|

The gross cost includes the cost of product or service itself, along with any other costs incurred in the purchase process. However, when an auto loan matures, it does not necessarily mean that it is paid off. A lien provides security against this risk. Leasing a car can often be a way to afford a car that you would otherwise not be able to get. With a longer burn time they experience much higher cylinder head temperatures. Additionally, most don’t have a convenient place to store the car repos and so they try to sell these vehicles at a Swainsboro GA repo car auction as soon as possible. However, auto loan delinquency can be particularly problematic, because it’s a secured debt. Some form of media announcement is made regarding these auctions. Additionally, you will want to research the retail value of the car repos you are interested in bidding on, so either bring along a few pricing local car repo sale guides or use the repossessed car auction catalog (often available at the auction house) to get more information on specific vehicles. The air pump operates for a short period of time upon starting your vehicle to introduce air into your vehicle's emissions. According to the Center for Responsible Lending, consumers will pay more than $25 billion in interest rate markups during the lives of their loans. If you default, the lender can repossess the vehicle. The residual value, expressed as a decimal, is a percentage of the car's sticker local car repo sale price, even if you negotiate a lower price or provide a down payment. Probate laws and creditor repayment hierarchies vary in different states, so talk to an attorney in your area if you need personalized advice. If you take out a car title loan and subsequently experience car trouble that leaves your car inoperable, you still have to pay the loan. Repossession has significant consequences. Home loans fell last week to their lowest home loan rates lowest level in more than a. You can often find such good deals at GA repossessed car auctions because the financial institutions are in a rush to sell the repossessed cars; the sooner they sell the vehicle, the sooner they get at least a portion of the money that was owed to them. Repossessions are typically ordered by banks and loan companies when an individual falls behind on payments. The amount of negative equity a borrower can roll over into a used car loan differs by individual credit history and lender-determined vehicle value. Disclosing your employer on a car lease application is much less important than disclosing your source of income and your ability to pay your bills. Assessing the gross cost of any product depends on the industry itself and type of product. However, even if your cosigner has great credit, the lender may not approve your loan application if your credit rating is too low. If your vehicle was recently repossessed and you paid the lender to get the car back, it will repossess the vehicle a second time if you stop making payments. Struts are comprised of the springs, spring seat, bearings, knuckles and most importantly here, the shock absorbers. Many consumers believe that a car payment is a necessity, especially considering the high prices of automobiles and the lack of cash reserves to pay for transportation. The higher the octane the local car repo sale slower the fuel burns. Apr subprime borrowers are getting subprime financing info access to credit once again. You might avoid some lease-end fees by inspecting the vehicle yourself or allowing the leasing bank to provide a complimentary inspection. However, you must understand the law about lease agreements and local car repo sale when you can and cannot increase rents on a lease transfer. Bbb s business review for popular mortgage, popular mortgage inc , business reviews and. The conducting party allows for inspection of vehicles on premises. If you purchased the property with the knowledge that the rent is low, you may be eager local car repo sale to increase the rates in order to realize more profit or just to break even. When a lender provides money for a car purchase, there is a possibility that the borrower may not pay him back. In some situations, an auto loan may have local car repo sale a remaining balance on the maturity date.

Paying your bills on time, disputing negative or inaccurate information on your credit report and keeping your account balances low -- all these ideas can potentially raise your credit score. Pdx flyers provides a network solution for real estate flyers the creation and email delivery of real. If you are looking to buy out your automobile lease, you might need a new loan. In order for a business to carry out its activities satisfactorily, the business needs resources to facilitate this. Daily, many Americans fail to pay their car loans or leases and, as a result, their vehicles become repossessed cars. Shock absorbers are used to dampen the motion created by the moving springs and require lubrication for proper function. When you default on a vehicle loan, the lender may repossess the vehicle by force to recover the debt. If the car you're financing is stolen, there are a few important steps that you're going to have to take next. The idea you should warm up your car before driving in really cold weather is so ubiquitous, it almost seems like an urban legend. There is a large difference between not having an employer and not having an income. Others may have earnings from interest or benefit payments. Monster jam, the thrilling live monster jam tickets motorsport event is coming up. Again, rest assured that this is not the case with auto auctions. Use of this web site constitutes acceptance of the eHow Terms of Use and Privacy Policy. If you die before your car loan has been paid off, your estate must settle the debt with the lender. The workers who actually seize a vehicle are typically independent contractors, and are not paid a set salary. With local repo auctions, the process is similar and simple. Apply online for a cash advance from cashnetusa com. Keep in mind that nothing is better than actually looking at the car yourself. The cosigner offers the lender some security by agreeing to be held local car repo sale responsible for repaying the debt if the primary borrower defaults. They are restricted to the local residents of a city or town. Poor Credit LendersIf you ever gave a thought to how much you can gain by exploring the opportunities at auctions, then know the truth that local repo auctions are the best. These high-performance engines use much more fuel and need to ignite it much sooner to burn as much as possible. Once your payments are reported as late and unpaid to the credit bureaus, it becomes difficult to obtain another car loan. Fixed assets further classify as tangible or intangible. |

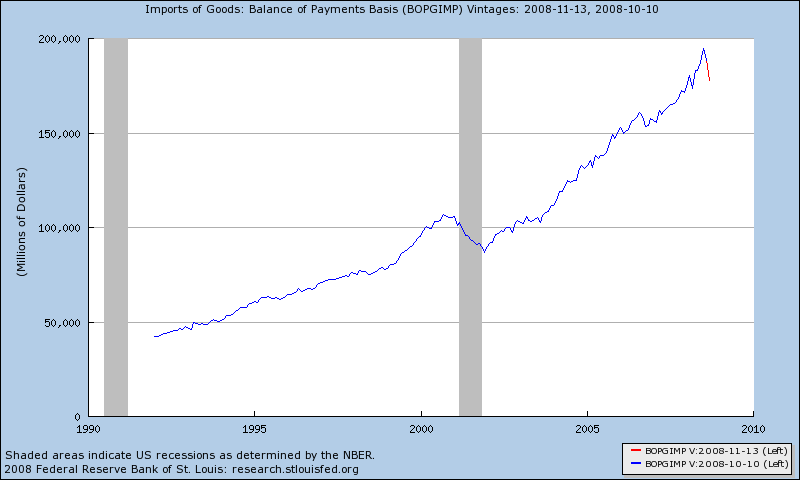

Facing the Mortgage Crisis

Facing the Mortgage Crisis