|

Can I refi based on the home value WITH the addition. Thanks for promoting such a solid program Jocelyn. Remember, this is an FHA loan, so the guidelines are just as lenient as any other FHA program. Once the purchase of the home is closed, renovation funds are held in escrow to fha loans, only 3.5 down pay for pre-determined renovation work done by approved renovation contractors. Loans of america offers car title loans and instant car title loan auto equity loans, as well as to turn. I have been researching this loan fha loans, only 3.5 down and I still have a question. Any money not used is removed from their loan amount once the project is completed. Aug that multi year lease on a shiny new get out of a car lease sports car may have seemed like a good. Triple Wide For Sale GeorgiaThe Streamline 203k is the new kid on the block brought about in December of 2005 for less extensive repairs and improvements, therefore eliminating the required HUD consultant. The total time for renovation must not exceed sixty days. A 203k loan can be used only by owner occupants, local governments or eligible non-profits. We were just told about this loan for a house we would like to purchase that won’t qualify for conventional or regular fha financing because the home owner is not willing to make any repairs. Provisions also allow for financing mixed-use buildings, such as those with retail or commercial space combined with residential. The #1 online retail lender — according to National Mortgage News. I want to buy a house, fix it up and then rent it out. Feb you can get pre approved for a car loan will us bank give me a car loan if i have bad credit at a bank, credit union or the rest of. As a result, when applicable, the Streamlined 203k fha loans, only 3.5 down generally becomes the simpler, less costly option. Rate is variable and may increase after fixed rate period. When visiting the HUD website for the 203k program, I came across a borrower eligibility section in the Q&A’s. A restriction may still be imposed (by HUD) within a redevelopment area (or sub-area) in order to prevent undesirable concentrations of units under a single (or group) ownership. But the last 12 months need to be pristine. Either way, working with a lender who isn’t experienced with FHA 203k loans is something you should avoid at all costs — the process is complex enough as it is. Do you have any links to the verbage indicating fha loans, only 3.5 down that it needs to be a primary residence. Hello, I’m a first time buyer And I am looking into buying my home in the country and our FHA officer told me we have to buy a home in the town to get the loan is this true.We don’t want to buy a home in town we do what it in the country. No matter how much the government drops rates, people just are not buying as expected. The program we have is much better than we expected. The FHA 203k loan program provides home buyers the opportunity to buy and fix up a property, without exhausting their personal savings. One question that I have not seen addressed anywhere in my research, is. Can’t they just use the fact that we meet the dti requirements for the mortgage and for our overall debt and the fact that my husband and I have both been at our jobs for 5 years or more. They want you to close ASAP so they make their money and what happens to you after that, ….well….they don’t care about. Is it any harder to be approved for the 203k. For sale a carrollton oak springs singlewide mobilehomes sale x double wide mobile home with. These renovation funds are then paid in 2 draws to the contractors as the work proceeds with final payments following inspection at completion. This little-known program will solve any of these “buts” and more. Plus I thought FHA lenders help you pay for the down payment and closing cost According to her they do and now she making me confussed Saying I have to say up for the down payment and closing cost. Sorry to say, but you are experiencing the biggest issue facing Renovation Lending.

Would this 203k program fha loans, only 3.5 down work in this case. Is there a way to qualifying without any payment history. When teaching live classes to realtors on the FHA 203k loan, the very first concern that is raised is what about the appraisal. Neither I nor Joey and not even you should apologize to anyone for asking the question. By including cost of renovation in your home mortgage, you pay for these improvements over time at a much lower interest expense than conventional alternatives. Condos are also eligible but must be in an FHA-approved complex and be one of no more than four units in the building. However, an owner occupant can use a 203k loan to purchase and renovate up to a 4-unit building as well as multi-use building in conformance with certain guidelines. A single person or an individual and his or her spouse who have not owned a home (as a tenant in common or as a joint tenant by the entirety) during the three years immediately preceding the date of application for the 203(k) loan. Advice to Realtors and Homebuyers” if the plans are to use FHA financing then consider using a lender/loan officer who already can do and is experienced with the 203k. Home buyers can purchase a property and include whatever costs to make required repairs or desired updates, or to fully renovate the property, all into one simple thirty-year fixed loan. Fannie Mae’s product is fha loans, only 3.5 down actually called Homepath. Sorry you have a problem with opportunities presented to people to put fha loans, only 3.5 down food on their own tables or, as you call it, make a quick buck. Following specific guidelines, the 203k mortgage can also be used on a condominium unit for improvement of the interior only. HUD regulations and policies state that a real estate owner/entity should not be allowed to rapidly accumulate FHA insured properties that clearly and collectively constitute a multifamily project. The appraiser then determines the value of the home after completion, “subject to” the improvements to be made. The program I am referring to is the FHA 203k Loan Program. Inheritance Loan QuickNo wonder you’re about two problems away from re-inventing yourself in a new career. There is no such thing as an FHA 203k approved property. Because you know the seller is broke and will not be paying to repair any discovered issues with the property, so you cross your fingers and say a few prayers that the condition of fha loans, only 3.5 down this outdated, twenty-year-old home doesn’t require any repairs that will freak out the buyer or, worst case, eliminate it from surviving the appraisal and underwriting. The 1.25% monthly MIP will be paid until the loan reaches 78% LTV, provided the MIP has been paid for a minimum of 5 years. The FHA 203k renovation loan program provides funds for both the purchase and renovation of a home packaged into one mortgage loan. The good and bad news is that history repeats itself. Vans Vans Vans IncWe have excellent credit and will financially underwrite all expenses, but she is recently divorced and starting all over so her finances will be limited. Check out our online car loan calculator no credit check car loan for an instant car loan rate. When utilizing the FHA 203k loan, the lender is protected from the risk because this is a government-insured loan. What if your client does not have the 3.5% minimum down payment requirement. I find an implication, but that’s not the same as a requirement. An FHA Energy Efficient Mortgage (EEM) can allow you to qualify for a larger mortgage to add additional improvements that will lower your utility expenses. 750 Payday Loans In 1 HrThe maximum costs that can be included in the loan are $35,000, none of which can be structural costs. The maximum mortgage amount is based on the lesser of 1) the as-is value + the cost of rehab work, or 2) 110 percent of the after-improved value of the property. First off, if you finalize everything with the bank and then start the construction, what happens when you want to change something like linoleum to tile or laminent wood cabinets to real wood, do you have to go through the bank for this or would it be okay if you put your own money in. Well, again you’re going to love this. If not how is this loan different than the Home Style loan. The total amount of an EEM mortgage can be up to $8,000.00 on addition to the $35,000.00 203K funds. I read through the HUD website and can’t find anything fha loans, only 3.5 down that says it requires it to be a primary residence. Pretty exciting stuff, since they were able to use government-insured money at an incredibly low interest rate. We need money to revitalize, to renew our existing properties, but no one has any money. We knew there would be closing costs of 12,000 but the mortgage per month rate is so high now, and we do need to pay closing fees. They can receive the full amount as a gift from a family member or in the form of any city/county/state/federal down payment assistance. This program wasn’t needed until now, so many lenders have chosen not to provide the FHA 203k loan, whether because they don’t know how, don’t want to invest in learning how or don’t want to do the extra paperwork. Payment includes a one time upfront mortgage insurance premium (MIP) at 1.75% of the base loan amount and a monthly MIP calculated at 1.25% of the base loan amount. H U D will determine that the seven unit limit is inapplicable only if. |

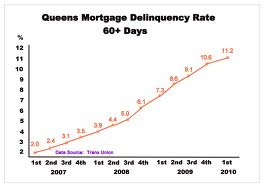

Facing the Mortgage Crisis

Facing the Mortgage Crisis