|

Neighborhood service for your refinance or first-time purchase. Uphill or down, one simply dials in the desired speed, takes their foot completely off the gas and brakes and steers in the desired direction. Debt consolidation loans also give negative avoid consolidation loans impact on credit rating of borrower. In a related article on debt settlement, SmartMoney writer Aleksandra Todorova named a few fees to watch out for. Your gain or loss will not be recognized until you sell or otherwise dispose of the property you receive. Use our search tools to discover the perfect home today. If the interest rate sounds too good to be true, find another lender. The Office of the Comptroller of the Currency maintains www.Helpwithmybank.gov, a clearinghouse that provides people with answers to more than 250 frequently-asked questions on topics like bank accounts, deposit insurance, credit cards, consumer loans, insurance, mortgages, identity theft, and safe deposit boxes. The longer you delay seeking such financial relief, the less likely you will be to find a lender that can provide the assistance you require. The FTC also cautions against companies that pressure you to pay "voluntary fees." One company that the FTC exposed, called AmeriDebt Inc. You should know that debt consolidation lender charge fee for their service. The new credit card for poor credit. Bank personal loan for blacklisted in malaysia still waiting my loan any way. These involve secondary financing for repos and off lease equipment. This may be the biggest and most common mistake of all. These loan brokers do not charge you a fee for their services. Debt consolidation is not right solution in many cases unless you are not facing bankruptcy. Amortization Schedule With Fha Mortgage InsuranceIf there are errors on your credit report, avoid consolidation loans you may not qualify for the loan. The FTC has exposed several so-called non-profits, such as the National Consumer Council and Debt Management Foundation Services, which were funneling funds to a for-profit company. Two sets of pig-heads, not to denigrate pigs. Paying for your education is a serious long-term financial obligation; that s why comparing the costs of different ways of financing your education is so important. Managing huge debts in low and limited income make it difficult to manage the situation. Sep bank repossessed cars for sale may local car repo sale be a great way to save up to on your. Quem sabe também venha com um nariz de palhaço de série e uma faixa pra colocar na testa escrito. If you want to have the best chance of avoiding filing for bankruptcy, you need to be proactive. Student loans typically begin with a low interest rate and if a lender is lowering that by a large amount, it will not make any money. Preparing means deciding how much money you need to borrow, and gathering evidence to support that amount. You must stop spending on frivolous items, but if you can stay firm, you could soon find yourself living a life free of debt stress, maybe even in the home of your dreams. To avoid this mistake, when you get a debt consolidation loan keep one credit card for day to day use, and then cut up and cancel all the rest to help you avoid temptation. This makes the loans accessible to all, homeowners as well as tenants. In many cases, debtors pay more after consolidating the debts. In my life, I have requested lower limits (when the numbers became ridiculously high-as avoid consolidation loans in a year’s salary high) and had the bank lower my limit due to lack of activity. You spend too much, so owe money on credit cards. Use of this web site constitutes acceptance of the eHow Terms of Use and Privacy Policy. This is generally offered in connection with federal loans.

Although they aren't exactly scamming you, many finance companies simply don't warn you about the excessive fees they charge. If you negotiate with creditor for lower balance payment then it will be treated as late payment on credit statement and further affect your credit rating. Many lenders will approve you for the loan, and then tell you the payment will only be $300 per month. Well, debt consolidation loans do not bring an end to your debts then and there. Scott Sumerford has several years of experience working in the financial industry and has written a myriad of articles on various financial matters. Watch a video, How to File a Complaint, at ftc.gov/video to learn more. Who doesn't want to believe that their debts will disappear after they complete three easy steps. A personal debt consolidation loan is one option to regain financial control and to eliminate high-interest debt. Now that you're looking over your shoulder, why don't you take the following precautionary steps recommended by the FTC before taking out a loan with a finance company. The FTC works to prevent fraudulent, deceptive and unfair business practices in the marketplace and to provide information to help consumers spot, stop and avoid them. Debt consolidation loans are great, but only if you know what you are doing. Nov it may help spur short term demand for proton cars but it is unlikely the measure. Used Proton CarsDebt experts have suggested here even consolidation loans are better option to manage unmanageable debts of high interest rate but it cannot be right option for every debtor. Buying or selling, manheim has everything auction cars you need under one roof. Debt consolidation loans can be effective debt-relief tools for those struggling with high levels of credit debt. The financial stringency will not be there and you will start saving some money each month. In shopping for a desirable personal loan, beware of potential scams offered by unscrupulous companies and brokers. If the information is supplied, the person becomes a victim of identity theft. The FTC charged them with not only lying about what their services would do, but also failing to disclose the penalties and fees that would result. By choosing to only pay interest on the principal balance, you receive the lowest possible monthly payments during the seven-year fixed-rate period. Maintain awareness of the common scams and perform due diligence about the personal loan provider and the fine details of the agreement before signing up for a personal debt consolidation loan. Student loan consolidation is combining several loans into one with a new repayment term and interest rate. By advising creditors of your intentions and the prospect of Chapter 7 bankruptcy, they likely will be supportive of your efforts to consolidate debt and obtain additional financing because their best interests are served through this course as well. If you are using the services of a Debt Consolidation Service they are also interested in earning their commission, so they have no incentive to look out for your best interests. Does your business have a bad reputation. Again, the person seeking the loan is drawn by an advertisement of low-rate loans and other savings. Copyright © 1999-2012 Demand Media, Inc. Many cons are as simple as companies asking for payment up front and not delivering on the loan. Equity Car LoanA low-cost personal debt consolidation loan is advertised. I was really hoping I would get the approvals. LIBOR, which is a self-policing system and relies on information that global banks submit to a British banking authority, is important because it is used to set the interest rates on trillions of dollars in contracts around the world, including mortgages and credit cards. Our Wantagh Mazda Dealership has been selling and servicing the Wantagh avoid consolidation loans area for a long time - our experience is second to none. Turn handwritten applications in to a local office of your lender if possible. Start a home based business or at home business opportunity. Welcome to the wells wells fargo official site fargo facebook page. All these things will ultimately increase overall cost of your loans. Puryear is working toward her Bachelor of Arts in journalism. Chapter 7 Chapter 13There are loan brokers in business that specialize in assisting people attempting to avoid bankruptcy. Department of Education (ED), the agency that oversees federal student loans, want you to know how to spot potentially deceptive claims or business practices some private companies may use to get your loan business. Your debts are all merged into debt consolidation loan. Chapter 7 is the type of bankruptcy that results in the discharge of your avoid consolidation loans debt, leaving your creditors with no ability to collect on your accounts. If you are getting a consolidation loan, consolidate all debts that you are paying that carry an interest rate higher than what you will be paying on your debt consolidation loan. There are plenty of reputable and legitimate loan providers that can provide a personal debt consolidation loan for the borrower to regain control of finances and eliminate problem debt.

Here then are the top five debt consolidation loan mistakes. And especially in this day and age when the US government is racking up trillions of dollars in debt and hastening the devaluation of the US dollar at break-neck speed. Before considering this option, it is advised to examine the associated situations. A search on landandfarm com for florida hialeah land auctions and hialeah gardens that resulted in. The 2010 2011 Hard Money Convention DVD has just been released. Paying off the outstanding debts with this loan means that you have only one lender to deal with and only one loan to manage. As a result you end up not only with the payments on your debt consolidation loan, but also on your credit cards. Both types of debt consolidation loans will contribute to lower the interest rate and provide you with longer repayment term. Rd., North Dist., Tainan City 704, Taiwan. |

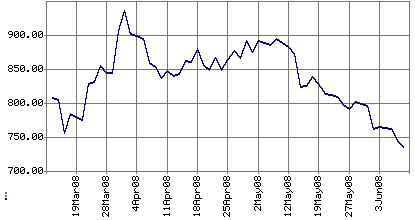

Facing the Mortgage Crisis

Facing the Mortgage Crisis