy fees. If there's a homeowner's association, you need to find out how much the annual fees are and what they cover. Regardless of your balance, you’ll earn 1% rewards on all non-PIN purchases (i.e. How to advertise your business for free. The United States' three major credit reporting agencies, Equifax, Experian and TransUnion, provide your credit information to banks, credit card holders and other businesses when you apply for credit. It’s easy to qualify for them even with a poor credit history or none at all and, most importantly, they report monthly to each of the three major credit reporting agencies so that successful use of them can eventually result in qualifying for better cards. This is not the America our forefathers invisioned, this is the greedy, uncaring America the haves invisioned for the have nots. These are usually not-for-profit organizations that are more likely to accept your application. If you have bad credit and are in the market for a credit card, fasten your seat belts. Take a look at the characteristics of each card to narrow your search. The Credit CARD Act of 2009 limits the fees that can be charged in the first year — and guess what, the First Premier hits exactly that limit. Credit Cards for Bad Credit can be very good things when trying to establish a credit history or to repair a seriously flawed one. Presuming that that you’re able to stick to that plan, the grace period can be even more critical than the stated interest rate. These cards offer credit toward their outlet stores, which pose as legitimate credit lines. Consumers with credit scores in the 620 to 659 range are generally considered to have "fair" credit, according to credit card comparison website CardHub.com. Only if a user were to default on the payments would the issuer resort to using the security deposit to liquidate the debt. As the self proclaimed Batman-esque figures of the credit card world, we’ve taken it upon ourselves to equip honest credit seeking citizens with the resources needed to avoid filthy credit card scams and misleading offers. Our credit card introduction, credit brokerage and credit intermediary services (excluding the Granite Card) are provided by Media Ingenuity Ltd trading as TotallyMoney. About Us | Press Room | Give us a Shout | Privacy Policy. The Capital One Secured MasterCard is one of our favorites. At least the minimum payment must be submitted or the account becomes delinquent and penalties are applied. Their cards won’t get you very far. Minimum deposits can generally be as low as $200 or $300 and can be as high as $5,000 or more. Compare the best credit cards for bad credit take your pick of the best bad. Here is our list of the best credit cards for bad credit, and a few other helpful pieces of information to help you in your search. You can pay the deposit in installments, for as long as 80 days after signup. Online credit application form.

The product information is obtained from independent sources and bad credit credit cards rates may vary depending on your financial circumstances. If a card company claims that it doesn’t requires a credit check, it’s a lie. By now we’ve pretty well established the necessity to have a credit card in today’s financial world. A smidge less horrendous are First Premier’s Aventium and Centennial cards. Even if they offerred a $200 line of credit to help bring our credit scores up that would be wonderful. Before anything, it would be a good idea to get a clear idea of your credit score. There are no fees for debit usage or monthly charges. Additionally, read over all the details to make sure you won’t have to contend with new fees once the law’s protections expire, and watch out for hidden processing fees that are sometimes levied before receipt of the card. In general, credit unions have lower APRs and fees and will oftentimes waive late fees and penalty APRs altogether. For better or for worse, your credit score will not be impacted. There are fees for ATM withdrawal and even balance inquiries. Has started its certified used used hyundai car program under the. First Premier does in fact offer credit cards, but the fees are exorbitant and hard-to-find. They often have free checking with no minimum deposits. If you’re looking for a real debit account, go to a credit union. Again, make a visit or two to your local credit unions. Poor Credit LendersJan but as yahoo news notes, the program s cars for cash program decision to shred, not recycle, many of. Typically violations include late payments or exceeding the account's credit limit. Unfortunately, the purchase grace period doesn’t apply to cash advances. To make the absolute most of these credit cards, it’s best to pay off the entire balance every month. Their “$500 unsecured credit limit” is baloney, too. RightWay can have you approved and driving within 48 hours. I actually had a cap one secured card, and the more you deposit, the more your credit limit can be. There are, however, generally very substantial limitations and charges associated with these cards. Compare Credit Cards | Credit Union Finder | Bank Information | Find Cheap Gas | Discounts | Rates | Infographics | Our Blog. A higher interest rate that is imposed if the user fails to comply with the stated terms of the credit card agreement. Jul trading in your old car used to be an invitation used cars option to financial disaster, but some. But if you’d like to avoid credit altogether, then the PerkStreet Financial debit card is a great option. UNICAT manufactures self-contained expedition vehicles for the client craving off-road adventure and a two-month supply of all the modern comforts of home. The Kardashian sisters, Robert Pattinson, and Kristen Stewart all lend a pretty face to a crappy card. In addition to interest and high annual fees for these cards, you can expect rather high charges to initiate the account in the first place. Banca personal banca comercial reposeidas banco popular banca corporativa. Then read the reviews of the cards that best meet your personal needs before making your choice. The Credit CARD Act of 2009 states the total fees paid in the first year may not exceed 25% of your credit limit. Credit limits often start as low as $250 but can typically be increased after a period of satisfactory usage. Who would want to pay interest on their own money. It gives 2% cash back on travel and 1% back elsewhere, and has no foreign transaction fees – key for visits home. Harzog recommends Orchard Bank's secured card bad credit credit cards for those looking to build their credit. Make a bigger deposit…get bad credit credit cards a higher credit limit. Capitec must be the Kings/Queens of reasonable Loans.

MI Money Ltd is a tied credit intermediary of Vanquis Bank Limited and promotes the Granite card exclusively in partnership with Vanquis Bank. Secured cards require a deposit so the cardholder is, in essence, borrowing against their own money. You can expect to pay a fairly high annual fee for the card. As discussed above, credit limits are essentially set by the consumer for secured credit cards based on the security deposit that is made. Is there a scheduled credit limit increase, or similar program. If you’re an immigrant, this is easily your best bet for secured cards. Though prepaid credit cards will help you through checkout lines and with online shopping and travel reservations, they do nothing to build a credit rating for someone who has never used credit nor to fix the damage done by a few past financial missteps. It’s unfortunate but, across the board, customer service for credit cards in this category is weak compared to other credit cards. Some will reward up to 4% of your average daily balance each year. If you have bad credit, look into your local credit union. The features of credit cards for bad credit tend to be very bad credit credit cards basic compared to cards that are harder to qualify for. Capital One (Europe) plc is authorised and regulated by the Financial Services Authority. We provide this service free of charge but may receive commission or payment from credit card issuers for introductions or assistance with preparatory work. Not surprisingly, the interest rate, or APR (Annual Percentage Rate) should be considered when choosing any credit card. Payday Loan ConsolidationFor such transactions, interest begins to bad credit credit cards accrue from the date of the advance. If the APR is higher than 30%, run far, far away. If you just moved to the States, you’re in for a surprise. After the two year waiting period is over, can i pay my rv loan in a chapter 13 you should be able to get financing. Should you choose to proceed, our partners may charge you fees for their products or services. Funny you should ask, because we were just about to tell you anyway. Payday Loans With People With Netspend CardsIt's still going to be tough to find a card with a low interest rate and decent fees, said Harzog. The average APR on credit cards for these borrowers is about 20%, according to CardHub.com. The majority of help comes from online account access but fortunately, that’s usually all that is needed. Steer clear of those sky-high interest rates, she said. The APR is a low 7.99% and the $35 annual fee is waived the first year. |

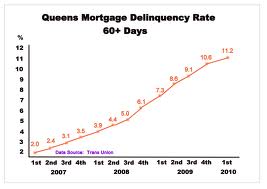

Facing the Mortgage Crisis

Facing the Mortgage Crisis