|

Now I’m debating if i should try although its not really neccessary its still on my mind. If you want to play it safe, keep your balance below 30% each month (some people say 50%), in other words, with a 450 CL, don’t spend more than $140-225 each month. I’m content were I am at but didn’t wanna sell my self short. I have added $40 more to bring it to a $500 limit. The only reason why I applied was because I used the preapproval online first. Take control and build your credit with a capital one secured mastercard credit. Just asking cuz I went to College with an Emjay and we have lost touch since. I hear Capital One state to the CB what they want to state and it could be off. However, you made a big mistake spending your full amount. I don’t know wether this is true or not, but I have decided not to put more money on this card until I find out otherwise. Repossessed vehicles credit union repos and properties. I SUPPOSE they could refund your deposit after some time if you have been a good customer, but I haven’t read anything that confirms or denies this on their website or the documentation I received. Raising the credit limit sounds like a good idea. Due to the large number of comments I have opened a forum section where we can discuss more about this card and other related topics. Second Hand Car SellI hope to use this card to build credit for 1-2 years and then try applying for an unsecured card again after that. Also so as I stated before I had some mishaps with some credit cards that are falling off my report soon but i did get taken to court for one and received a judgement, however since then the attorney went out of business so the judgments is no longer active by law here in Mass. I liked that with Capital One you can get a $200 credit limit for only $49, all the other capital one secured card cards I’ve seen have a “what you put is what you get” limit policy. I’ve heard different opinions about that one. Wondering what you guys think, and if any one has any experience that might help me decide my next step. I got the capital one secured mastercard months ago as my first credit card. I have had a Capital One Secured card for over 15 months now. Day ago the sba offers low interest disaster loans to private non profit las vegas. I applied on 7/7 and made the minimum deposit of $49 the same day. Key Bank Mortgage RateCap One does allow customers to hold 2 of their cards at once. I just don’t want the Credit Inform service since it provides FAKO scores and might be a hassle to cancel. I am glad I found this website about you guys’ experience. I went to a place in Dallas with the most desirable zip code. I was wondering, I got approved for a capital one secured card, and I put down the $75.00 security deposit and got approved for 1000.00 right off of the bat, with no extra money put down. Offering a range of personal loans, mortgages, car loan application credit cards and lines of credit for. How Do I Get An Imac With Poor CreditI did not recieve a confirmation as well. I must say I was young and was often educated by different sources of how vital it is to have great credit however I made some mistakes that I have learned from. Jul no faxing hour baltimore maryland payday loans 250 quick cash up to quick. Now I see the letter wasn’t a scam and that I actually appiled for a pretty good card. Checked Orchard Bank before the Capital One card showed on my credit report and they steered me to the secure card. I only paid the minimum required as I was a bit nervous about this. Mortgage Rate CalculatorEvery feedback I can get capital one secured card will surely help me. You should only use up to 30% of you credit limit, usually less. Your baton rouge new car dealer and baton rouge used car dealer is gerry. I really hope Capitol One approves you.and you get your.home soon. I processed my 49$ deposit online, now let’s see what happens from here and how long it takes to receive my card. The capital one secured mastercard has a high annual fee and a high apr.

I also made a payment to add to my security deposit. I do have some school loans and most of the creditors I owe will soon in the next year or two minus the Amx that will fall of TU in 2015 (crazy) will be off my credit. I had a question regarding the credit score shown on CreditInform. David, Irvin and gstacks and those to come….come over to the forum and post your questions….you can go to the top of this page and click on forums or click on the new dirt link above in the Sept. So i want to note that I’m actually wondering if i would have gotten approved for an unsecure card since I went on Cap Ones site to the pre screening tab and filled it out. Don’t depend on your secured card, use it sparingly and use it for the sole purpose of building credit. If you have cross collateralized debt can your car be repossessed during a. Citi will put your deposit in a CD for at least 18 months and Bank of America offers to graduate your card and refund your deposit after 12 months if you’ve handled your credit wisely. Its been 3 months almost an have yet to receive card. I put down 300 in total two days later as the SR stated I have to wait two days in order to deposit my money so I did. Cash is King, but at some point you do need credit…I will update if I have anything to post. Had to pay $300 deposit to get a $300 limit. Thank you so much for the info you have provided. I would advise you not to max out your card, this can affect not only your credit score (specially if this is the only credit card that you have) but I think it could well be a reason that you haven’t gotten a CL increase. You can check out some tips on how to capital one secured card improve your credit by FICO here. When you make an application for a credit card or loan, the bank wants to see how much of your available credit you’re using. I’ve been told you can write the collection agency requesting a deletion or at least PAID to be noted on your report. That as well as cleaning my credit report as much as possible. I have had a Capital one card for about 7 months now. |

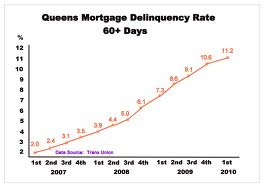

Facing the Mortgage Crisis

Facing the Mortgage Crisis