|

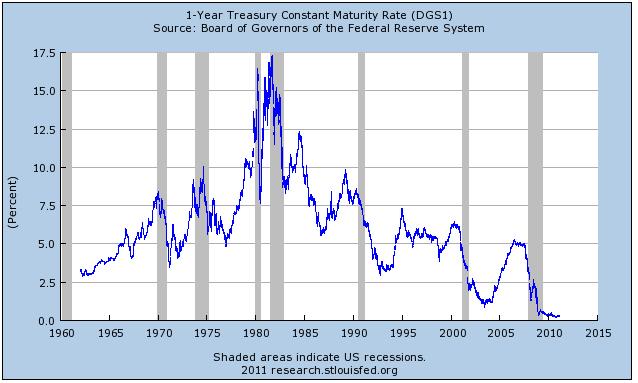

Also, review your loan documents to see if any rate caps or floors apply that will limit the interest rate move when the rate adjusts next spring. Having a few important documents ready before you contact us will help us find the refinancing option that’s right for you. Not enough info to really come up with a rate range and closing cost option, but in 15 yr fixed can run from 2.75-3.5 and 30 yr from 3.5-4.25, so all the pieces of then puzzle are needed. Heirs Mortgage Loan Sample PhilippinesThe equity you have in your home is based on the value of the home and what you currently owe that’s secured by the property. Now that you've got a new monthly payment amount, it's a good time 2.5 refinance rates to see how it fits in with your other financial obligations. Of course, there are "no-cost" or "low-cash-out" refinances too--transactions that allow you to roll closing costs into the mortgage rate or loan balance. Yes, there are costs associated with refinancing. Gorgeous diamond bridal sets are available wedding sets at great low prices with samsclub. Doing this research might also help you find the 2.5 refinance rates lowest possible interest rate for your new loan. But for some borrowers, this type of refinance can allow them to pay off high-interest debt or make needed home improvements more quickly. One thing is certain, however, lower interest rates help many companies find success by avoiding high monthly repayments. Create a news alert for "refinance" advertisementRelated Links. Nov jeremy conklin is a year guaranteed car loans old high school graduate. Other covered activities include, for example, financing, zoning properties, new construction design and advertising. Mar every now and then doral bank direct offers competitive cd rates. The new legislation, if passed into law as it is, wouldn’t meet some of the goals rumored to be coming in the so-called HARP 3.0, including. Many homeowners do not have the luxury of considering refinancing as just an option available to them. Bankrate's content, including the guidance of its advice-and-expert columns and this Web site, is intended only to assist you with financial decisions. Refinancing involves locking in a new interest rate on a first mortgage. Track leading interest rates" provides the current rates on the interest rates used to price adjustable-rate mortgages. Depending on the state you live in, this body could be called the Housing Authority, Housing and Finance Authority, Housing Department, Department of Community Affairs, or something similar. Please note that if a third party, such as an advisor or a nonprofit advocate, contacts us to submit an escalated case on your behalf, we must have your written authorization before we can communicate with them about you or your loan. One provision allows state governments to utilize money from MRBs (or Mortgage Revenue Bonds) to make ascertainable refinance mortgages on existing subprime mortgages. With careful financial analysis of the costs and benefits of the refinance, you can determine what refinance option will be most advantageous for you. Cash Advance LoansWith regards to your disability, the lender cannot use any information you provide as a basis for denying credit. A summary of the legislation says there are 17.5 million loans guaranteed by Fannie Mae and Freddie Mac paying interest above 5 percent that could benefit from a refinance. If you are working with someone you like, I'd stick with them, but let them know that you found some better rates out there and see if he will match them. It is important that you continue to make your normal mortgage payments until you sign the loan documents and your refinance takes effect. BestRate.com has been recognized by the media, including Forbes and Newsweek, for delivering a "stand out" among mortgage and loan sites. Texas refinance rates continue 2.5 refinance rates to be near historic lows. How do you know if you are a good candidate for a home refinance. As you can tell by the above responses, Different lenders offer different programs, but no one can be sure without looking at your complete scenario. We will review the property appraisal with your credit history and overall financial situation to make a decision whether to approve your loan request. If you were denied home loan assistance, such as a request for a loan modification, short sale or deed in lieu you may be able to dispute the decision. HSH.com's up-to-date mortgage rate data and mortgage rate forecasts can help you decode all this. There are also many non-government organizations offering advice on finding the government refinance loans assistance programs that are available to them. Then click above on a suitable link to start saving on Texas refinance rates. If you think this is the case or is likely to be the case, or have concerns about what information the lender is entitled to know, you should inquire or file a complaint online with HUD or file a complaint online or with the Federal Trade Commission. Do experts predict big changes on the way. One factor that greatly affects your decision to apply for a mortgage 2.5 refinance rates refinance should be how long you plan to stay in the property. In general the rates you were quoted are fairly 2.5 refinance rates reasonable for the terms you included. Business.com makes it easier for you to compare the services offered by refinance companies. We will contact you regularly during this time to update you on your status. The interest portion of a capital lease capital lease in cash flow payment is a cash flow from operating. The APR is going to include lender fees, including their compensation.

In April 2008, I refinanced my first and second mortgages 2.5 refinance rates into a 3/1 adjustable-rate mortgage at 5.125 percent. California refinance rates continue to be near historic lows. Though that's a compelling reason, there are actually many possible reasons for refinancing. Loan For Low Credit ScoreThe content is broad in scope and does not consider your personal financial situation. Assuming you have 20% equity based on a new appraisal, and credit scores of ~800 as mentioned, our rate today for a 30 yr Fixed Rate $218K loan amount was at 3.875% @ 0 pts (3.901 APR), based on a 50 day lock. Consult with an experienced mortgage lender to determine which type of loan best meets your financial needs. VA refinance mortgages have lower equity requirements and no mortgage insurance premiums. However, when taking out a new loan, customers can expect to pay an additional fee to the lender in the form of a closing cost, usually anywhere from 2.5 to 3 percent of the amount borrowed. Waiting until next year to refinance, or sell your home, isn't enough time to get you a whole lot of appreciation in your home's value. Interested VA’s take note that although the Veteran’s Administration is a government 2.5 refinance rates agency, it is actually private lenders who offer these VA refinance mortgages. More information on your state’s progress in this area can be found at the National Council of State Housing Agencies. Then click above on a suitable link to start saving on California refinance rates. Helps buyers finance their car online car refinancing purchases or refinance loans. HSH.com's Tri-Refi mortgage calculator makes it easy to make side-by-side comparisons of different refinancing options. Toyota DealerThey also may have no more than one late payment in the last 12 months. Hope Now counselors listen closely to each homeowner’s unique set of circumstances and then lays out clearly all the government refinancing options available. Mortgage resources, rates, press releases, mortgage tools industry news, glossary, legal. Strict underwriting standards, fraud, prohibitive costs for borrowers and conflicts between servicers have also gummed up the works. If you're planning on trading up, waiting for your house to recover could cost you more money than finding a way to buy the new house now. Because of less risk taken upon by the lender, Texas refinance rates tend to be lower than what you can typically receive on second or third mortgages. We list information on an up-to-the-minute basis from a pool of several lenders in your area. I usually don't suggest 15 year mortgages for most of my clients but would be happy to discuss the details. Looking to find the best loan bad credit loans for people with bad credit. And always compare APR at the end of the day. After you have explored several of these websites, you should have a better idea of whether refinancing can actually help you lower those payments. He said closing costs would be $3,000, plus almost $2,000 for escrow. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis