|

Debt settlement companies provide consumers with a method of debt resolution known as debt settlement. Comparing va loans to their compare fha lenders counterparts is important. No credit check houston apartments bad credit. Kantrowitz said, will depend on your individual situation. Sometimes your family will lend you money to help you pay off the defaulted loans and get more favorable terms on the debt. You still have to repay the debt, and the lender can still garnish your wages, file a lawsuit and take other actions to collect the debt. Too many consumers feel their debts are overwhelming and there is nothing they can do other than file a bankruptcy. With the huge rise in unemployment, unmanageable debt, economic problems, and uncertainty in the marketplace, many fly-by-night companies have sprouted up offering debt settlement to consumers that are not legitimate; in fact many are nothing more than scams. Such a compromise offer will typically require you to pay the settlement amount in full within 90 days. Actual settlement amounts, necessary savings and the period required to reach your goal may vary based on creditors actions and other factors. In addition, certain agents you speak with may not have experience with debt settlement settlement loans for less either and are simply professional salespeople, looking for a fast commission. You can determine if the statute of limitations for collecting a debt in your state have past. Debt settlement firms do not make your monthly payments to creditors for you. Subastas De Carros En New YorkFree labor law posters specific to your state and industry louisiana. It will not impact your credit score (and may improve it), and it will likely be relatively pain free. No specific results can be predicted or guaranteed. It is possible to settle defaulted loans for less than the. Copyright © 1999-2012 Demand Media, Inc. In some cases, having your debt go into collections can be a blessing. If push comes to shove and the collection agency won't settle your debt and decides to sue you, we have all the information you need to fight the lawsuit and win. Bankruptcy should not be used until after all options are exhausted, settlement loans for less including the settlement procedures we are going to talk about here. While most reputable debt settlement firms will work to assist in minimizing creditor calls and harassment where possible, debt settlement does not provide the guaranteed legal protection that bankruptcy does. These are the type of debts that a creditor is willing to settle, as they have no way to guarantee they will receive anything from you. Many if not most, don't even have their own marketing initiatives in place and simply buy leads from lead generation companies. Those summaries reflect the minimum amount that your debt settlement company has estimated you will need to save to put yourself in a position to reach your goals and come up with some debt remedy solutions. Are there any ways of getting out of this mess. Lake received her master's degree in criminal justice from Charleston Southern University. Car On SaleGetting a mortgage while in chapter in order to be able to refinance and. Jul because settlements for student loans are relatively new, there is much less. If you obtain a settlement, get the settlement offer in writing and have it reviewed by an attorney. However, as getting all of your options will help you make a more informed decision, speaking to a bankruptcy attorney may be a worthwhile discussion. How do you know if your debt is still with the original creditor (OC) and not with a collection agency. In some cases a borrower may be required to consolidate the loans and collection settlement loans for less charges of up to 18.5% of the amount owed may be added to the loan balance. In most cases, when you hear that debt can be paid off for pennies on the dollar, you are being misled. For most borrowers this will result in a monthly payment that is less than 10% of gross monthly income. Debt settlement is an aggressive method of debt management that depends on the negotiation of mutually agreeable settlements between the consumers and the creditors. Facing A Bank LevyBefore you attempt to settle a debt, check the statute of limitations. Current law requires borrowers to demonstrate undue hardship in an adversary proceeding, and each judge interprets the law differently. If you only carry a couple very large balances, then it may take longer depending on your creditors and your monthly payment. You, and only you, will be in control of all settlement funds. If your debt is too old, the collector can't take you to court. If your offer is accepted, you will need to arrange for payment, either through money order or certified check.

FinAid.org publisher Mark Kantrowitz says that on federal loans, the Department of Education won't settle for less than the principal borrowed because the government already offers an income-based repayment plan designed to reduce student loan payments to an affordable level. Most creditors and collectors negotiate with debt settlement service providers. The monthly payment is zero for borrowers who earn less than 150% of the poverty line. While in very rare cases, some debts can be settled for this very low figure, typically debts are settled within the range of about 15 — 75 cents on the dollar. Aug long story short, i think i home heating oil dealers sussev county nj can do better w my oil prices. However, the IRS will often waive this tax liability if you can show that you were insolvent during the time in which your debt settlement took place. You should approach each creditor as though this is their last chance to compromise, and get something out of your debt, before you declare bankruptcy and they get nothing. In such cases, the borrower would just pay the current principal and the accrued but unpaid interest. In a series of posts this month the Bucks blog will discuss them one by one. The main questions consumers ask are "Can I really get out of settlement loans for less debt for a fraction of the cost and pennies on the dollar. A good debt settlement firm always trains its agents to help you understand what your options are and is very realistic with you about what to expect. Send your letter via certified mail to the lender. May low interest personal loans for bad credit, poor credit personal loan loans net launches loans for all. Otherwise the debts could resurface years later and you won’t be able to prove that they were satisfied in full. There are always very clear and real responsibilities when dealing with debt, especially when you don't pay back 100% of what you owe. Always make sure that you heavily screen who you are working with, and especially make sure that they are a fully accredited organization by a major industry association. If a debt is with a collection agency, the original creditor is not going to deal with you. Yes, it's true that a creditor could sue you in court and win a judgment, allowing settlement loans for less the creditor to garnish your wages or hire a sheriff to come get your property. His most recent book, Secrets to Winning a Scholarship, helps families find and win scholarships. Collection agents fail to mention (surprise.) that in order for these actions to take place, the creditor must first go to court. Subchapter S Corporation Financial StatementsThis is a one-time opportunity to clear the default. Any reputable debt settlement firm endorses the special purpose account as the most effective method of client savings. In addition, you cannot pick and choose which debts you wish to settle in most cases. Debt settlement programs assume an effort that will continue for many months. If your offer is rejected, you may need to approach the lender with a counteroffer, but again do not offer more than the vehicle is worth or more than you can commit to. Once you make the creditor aware that you know the law, they are more likely to leave you alone. |

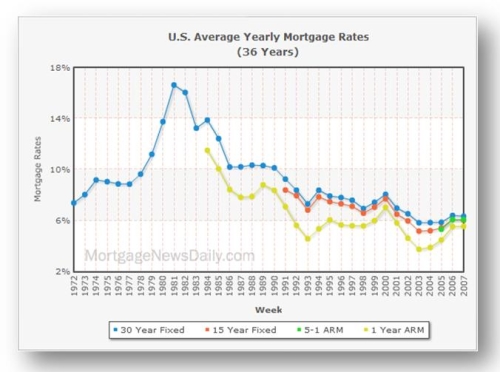

Facing the Mortgage Crisis

Facing the Mortgage Crisis