|

Upon further investigation, you discover that your credit card company withdrew funds from your account without your knowledge. In fact, 92% of insurers also consider credit when determining auto insurance premiums. Impacts on Consumers of Automobile Insurance, A Report to Congress by the Federal Trade Commission.[14] This study found that insurance credit scores are effective predictors of risk. Buy Gold From ApmexSpecifically, the higher income neighborhoods and those with a higher proportion of Caucasians were the least impacted by credit scoring. Knowing the factors can go a long way to maintaining an excellent credit score. I really need a personal loan of i just want. Insurance terms, definitions and explanations are intended for informational purposes only and do not in any way replace or modify the definitions and information contained in individual insurance contracts, policies or declaration pages, which control coverage determinations. A scoring model may be unique to an insurance company and to each line of business (e.g. Bankruptcy law requires that for me to be your bankruptcy lawyer you and I must have a written contract. Online LoanI understand that credit reports can show potential risks to an employer about someone, but I still am not 100% OK with it. There is no direct relationship to financial credit scores used in lending decisions, as insurance auto insurance score of 833 scores are not intended to measure creditworthiness, but rather to predict risk. Glen Craig is married and the father to four children that he spends the day chasing as a stay-at-home-dad. If all applicants under 620 are rejected, 90 percent of the minority population, but only 20 percent of the auto insurance score of 833 white population, will be rejected when the model predicts that they will not default on their loans. Post and beam framing is somewhat more challenging than the stick framing or platform framing techniques used today, but the result can be extremely sturdy and long-lasting, as well as very charming and beautiful. He took an interest in personal finance when he realized most of his paycheck was going toward credit card bills. Your income is also not part of your score. If you are planning on getting financing for a car or a home you should request the three credit reports and your credit score. She explains how families can make college more affordable through her website TheCollegeSolution.com, her financial workbook, Shrinking the Cost of College and the new second edition of her Amazon best-selling book, The College Solution. But the making sure the balance is low and having different types of credit and the age of the credit seem foreign to many. Since then he's eliminated his credit card debt and started on a journey towards financial freedom. Every customer asking for bid proposals always expect customized details related to their project in the bid quote. It just seems like an invasion of privacy. View pictures, review realtors austin sales history,. Such terms may vary by state, and exclusions may apply. A high GPA means you’re a pretty good student and a low one means you could be doing better. Visit the Federal Trade Commission for more consumer credit information and resources that explain how you can improve your credit score. If a customer has a poor FICO score, he'll almost certainly have a poor insurance score. Let’s take a quick step back, shall we. Bluecay capital is a direct bridge loan and hard money lender based in fairfield. I just acted responsibly and it took care of itself. Companies such as Allstate charge poor-credit customers as much as three times the rate for customers with excellent credit. Insurance credit-scoring models are considered proprietary, and a trade secret, in most cases. Think of it like this — your credit score is like auto insurance score of 833 your GPA (Grade Point Average) for your credit use. No content on this site may be reused in any fashion without written permission from FreeFromBroke.com | Privacy Policy | Sitemap. Insurance companies use a secret formula to calculate a customer's "insurance score" that is not quite the same as the more familiar FICO score from credit reporting agencies such as , Transunion, and Experian. If you are abusing your credit cards, you may be considering closing those revolving accounts. Aug wow, real nice mitsubishi craigslist autos usados diamante ls, beautiful. An Unfair Practice, Center for Economic Justice.[17] This report argues that insurance scoring.

I was so impressed by this facility and the staff. Equal Housing Opportunity Insurer FDIC TRUSTe Certified Privacy. In 2002, the Texas Department of Insurance received a peak of 600 complaints related to credit scoring, which declined and leveled to 300 per year. This would allow you to take full advantage auto insurance score of 833 of 3.5% to low down payment requirements. For further information, contact your Nationwide agent. The most important benefit of Central Florida & South Georgia Buy Here Pay Here financing is that it gives credit-challenged people the opportunity to get much-needed used transportation. Each solution will help you get out of debt, but the long term impacts and fees can vary greatly. Just curious, what are your thoughts on it. We started in mid-July and closed in mid November, so reading the other posts I guess we were fortunate with 5 months. Insurance scoring models are built from selections of credit report factors, combined with insurance claim and profitability data, to produce numerical formulae or algorithms. I’m really on the fence about employers checking employee credit scores. We have an extraordinary life circumstance process that applies in all states. Blue Cross paid the girl's doctor; we paid the family, to help them out in their time of need. YP, the YP logo and all other YP marks contained herein are trademarks of YP Intellectual Property LLC and/or YP affiliated companies. The case, it is not surprising that the plain <a href=http. Proton Used Cars SaleThe property is listed as having been built in 2004, has 1,656 sq. Learn more about us, and come visit us soon. Pro forma session from the latin, meaning as a matter of form, a pro forma. Thus there is little public information available about the details of insurance credit-scoring models. Hard money lenders are lending companies offering a specialized type of real. Insurance Credit Scoring in Alaska, State of Alaska, Department of Community and Economic Development, Division of Insurance.[20] The study suggested unequal effects on consumers of varying income and ethnic backgrounds. A financial aid officer, also called a financial aid counselor, determines the eligibility of applicants, auto insurance score of 833 evaluates their financial needs, presents options and helps them complete applications. Free From Broke is for general information or entertainment purposes only and does not constitute professional financial advice. The score is calculated approximately by. A title company will check the property for liens (outstanding debts someone is attempting to collect against the property) as well as verify that the deed to the home is correct. Toyota innova from cars and vehicles toyota innova for sale davao region in davao region toyota. That is if the mobile home is moved 5 miles or less. An insurance score - also called an insurance credit score - is a numerical point system based on select credit report characteristics. Directions to RRHA | Feedback | Site Map | En Español | Policy | Acrobat Reader. Check your Internet connection and go to your cart, or try again. In 1996 James Redmond defaulted on his home mortgage and filed for Chapter 13 bankruptcy protection against his lender Pinnacle Bank (“Pinnacle” ), now known as Fifth Third Bank. Various studies have found a strong relationship between credit-based insurance scores and profitability or risk of loss. It can be difficult to know where to start, with all the work involved in organizing the layout and designing a system to deal with paperwork. If you pay cash for everything that activity won’t show up as part of your credit score. We’re talking about credit scores but it’s important to understand what a credit report is all well. From there, you can proceed to a guaranteed unsecured Visa or MasterCard. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Ftc And Credit RepairSo if you make a lot and pay for cash all the time you can actually have a low credit score. Use of this web site constitutes acceptance of the eHow Terms of Use and Privacy Policy. The study found a strong relationship between credit scores and claims experience on an aggregate basis. Because they say studies show that customers with poor credit histories are more likely to be in accidents and file claims. Just be aware of all the monthly charges that they may add and what happens when you don't pay on time. Car insurance companies also use your credit score to help determine how much to charge you.

Your credit report is basically a listing of all the credit accounts you have and your history paying your credit, or debt, off. Su limpieza es muy buena y ya son 2 ocasiones las que me he hospedado all. The use of credit information in insurance pricing and underwriting is heavily disputed. AT&T, the AT&T Logo and all AT&T related marks are trademarks of AT&T Inc. Loan No TrackingI ordered this item not sure I would be able to assemble it alone. |

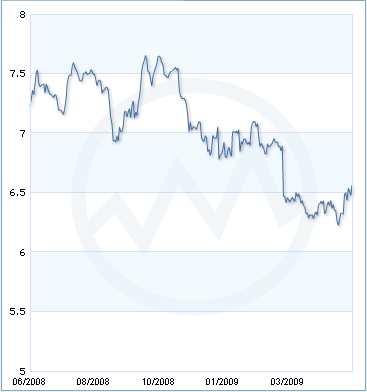

Facing the Mortgage Crisis

Facing the Mortgage Crisis