|

These incredibly attractive financing options are also ideal for those who want to take advantage of cheap land prices, buy foreclosures, fix up the home of their dreams or just move a little ways out of the city and grab a few acres for raising the kids with more room in a safer environment. Well, unless you are Mark Zuckerberg, you have a gazillion shares of Google, or are bank of america usda interest rates next in line for promotion at Apple, you may have a good shot at getting approved. USDA-guaranteed loans are popular because no down payment is required bank of america usda interest rates and there are no monthly mortgage insurance premiums. I live in North Carolina and I found a home that I love. If you need to stop a foreclosure and we buy houses fast have a house that is behind on. Reserve your rental car from one of rent a car over thrifty car rental locations. Within the last month, USDA has opened the Conservation Reserve Program to emergency haying and grazing, lowered the borrower interest rate for emergency loans, and worked with crop insurance companies to provide flexibility to farmers. Or do we have to first find out if a given house is qualified .although it is in a qualifying area. The rent will cover the monthly expenses and you’ll benefit from any appreciation. Vilsack also announced today the availability of up to $5 million in grants to evaluate and demonstrate agricultural practices that help farmers and ranchers adapt to drought. FIRE THIS AGENT and find another one that will do his or her job. In addition, many mortgage lenders choose not to deal with rural housing loans because they don't do much business in rural areas or don't want to assume the risk of underwriting these mortgages. My husband check our mortgage status and it shows that we are Now three months behind and they want the money for the last three months, after they told us and verified the documents we got in the mail were correct.My husband called Bank of America and asked them what is going on. This funding model is similar to the way the FHA mortgage insurance operates -- the mortgage insurance premiums collected from borrowers keep FHA's program afloat, with no taxpayer money involved. For example, to ensure that we do not ask you to enter your state more than once, this page sets a browser cookie on your computer indicating the state that you select. I called my realtor, she told me that New Mexico is out of funding for USDA direct loan. Find a ready to move in manufactured or modular dream home modular home at clayton homes, the. In the past 3 years, USDA provided 103,000 loans to family farmers totaling $14.6 billion. With 100 percent financing and easy qualifying, asking about USDA home loans is smart. With USDA loans, underwriting guidelines are similar to those of the Federal Housing Administration (FHA) -- that is, the guidelines are more flexible than those for conventional mortgages. Qualified applicants are required to complete 65 percent of the work to build the home. I am planning to get a USDA direct loan for my new manufactured home. When it comes to appliances you may also find it wiser to obtain financing elsewhere so that the debt is not tied to your home. Jim - My only dealing with them, and likely my last, was just horrible. I have looked into the qualifications needed for this loan and haven’t seen (until today) that you cannot own a home within commuting distance of the home you wish to purchase. But the USDA loans program is one that most any lender who is USDA approved can help you get a USDA loan and you will be just fine. Because, most foreclosed homes require new carpet and repairs. Earlier this week, President Obama and Secretary Vilsack traveled to Iowa to announce USDA's intent to purchase up to $170 million of pork, lamb, chicken, and catfish for federal food nutrition assistance programs, including food banks, which will help relieve pressure on American livestock producers and bring the nation's meat supply in line with demand. Used Car Sale PricesTo qualify for the program, the home must be modest in size, design and cost. I'd also like any other Realtors or lenders to add any addition information that might be helpful to someone in a quandary like this one. There is no way it should take from September until now to get a USDA loan closed. And if they always did business like this they would obviously not be in business, is what the manager told me. Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, Mississippi, Nevada, New Jersey, New Mexico, North Carolina, Ohio, Oregon, Rhode Island, South Carolina and Tennessee. After I was told the date, I kept checking the WA USDA website that stated what date of applications they were working on. In addition to a decade in mortgage lending, she has worked as a business credit systems consultant for Experian and as an accountant for Deloitte. The lender for the Section 502 direct loan is the FDA’s Rural Housing Service and Rural Development handles the servicing. USDA-backed home loans are really designed to assist lower income borrowers, though who hasn’t found times a little more challenging lately. You'll want to contact your local USDA rep. It means that any mortgage lender funding a USDA home loan for the time being is on the hook to buy back loans that default. The rural designation includes many small- to medium-sized towns as well as suburban areas outside larger cities. I asked if my file had even been submitted and she told me that it had but that USDA had requested more information. This is in addition to the income requirements and property eligibility requirements. The Guaranteed Loan program guidelines allow applicants earn up to 115 percent of the median income for the area after certain adjustments.

The President stressed the need for the entire Administration to continue to look at further steps it can take to ease the pain of this historic drought. Is this basically bad business for B of A, or is this fraud. It seems that in the USDA process you first find a home and then see if it qualfies for the USDA program and that you qualify for the dollar amount of the home. Today, total production is forecast at 10.8 billion bushels. I think you need to stand firm, present the information, and put up a fight. The Guaranteed Loan program is funded through USDA-approved mortgage lenders and brokers. Nissan altima sedan models come nissan clearance 2012 in three different trims. The USDA offers a lookup tool for property eligibility. Your state selection is the only information we collect. Also is this process a little difference than the regular process of purchasing a home in that in a conventional process you are approved for bank of america usda interest rates a particular dollar amount without a particular home in mind and then you look with your realtor for a home that fits those finacial limits. Chimey, it appears as if your real estate agent isn’t doing his or her job. You don’t want to buy a house with no down payment. Who knows who is next to go under, and you may not even get as much as a Bernie Madoff victim if your bank tanks. USDA is an equal opportunity provider and employer. I tried to work with lenders, but no one seems to be bordered. Instead, the program will be self-funded, with higher fees assessed on borrowers. Nov i owe about, and i ve paid a monthly average monthly payment of 40k car loan payment of about for the past. Many whose income would qualify them for the Direct Loan program choose the Guarantee Loan program instead because of the additional bureaucracy and paperwork associated with the Direct Loan program. Results of find mobile homes, mobile homes rental for rent in your local area. The Home Repair Program also provides funds to make a home accessible to someone with disabilities -- for example, to build a ramp for someone using a wheelchair. The fed-exed the file that day and is currently in line to be processed. Racing junk haulmark renegade nrc optima rv loan options show hauler united specialties. We got a loan modification bank of america usda interest rates about a year ago. Does this mean any ‘single family’ house in East Windsor qualifies for a USDA ‘Guaranteed Loan’ scheme. An understanding of the policies and procedures is just one way I can help bank of america usda interest rates you to the successful sale or purchase of a Gettysburg, Pa property. One of these is if you are forced to move to accept a new job. It was a foreclosure and nothing went well. Used Cars For Sale CheapI'm not an advocate for lawsuits but perhaps your situation justifies an effort. Home Depot and other stores frequently provide no interest financing type deals on these items. Since you don’t mention where you are, you’ll need to check to see if it’s available in your state. Your tax dollars go to guarantee these programs, so isn’t it about time you got something back. The USDA defines "rural" generously -- you don't have to buy a home in the farm belt to qualify. No extras though just enough to get the home up to minimum HUD handbook guidelines. We like the no down payment option and the option to roll over the closing costs in the loan. They should be refunded in the next month or so, so be patient. Like the FHA program, the USDA doesn't directly fund these loans itself but instead guarantees them, making them a safer investment for the lenders. |

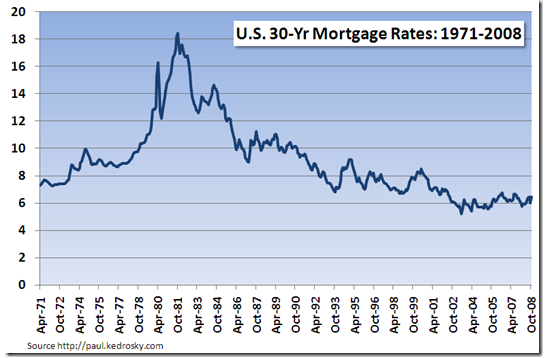

Facing the Mortgage Crisis

Facing the Mortgage Crisis