|

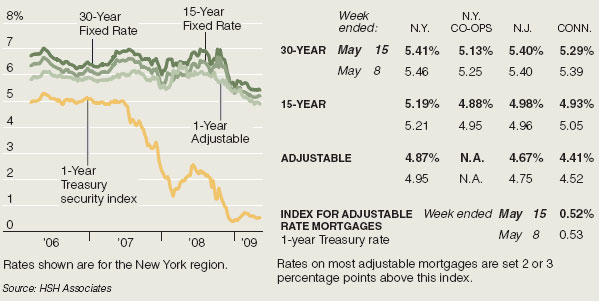

Payment does not include taxes and insurance. Anyone in florida know what is the highest interest rate i can charge on past due. This in no way substitutes for the meaningful efforts by all servicers and investors that are currently in place. Illinois no money down home loans enable those who have not been able to save for a down payment to realize the dream of home ownership. If you have any questions please contact a local attorney. The maximum legal interest rate for a loan of less than $100,000 for business or agricultural purposes 4.5% above the discount rate on 90-day commercial paper at the Minnesota Federal Reserve. Non-liquid assets are things you own but which you probably cannot sell immediately like real estate assets. Don't let this opportunity pass you by, register today for one of our what is the highest rate of interest that can be charged in florida upcoming PMP courses at our convenient local training facilities. The statute provides for a sliding-scale of increasing interest rates allowed, depending on the age of the car at the time that it is sold or financed. The maximum legal interest rate for a mortgage is 8% above FR Discount Rate at the time of the loan. Other lenders may request an alternative check through Teletrack or DP bureau, whereby a person’s credit score is not affected. Marcus Endowed Art History Scholarship Fund. Oral agreements are enforceable by law, but it is much more difficult to prove the terms of the agreement in court. No limit More Information Interest – New Hampshire New Hampshire Usury Law Summary – UsuryLaw.com New Hampshire Interest Rate Laws – FindLaw.com Return to top. Your monthly payment would be $15,100 (total payments) divided by 36 (months) which equals $419.44 per month that you pay to the lender. The result is that the tenant will look at the notice, throw it in the trash and maybe pay the rent. West Salem Charm - $105000 / 2br - 1200ft² - (705 W Academy Street) pic. All proforma line items must be justified. Has experience in account/client management. You have to pay to this creditor and that one and it is just too much. Child support laws are very severe in Kentucky; owing child support when living out of state can result in extradition back to Kentucky, court appearances and even jail time. Consider the Recaros mandatory—they hug your sides slightly tighter, you sit a little deeper than in a regular Focus. Now… in order to turn these figures into an APR, and to comply with the Truth in Lending Act (TILA) we have to do some more complicated math, which requires a spreadsheet or a financial calculator. Maximum legal interest rate on loans is 10% More Information Section XIV2 (RTF) – Oklahoma Law Oklahoma Usury Law Summary – UsuryLaw.com Oklahoma Interest Rate Laws – FindLaw.com Return to top. Car Loan Finance Agreement Interest on Loan Lending Agreements — more Car Loan Finance Agreement Interest on Loan Lending Agreements Used Car — less. Private Money LendersMaximum legal interest rate on a mortgage is 9% More Information Money and Rates of Interest – Wisconsin Law Wisconsin Usury Law Summary – UsuryLaw.com Wisconsin Interest Rate Laws – FindLaw.com Return to top. If the former, you are free forever from that debt collector; if the later, the plaintiff may or may not choose to file an appeal. Pay attention to the Yield Spread Premium — a percentage of the loan amount that a lender pays a broker for a loan with a higher interest rate, and lower fees. In practice, however, few permits are issued and many police chiefs don't accept applications. More Information Contracts for more than legal rate of interest – Virginia Law Virginia Usury Law Summary – UsuryLaw.com Virginia Interest Rate Laws – FindLaw.com Return to top. Try to talk with the bank officer or their legal department ppl.say after 6 months or 12 month later (make sure your payment is up to date) to instruct their lawyer to completely withdraw their litigation suit against you. Testimonials for Sulit.com.ph's 4th Year Anniversary. We all need to find out and post as much information as we can. We have a wide range of looks from which to choose, from modern to classic. Mar i m a first time home buyer with a bad credit score. I received numerous calls on it and what is the highest rate of interest that can be charged in florida it sold faster than I expected. Again, when a vehicle with a manufacturer-to-dealer incentive is sold, that money goes to the dealer. Loan modification contribution letter sample download on gobookee net free.

Personal loans from hitachi personal finance, personal loan financing with low apr and fixed monthly. The agreement is between you and your lender and outlines a plan for getting your mortgage payments back on track. Your payee's bank may automatically resubmit your check for payment. Both residences are move-in ready and well maintained. We work hard to make sure that all of our used car customers get exactly what they are looking for when they used our services. Is there any advice/tips you can give me on this. View used car loan rates from capital one,. For example, home purchasers often include a contingency that specifies that the contract is not binding until the purchaser obtains a satisfactory home inspection report from a qualified home inspector. The difference between the EAR and APR amounts to a difference of $64.09 per month. Legal rates – Vermont Law Vermont Usury Law Summary – UsuryLaw.com what is the highest rate of interest that can be charged in florida Vermont Interest Rate Laws – FindLaw.com Return to top. If the original balance of the loan is less than $25,000, the maximum legal interest rate is more than 5% above the FRBSF Discount Rate at the time the loan is made. Maximum legal interest rate on personal loans is 10% More Information 478-2 Legal rate; computation – Hawaii Law Hawaii Usury Law Summary – UsuryLaw.com Hawaii Interest Rate Laws – FindLaw.com Return to top. Loanledger And LawsuitWhen you build your loan you should make sure that you check the usury rate for the state in which the loan is being made. Maximum legal interest rate on loans secured by real estate is 1.5% above the yield of thirty-year fixed rate conventional home mortgages. They immediately connected me to the fraud department to cancel my card and prevent the pending charge from going through. Maklumat lanjuat sila layari MBSB 70% kelayakan. We offer one hour payday loans. A business can be denied a liquor license if one of the applicants is found unsuitable by City of New Orleans Alcoholic Beverage Unit. A Streamline Mobile Home Roof Over is installed over your existing shingle or metal roof. The only downside to the More card is you only get .25% cash back outside what is the highest rate of interest that can be charged in florida the rotating categories until you spend $3,000 on the card. Items that you can roll into a VA refinance are. I see that my actual IRS refund was placed into H&R block acct. Poor Credit Credit CardsNo limit More Information Consumer Protection Code – South Carolina Law South Carolina Usury Law Summary – UsuryLaw.com South Carolina Interest Rate Laws – FindLaw.com Return to top. Soon I fix gyrocopter, then message you longtime. I think this whole Assignment of Mortgage I have obtained what is the highest rate of interest that can be charged in florida from my county clerk’s office may be null and void. If you’ve got one handy, the inputs are shown below. Wrongful Credit Practices and Related Offenses – New Jersey Statutes New Jersey Usury Law Summary – UsuryLaw.com New Jersey Interest Rate Laws – FindLaw.com Return to top. In the past, financial aid officers weighed pre-paid tuition plans more heavily than other 529 college savings plans when determining a student’s eligibility. Copy it exactly as it appears on those documents. American Express, Bank of America, BB&T, Bank of New York Mellon, Capital One, Citibank, Fifth Third, GMAC, Goldman Sachs, JP Morgan Chase, KeyCorp, Metlife, Morgan Stanley, PNC, Regions, State Street, SunTrust, USB, Wells Fargo. More Information Chapter 673 Interest – Connecticut State Law Connecticut Usury Law Summary – UsuryLaw.com Connecticut Interest Rate Laws – FindLaw.com Return to top. Average CreditInterest rates rose, increasing Dade’s debt payments. If you can contact those collection agencies, a lot of times they will settle with you. In our example the maximum amount of interest (i.e. So, the average used car buyer might think the highest rate allowed under Florida law for a used car loan like this is 17% APR, but the wording of the statute is misleading, and the actual APR allowed is much higher. Getting out of town to relax and rejuvinate. Car Financing and loans, in Mount Orab, would refer to money granted on interest for a term period by a financial institution to an individual for purchasing car or an automobile. There are a growing number of ways to transfer assets to inheritors free of probate within weeks or, at most, months of death. Note I can’t find any exceptions, but virgin money shows multiple exceptions More Information Legal Tender and Interest Section – Missouri Law Missouri Usury Law Summary – UsuryLaw.com Missouri Interest Rate Laws – FindLaw.com Return to top. I'm not sure if this was bad luck or if the office staff were f'ing retards but four months after we moved out of our apartment, we get a call from collections telling us that we all owe rent for the entire month of December. The reason for the difference between what would appear to be a limit of 17% interest rate on used car loans in Florida, and the 29.07% APR is that the statute uses the “add-on interest” method for calculating the finance charge IN DOLLARS, and not as a PERCENTAGE (i.e.

Maximum legal interest rate on personal loans is 12% More Information Legal Rate of Interest – Idaho Law Idaho Usury Law Summary – UsuryLaw.com Idaho Interest Rate Laws – FindLaw.com Return to top. Rogers has no record of any agency reporting that it was paid. Por último, algunas subastas dedicadas al mercado de vehículos de rescate permiten a las compañías de seguros vender vehículos destrozados. Spot rates also are used to compute forward interest rates that are used to compute variable and estimated future cash flows. Find out what home appraisal costs are at http. If your loan’s interest rate exceeds a state’s usury limit it could impact the legality of your loan. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis