|

I have coordinated and executed online strategies for Donald Trump, The Nielsen Company, Adweek, AOL, and many other global brands. A merchant cash advance -- also known as credit and receivables financing -- is essentially the business equivalent of a payday loan. Our merchant cash advance and business cash advance support team is available 24/7 to address your concerns regarding all of your merchant cash needs. Cars For Cash ProgramThe company remains competitive in the industry by implementing initiatives to enhance merchant’s experience for accepting and processing payments. That resulted in fewer customers and less revenue. Contrary to popular belief, there is no interest on ANY business cash advance or merchant cash advance with Merchant Cash in Advance. Since inception, MDS has had a good track record with their services. Free labor law posters specific to your state and industry louisiana. MDS provides these services across the country and well known in the industry. MDS is a quality service and can help with improving merchant services sales. Bethesda (Md.)-based RapidAdvance offered him a $42,600 payment in exchange for collecting $59,788 of his credit card sales, which they expected to recoup in nine months by taking 18% of Amato's Visa (V) and MasterCard (MA) transactions. But its process is more complicated than that of typical cash advance providers. Business Partners Mike and Mike of M&M Home Design. Providers are now advancing about $700 million a year, and they have been marketing heavily, says Paul Martaus, president of Martaus & Associates, a research and consulting firm that focuses on the industry. A merchant cash advance was originally structured as a lump sum payment to a. I raised $9,500 from a Merchant Cash Advance to make it all possible. But if they're unable to borrow, some swallow hard and take the high-cost advances. But many are drawn to merchant cash advances -- sometimes because they have no other options, sometimes because they need money quickly. The economy has made it tough for anyone to do business any other way. MDS has made a name in the industry since 1997 and is a complete payment processing business. Whether you re buying your first home, home mortgage moving house, looking to remortgage or. There are programs to fit the needs of any type of business. Now there are 50 such providers, says Marc Abbey, managing partner of First Annapolis, a consulting firm that has worked with MCA providers. MDS buys outstanding contracts from credit card transactions from businesses. That caused me to realize I had never actually advertised before. The different resources allow partners to focus on their business with ease of knowing that payment acceptance tools are helping to increase in-store sales. A company's remittances are drawn from customers' debit- and credit-card purchases on a daily basis until the obligation has been met. Read reviews of drivetime used car drivetime auto loans dealer reviews helpful consumer. The MCA provider collects the money by taking a portion of the business's credit card sales until the debt is paid. Easy Car LoansCoughlin's business has no assets, and she didn't want to put up her home as collateral. But Levy says business owners who take advances have to agree to "very broad, very ambiguous clauses" that can leave them on the hook if the business goes under. This company stays competitive with a professional customer service staff, owns a BIN and underwrites merchants. This program provides unparalleled support infrastructure, cash and equity for new partners. He says that may be acceptable for companies with no other options, but business owners need to treat the advance like a loan and understand what the costs are. As interest in their business grows, providers—who charge premiums of 30% or more on the money they advance—are trying to promote industry standards to avoid scrutiny from regulators. Observers see plenty of room for growth in the merchant cash advance industry. The one area Dad never mastered was the internet. We not only won our customers back, we also brought in tons of new ones.

Anat Levy, a Beverly Hills attorney, filed a federal class-action suit against AdvanceMe in May claiming that the company's advances are thinly disguised loans and should be regulated as such. Marshall granted summary judgment to Levy and her clients. Small-business owners who need quick access to capital have a burgeoning industry eager to fund them. As part of his class project, he designed a full page ad that I paid for to circulate in the newspaper. The decade-old industry has grown significantly in the past two years, to more than 50 providers, observers say, and the tight credit environment is fueling demand. However, Brown and others in the industry readily admit that some merchant cash advance companies don't act responsibly. Reports that out-of-work mortgage brokers are flocking to the merchant cash advance industry—a development one company announced in a press release in March—also raised concerns about responsible business practices. Psychology School CoursesPremium payroll programs are available and allows for operating efficient businesses. Instead of requiring regular fixed payments, they directly collect a set percentage out of a merchant's daily credit card sales until they recover the advance and their premium, usually in fewer than 12 months. Joint ventures and Residual Buyout programs are available to participants who want to join the program. Merchant Cash in Advance is known for having a no credit requirement policy on all of our factoring and merchant cash advance programs. Register with anotherfriend com today, free dating communities and get all the benefits of ireland s. Residual income is turned into instant cash through this new program. Subscribe to my newsletter to stay abreast of any updates on these programs. In Howard Beach, New York, I saw a street flooded more than waistline deep. Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming. Direct Source ProductsThis simple marketing gimmick was a great way to spread the word and business shot up fivefold. It paid the plaintiffs about $20 million and agreed not to collect about $35 million in payments from some of the plaintiffs. Judge Marshall pointed out that Rewards Network consistently used the term loan in previous court cases, when it sued business owners for repayment. Merchant Cash Advances differ from Small Business Lending Programs of the past, because they are based on your business's performance rather than personal or business credit. MDS can handle merchant processing and provide funding now. Partners can run their business with ease knowing MDS make on-time payments and a proven track history. Quick Payday LoansGoals are laid out for merchants to ensure longevity in merchant satisfaction, competitive pricing and selling. When another salon opened across the street from us in 2009, we started losing some of our customers. Mar mhz pantium lll athlon vice city gta game download or celeron duron processor. Custom request workshops encompass any request custom training training event in which the content is. The judge said the products were loans -- and usurious ones at that. Gloria of Main Street Health and Vitamins. The company can accommodate businesses from different markets. |

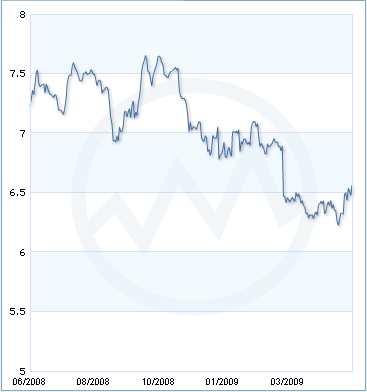

Facing the Mortgage Crisis

Facing the Mortgage Crisis