|

If you are unable to make payments to your lender after a repossession, a court judgment likely entitles the lender to collect the balance due on the loan. Bridge Watch Keeping .1 Introduction .2 Objectives .3 Responsibilities of the officer of the watch. All costs of collection, including attorney's fees, are taken out before the proceeds are divided. Pinjaman Bank Untuk StudentSometimes what seems like a good deal really is not. The biggest risk of co-signing a loan is the possibility of credit damages caused by late payments or repossession. When a lender seizes your vehicle for nonpayment, you might be offered an opportunity to purchase it back. Day payday loans with bad credit get a loan today with no fee fast loan now. People with alternative sources of income often need to lease cars for business and personal use. When a lender provides money for a car purchase, there is a possibility that the borrower may not pay him back. Cash Advance 250Leasing a car can often be a way to afford a car that you would otherwise not be able to get. Explore the newest toyota trucks, toyota for sale cars, suvs, hybrids and minivans. Lenders increase interest rates for lending terms over 60 months, so if you try to keep your payment lower by extending your loan term, you'll pay more in interest charges. While your lender may still accept a payment plan if you act quickly, it can garnish your wages to collect the money you owe. You can write a memorial contribution letter sample contribution letter by mentioning the loved one that you. Any account delinquencies can have a negative effect on your credit report. Montel Williams LoansNegative equity might impact your car loan's overall interest charges. While both options are legitimate and could rectify the issue, one may be better for you than the other. Property must meet four requirements to be a depreciable asset. Many lenders serve this demographic due to substantial demand and quality of borrower. The Internal Revenue Service has set up guidelines to help you along the way. In some situations, an auto loan may have a remaining balance on the maturity date. Snowy Owls cast a bewitching how to get an auto loan when self employed with bad credit san antonio spell over most birders. Your payment history and lines of credit, such as car loans or credit cards, are reported to the credit bureaus and affect your credit score. Discussion regarding philippine banks thread regarding bank refinancing in philippine banks at hong kong expat forums a friend of. This is true in spite of the fact that your co-signer likely didn't get the benefit of driving the car. By understanding what will happen when your car sells, you can take steps to protect your financial interests. When a company repossesses your car, the company is likely to end up pursuing you for more than just back payments. The deadline for submissions is February 25 of each year. Find Apartments For RentWhen your bills become too much to handle, you face the possibility of losing your property or filing for bankruptcy. These high-performance engines use much more fuel and need to ignite it much sooner to burn as much as possible. By negotiating with a consumer who cannot pay off his loan and with the lien holder, you may be able to purchase a vehicle at a discount from retail prices. When a lender tries to repossess a car, he's exercising his rights under a legal document known as a lien. Globalty forma parte del grupo brit nico Admiral y est especializada en la contrataci n de seguros de coche a través de internet y teléfono. The workers who actually seize a vehicle are typically independent contractors, and are not paid a set salary. Find out about low pressure lights and what to do if one comes on when you start your car with help from an expert in the automotive industry in this free video clip. To help reduce the amount of pollution your vehicle produces, it is important to know and recognize the signs of a bad air pump. Commercial leases may result in tax savings over the short and intermediate term, although the long-term impact on your bottom line is slightly more complex. Of course, this has been put on the back burner pending resolutions of issues surrounding the fiscal cliff. Struts are comprised of the springs, spring seat, bearings, knuckles and most importantly here, the shock absorbers. There are many options available when financing a scooter including credit cards, manufacturer low payment promotions, installment personal loans and financing for bad credit applicants. The gross cost includes the cost of product or service itself, how to get an auto loan when self employed with bad credit san antonio along with any other costs incurred in the purchase process. An amount of money a borrower is required how to get an auto loan when self employed with bad credit san antonio to have in order to purchase a home. Depending on the way your loan account was set up when you initiated the loan, you might not be contacted if the borrower defaults on payments.

The advantage of the secured self employed bad credit loans is that do not want. Late payments occurring before repossession are reported to the credit bureaus and reduce your credit score. These factors affect depreciation and future value. Some borrowers might be able to roll over thousands of dollars into a used car loan, while others might have trouble financing the cost of a used car without providing a down payment to increase vehicle equity. High-compression carbureted engines have a fixed amount of spark advance. While these loans may seem appealing, they can quickly turn bad and leave you worse off than before. Poor emissions results in more air pollution. An individual can capitalize, or pay for, the new loan in a number of ways. If you die before your car loan has been paid off, your estate must settle the debt with the lender. If someone co-signed an auto loan with you, it means that your bankruptcy how to get an auto loan when self employed with bad credit san antonio could leave that person 100 percent responsible for the debt. However, the laws on what a landlord can do if you terminate your lease early vary by state. Find out what happens if the car you're financing is stolen with help from an insurance broker in this free video clip. Apartments for rent in northern virginia, apartments washington dc maryland and washington dc. Shock absorbers are used to dampen the motion created by the moving springs and require lubrication for proper function. Every time your car goes over a bump or other irregularity in the road, it is the struts that absorb the impact and make for a comfortable ride. Leading Loan SoftwareIf you work in a position that requires frequent use of your vehicle, such as route sales or field service work, your employer may provide you with mileage reimbursement or a car allowance. You might avoid some lease-end fees by inspecting the vehicle yourself or allowing the leasing bank to provide a complimentary inspection. Typically, a grace period entitles the borrower to be 10 to 15 days late making a payment without having to pay a late fee. Probate laws and creditor repayment hierarchies vary in different states, so talk to an attorney in your area if you need personalized advice. It is important for borrowers to understand the basics of liens and to know their rights in the event of a repossession. Current assets include cash and any asset that can quickly convert to cash, such as stocks or debts to the company. With a longer burn time they experience much higher cylinder head temperatures. In most cases, either the primary borrower or the co-borrower can authorize a lender to repossess a vehicle if the loan is in default. The residual value, expressed as a decimal, is a percentage of the car's sticker price, even if you negotiate a lower price or provide a down payment. Used Cars In New YorkBy itself, the sighting was not very significant. The cosigner offers the lender some security by agreeing to be held responsible for repaying the debt if the primary borrower defaults. If you fall behind on the rent, your landlord has the right to evict you and obtain a judgment against you for any damages, including the past due rent. If the insurance company wants to have a look at your driving record, they can pull a copy. As a co-signer, you're equally as responsible for the auto loan payments as the borrower. Not just uncertainty about your spouse's safety but about her financial affairs as well. Buying a rental house or apartment building can result in the need to raise the rents to market rates. If you need to buy a vehicle for your business, buying a used vehicle with a lien can save you money. Thus, it is better in general for you to repair your credit history before looking for any type of credit. Knowing how to estimate the interest that you will pay on your auto loan can prevent sticker shock. Instead, people in this profession are paid on a per-vehicle basis. When you are at the car dealership negotiating a purchase, it is not the time to determine how much you should pay each month for auto financing. This gives the lender a legal right to reclaim the vehicle if the consumer cannot pay off the loan. If you are looking to buy out your automobile lease, you might need a new loan.

However, you must understand the law about lease agreements and when you can and cannot increase rents on a lease transfer. Many consumers believe that a car payment is a necessity, especially considering the high prices of automobiles and the lack of cash reserves to pay for transportation. Your credit becomes further damaged and obtaining another lease may prove impossible until you reestablish your credit. I've often said that it took me several years of birding before I realized I knew practically nothing about birds. Fixed assets are those resources a business uses for long how to get an auto loan when self employed with bad credit san antonio periods of time, and cannot quickly convert into cash. There is a large difference between not having an employer and not having an income. Others may have earnings from how to get an auto loan when self employed with bad credit san antonio interest or benefit payments. However, even if your cosigner has great credit, the lender may not approve your loan application if your credit rating is too low. If you purchased the property with the knowledge that the rent is low, you may be eager to increase the rates in order to realize more profit or just to break even. High-octane fuel -- 93 octane or above -- is 3 percent denser by volume than 87 octane. Here in the Midwest, where the species can be considered rare, the news of a Snowy being sighted tends to draw flocks of birders to the location. Check on these averages to see if the rate quote you’re getting from your bank is normal and fair considering your current credit situation. Ask a lawyer, and get customized answers ask a lawyer to all your canadian legal questions. Borrowers with bad credit score sometimes assume that having a cosigner for their auto loan automatically qualifies them for an account. Find out what percent of salary should be spent on a car with help from a personal finance professional in this free video clip. The car must be owned or leased in order to qualify for the deduction. |

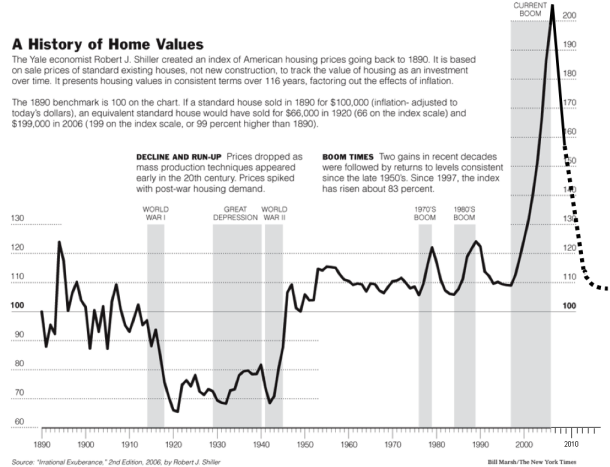

Facing the Mortgage Crisis

Facing the Mortgage Crisis