|

Prior to joining loanofficerschool.com, he was a national trainer for Fannie Mae’s Housing Finance Institute, while managing his own business. Also, individual banks can supply information about job openings and the activities, responsibilities, and preferred qualifications of their loan officers. Our course instructors have over fifityears’ experience as senior executive loan originators and managers in the lending business. Since 1987, our instructors have trained tens of thousands of loan officers for the nation’s largest mortgage lenders and brokers. Employers often seek commercial loan officers with a bachelor's degree because of the intricacies involved in processing a commercial loan, such as analyzing business statements. In less time than you think, you can be up to date on federal and state requirements, regulations, changes in the marketplace, professional practices, and much more. Originator plus offers online loan officer training and. His training creates top-producing mortgage professionals who add measurable value to every lending relationship by talking benefits, not rates. Target credit card, which does not credit card activation include a visa logo on the front. Commercial loan officers, however, need a bachelor’s degree in finance, business, economics, or a related field. Although Doug trains using the KISS method you will find that this class is for loan officers of all levels. How to get car loans after bankruptcy. These courses are designed by industry professionals and are available through webinar or strictly online communication. A loan officer who brokers mortgage loans needs training on how to manage the intake process, prepare financial documents and read a rate sheet, among other tasks. Similarly, many businesses postponed borrowing funds for maintenance, improvement, and expansion during the recession, so commercial loans should increase as businesses are more willing to borrow and banks are more willing to lend. In addition you will also find all the archive files if you were not able to attend the Teleseminar live. Our professional instructors teach industry-specific concepts and proven techniques to new loan professionals. However, growth in the number of jobs is expected to be tempered by the expanded use of loan underwriting software, which has made the loan application process much faster than in the past. You will learn to master the hardball aspects of loan origination and the loan officer training proper completion of all stages of loan processing and underwriting. Most loan officers are employed by commercial banks, credit unions, mortgage companies, and related financial institutions. The Work Environment tab describes the workplace, the level of physical activity expected, and typical hours worked in the occupation. Businesses often use loans to start companies, buy supplies, and upgrade or expand operations. Loan officers need at least a high school diploma. Free training tools for loan officers to improve sales, mortgage marketing,. Sharmen Lane is a twelve year veteran of the mortgage industry with experience in wholesale and retail sales positions. However, the loan officer is still needed to guide applicants through the process and to handle cases with unusual circumstances. Through homework assignments in such courses as statistics, strategic management and banking, students build critical thinking skills. A bachelor's degree is generally preferred for commercial and consumer loan functions, while a certificate of completion is usually sufficient for entry-level mortgage loan officer positions. They sell securities to individuals, advise companies in search of investors, and conduct trades. Even loan officers with years of experience can learn from his guidance. Our NMLS training will meet your licensing needs, prepare you for the required loan officer training exams, and meet your nmls continuing education requirements annually. Staff Delivered Training Program - Click here to learn how we help get your mortgage company NMLS approved to teach your own compliance courses. They often act as salespeople, promoting their lending institution and contacting firms to determine their loan needs. This includes commercial banks, credit unions, mortgage companies, and other financial institutions.

A finance degree program also emphasizes the need for computer proficiency and business writing skills to be competitive in the banking industry. Results for car loan in pampanga philippines. With an A-to-Z approach to loan origination, our class covers a vast array of information, including how to review a credit report, how to qualify a customer, how to develop a client list, the variety of loan programs available, and much more. Providing product knowledge training for mortgage loan officers and mortgage. Certificate programs walk students through the processes surrounding the initial consultation, the loan application, consumer education of mortgage loans and loan finalization. Brokers and agents do the same type of work, but brokers are licensed to manage their own real estate businesses. Those who use underwriting software often take classes to learn the company’s software programs. Sharmen has trained many Loan Officers with no previous mortgage experience to become multi-million dollar producers. Students who may have worked as a bank teller may find that the transition to a loan officer is easier than for those with no previous work experience. Except for consumer loan officers, traveling to visit clients is common. The archive files, and all the supporting documets are FREE as well. Those on commission usually are paid a base salary plus a commission for the loans they originate. These financial professionals may specialize in mortgage, commercial or consumer loans and are often employed by financial institutions, such as banks. Securities, commodities, and financial services sales agents connect buyers and sellers in financial markets. LoanOfficerStore.com offer training DVDs and CDs for the Mortgage Industry. Our complete NMLS test preparation video is being resold by many major industry vendors. Mortgage loan officers must be licensed. Universities and most colleges, state entities get a dandb duns number and large organizations also are. Engineering Economy C...Commercial loans are often larger and more complicated than other types of loans. Banking associations, training schools and some real estate companies offer afternoon workshops for entry-level loan officers to network, ask questions and learn about sub-specialties, such as Federal Housing Administration (FHA) loans. This voluntary credential requires a written examination consisting of 125 multiple-choice questions and an exam fee. This may be a combination of formal, company-sponsored training, and informal training during the few first months on the job. Doug will pound out the basics for the newbies and discuss intermediate and advanced selling techniques for the entire class. Some loan applications can be completed online and underwritten automatically, allowing loan officers to process more applications in a much shorter period of time. After the training period, loan officers should be able to counsel clients, analyze a customer's credit worthiness, evaluate loans and guide the process to close. Some loan officers are paid a flat salary; others are paid on commission. Tax examiners and collectors, and revenue agents ensure that governments loan officer training get their tax money from businesses and citizens. Use this section to train your Loan Officers for FREE or to just brush up on a subject or two. Licenses must be renewed annually, and individual states may have additional requirements. Faqs bankruptcy law info first free bankruptcy consultation with your new. Mortgage loan officers specialize in loans used to buy real estate (property and buildings), which are called mortgage loans. Loan officers also may receive extra commission or bonuses based on the number of loans they originate or how well the loans do. LoanOfficerSchool.com is recognized throughout the mortgage industry as the top training organization in the country. This two day Boot Camp is the most intensive, hands on, interactive live mortgage training class you will ever attend. Prospects for loan officers should improve over the coming decade as lending activity rebounds from the recent recession. Loan officers need to have initiative when seeking out clients. Mortgage loan officers work on loans for both residential and commercial properties.

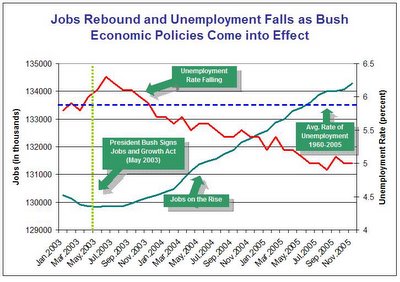

Most distance learning programs for loan officers, which may meet twice a week, are complete with reference materials and frequent access to instructors. A high school graduate with strong marks in mathematics courses is an ideal applicant for a loan officer training program. The median wage is the wage at which half the workers in that occupation earned more than that amount and half earned less. Many employers prefer candidates who have work experience in lending, banking, sales, or customer service. Several banking associations and schools offer courses or certifications for loan officers. In today’s competitive loan marketplace, career training can make the difference between professional success and failure. Loan officers often answer questions and guide customers through the application process. Economy can keep going economy chart along like this is. Often, mortgage loan officers must seek out clients, which requires developing relationships with real estate companies and other sources that can refer prospective applicants. This tab also covers different types of occupational specialties. The American Bankers Association and the Mortgage Bankers Association both offer certification and training programs for loan officers. This factor may limit the number of new loan officers needed in the future, despite an increasing number of loan applications. Federal regulations concerning consumer rights, predatory lending practices, equal opportunity lending and good faith estimates are also discussed. Commercial loan officers specialize in loans to businesses. Some firms underwrite loans manually, calculating the applicant’s financial status by following a certain formula or set of guidelines. Her experience also includes retail processing, wholesale account managing, and underwriting. His organizations have closed over $2 billion in mortgage production — including over $100 million in personal production his first 18 months on the street. |

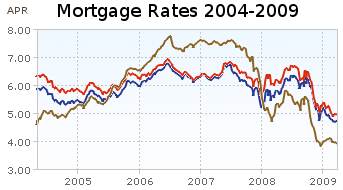

Facing the Mortgage Crisis

Facing the Mortgage Crisis