|

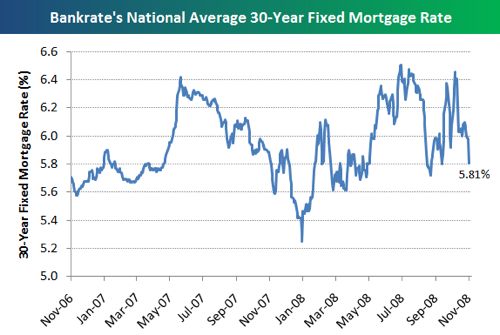

It could pay if the borrower could slash the loan rate by two or more percentage points. Clarocet alert www consumerhealthanswers com. They would have a higher housing looking to refinance payment and less money saved. That's true even if you opt for a no-cash or low-cash closing. While that's still a much better plan than a 15 year loan after those 25.6 years, when the house was finally paid off, you'd have saved an extra $24,320 if you just put that $950 a year into a savings account. While looking over our finances, it’s looking like we may want to go ahead and see if we can snag a deal. I’m typically to blogging and looking to refinance i in fact abide by your content. If you wanted to you could pay off the remaining balance and still have plenty left over. Then contact a professional mortgage professional to provide you a Total Cost Analysis and discuss your options. Based on the scenario you gave, and assuming you're in a conforming loan (which I do based on the fact that you are in a 30 year fixed from 2003), you should have no problem refinancing to today's lower rates. Sell your unused junk car for cash in any condition. In the other you'd still have a $950 a month payment for the next few years but would also have as much as an extra $100,000 in the bank. There are huge dips every so often in our economy, but one thing is for certain. Because of these two reasons they give slightly better pricing if you have one. If you have the cash and you expect to stay in the home for many years, then it may be worth taking this step. That's not what we're talking about however. Personal Loan FinancingCheck out MainStreet's look at alternatives with Seller Financing. Assuming Clay's calculations are correct (and I do) you'd be paying about $950 extra towards your mortgage every year with a biweekly payment plan. Also note that both Fannie Mae & Freddie Mac have special programs, if they own your mortgage, to avoid MI on those mortgages when refinancing. Above all else we can summarize what all of our goals should be with those three words. Ask the loan officer, or consult a mortgage calculator, to determine what your principal and interest payment would be with the new loan. If not, they can be added to your loan amount looking to refinance or paid out of pocket at closing. The most comprehensive of these updates remains the Fair and Accurate Credit Transactions Act, signed into law in December 2003, which initiated the free consumer annual credit report, among other upgrades. Stating a discriminatory preference in an advertisement for housing is illegal. If you’re looking for more insight, I highly recommend looking to refinance checking Sandy’s perspective on Yes, I Am Cheap. There are always 3rd party costs when you finance, I would request a closing cost estimate to confirm the $0 cost is a true zero cost. I know it seems backwards, paying more inertest to create real wealth, but that is really the way it works. What if you owe more than your house is worth. During those 25.6 years you'd have more money in your pocket, and afterwards you would too. With all the different rates, APR's and fees, I guess my questions. Note that there are four ways to figure out the break-even period, depending on assumptions you make about taxes or alternatives such as using cash to pay down the existing mortgage instead of spending it on closing costs. Letter Of Agreement TemplateI agree with you everyone should have their own investment strategy that they implement with their financial professional. REFINANCINGS made up 79 percent of all 2011 mortgage applications as of early October, according to the Mortgage Bankers Association, about the same level as last year but well above the 54 percent average of the last decade. If you’re trying to figure out whether or not refinancing is for you, there is a bit of financial legwork you should do. If you were forced to relocate, you might wish you still had those thousands of dollars you spent on closing costs. All that’s fairly intuitive, and the longer break-even time is no problem if you plan to stay in the home for at least 34 months. If you don't plan on being in the house very long, then the lower payments associated with the refinancing won't cover these closing costs.

Phillip daniels president of fuqua homes lost his license as a manufactured. Don’t forget to make closing costs a key factor in your loan shopping. Refinance in canton, mi we are looking to refinance our property located in. A home loan can be a very detialed process and you will need a consultant who can walk you through the process and quicly close your application. If it does, determine what the penalty would be if you refinance, and add that amount to your closing costs to determine your new break-even point. You can calculate it by dividing the mortgage fees by the monthly savings. It should be a good thing for you because you’re not terribly far into the loan, so as long as you’ve been making good progress, you should be able to save quite a bit. Refinancing involves starting over and applying for a new loan. But in recent years borrowers, lured by online comparison shopping and easy application processes, have often refinanced to save only one percentage point, sometimes less. Click the “View Report” button for a detailed analysis, and look at the figures for total interest costs over each loan’s life. NEW YORK (MainStreet) - While different methodologies produce slightly different results, all mortgage surveys show that rates are extraordinarily low right now, making refinancing look awfully attractive. Notice I have never once even mentioned the stock market nor do I give any specific investment advice. You're issue seems to be with investment strategy, not with the 30 year mortgage. With everything going for a refinance, you would think that it’s a no brainer.That’s not always the case. The 30 year borrower ends up with a higher net worth, more savings, as well as more cashflow and flexibility after 5, 10, 15, 20, or 30 years every time. Before you rush to refi, take a few minutes to determine if it's the right move for you. However there is lost opportunity cost of that money. However, the government and many private resources are aware of the difficulties and limitations faced by people connected with mining projects and this is because some mining grants are being offered to eligible candidates. More importantly a true professional, not just a sales person (which is what you usually end up with at these "turn and burn" nationwide refinance shops) but an experienced consultant that will help guide you to make the best decision possible. Hire freelancers to work in software, writing, data entry and design right through to engineering and the sciences, sales and marketing, and accounting & legal services. The program is a joke, its the same as the sams club auto buying aaa, sam s club, etc the way to buy a. Here are five things lantz says homeowners looking to refinance should do. Now we’re seeing some incredible deals. You can apply for discover student loans on the internet or over the phone. The banks want you to have one for two reasons a.) because they want to ensure that your home is always ensured and taxes are paid on time, and b.) they earn interest on all their client's combined escrow accounts as they collect them. For a clearer look at your options, try the calculator, as a number of factors can change the results, such as your tax bracket. You end up paying those fees one way or another in your payment, and you may pay for them many times over if you own the home for a long time. I don't know about you but when I look at the big picture paying extra to your mortgage makes very little to no sense. Find out if your current loan has a prepayment penalty. Now you can figure out how much you would save every month. Doing that it doesn't matter how the markets perform all that much, the 30 year borrower will always end up having more wealth accumulated and much more financial security. This is not a theory, it's a concrete fact, provable with real figures, that results in the same thing, every time. I hope I answered those questions adequately. I have gone through the loan request on Mortgage Marketplace and have gotten results. On the "$0 fee loan" the lender is just paying your fees for you, by getting more revenue from the 2ndary market for a higher rate.

We're talking about using one's mortgage as a financial tool rather than looking at it as a debt that we need to get rid of. Who would’ve thought that rates would be as low as they are right now. In 100% of the scenarios/models, regardless of income/assets/age/etc, it is more financially prudent to go with the 30 year loan and they all end up accumulating mote wealth and financial security using the longer term mortgage, even though they pay more interest over the life of the loan. Sample Loan LettersAs far as I'm concerned, I would have no problem paying $950 a month mortgage payment if I had $100,000 in the bank. I am looking to refinance to remodel the house but dont know where to begin. You are not wrong that paying an extra payment per year on a 30 year loan is the preferred choice when compared to a 15 year (or any term shorter than 30) mortgage for all the reasons you mentioned. It might make sense to hold off on refinancing until you're clear of the prepayment penalty period. As for the second part of the question, I wouldn't expect much of a drop in rates. How can you expect the lender to give you a loan for $280,000 at more favorable terms. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis