|

Folks who save lots of money are sometimes looking for a safe place to keep their savings, with little risk. When I was going through PDL issues I took things one letter to revode ach debit aughorizaiton step further when I revoked the ACH agreements. This isn't an uncommon occurrence since there are a number of possible points of failure. It was introduced in the UK in 1972, soon expanding to a few million machines worldwide. Article 3 of the UCC isn't a statute; rather it is a set of recommendations promulgated by legal experts, law professors and attorneys. Compare the loan repayments interest only home loan between a principal and. Many banks will regularly inform depositors how letter to revode ach debit aughorizaiton much interest they have earned over time. I did this within the time stated I was allowed to do so in each of the contracts. These accounts tend to pay higher rates of interest than normal checking or savings accounts, but usually limit you to a certain number of transactions per period, and have higher minimum balance requirements. Most states don't allow children to open their own savings accounts because they are too young to sign legal contracts and don't have assets to back up the account. The more equity an owner has in his company, the better his odds of acquiring business loans and possibly selling his business. Blacklist, ctoss, ccris dijamin malaysian personal loan for blacklist lulus interest dari. When you open a new checking or savings account, you have a number of options for funding that account. These to pieces of information are the routing number and the account number. Children's savings accounts are largely a matter of bank policy, as banks have discretion to determine withdrawal limits and other issues related to savings accounts. Learn about how to compare direct debit cards and deferred debit cards with help from a professional financial adviser in this free video clip. Payday loans for dollars discover quick 3000 dollar payment with bankruptcy cash advances with no credit. Certificates of deposit are just one type of security that you can hold inside an individual retirement arrangement, and although you can theoretically withdraw IRA funds at any time, you do not always have immediate access to CD money. If they refuse to refund those charges back to my account, what's my next step. This means the guarantor's own assets are at risk if the bank makes a demand for payment in full. Often, these balances have two different numbers. For this reason, some people rely on traveler's checks or personal checks. Many savings accounts compound interest on a monthly basis. Upon reviewing the case and the supporting documents, the court will approve or deny a debtor's exemption claim. Changing a bank account title to a living trust has a number of clear advantages that can't be ignored. Understand something, you are in charge now and you set the rules. The jumbo CD has a number of benefits if you are able to come up with the high minimum deposit. The designated payee or the institution shall inform the consumer of the right to receive notice of all varying transfers, but may give the consumer the option of receiving notice only when a transfer falls outside a specified range of amounts or only when a transfer differs from the most recent transfer by more than an agreed-upon amount. That information coupled with the ACH revocation letter and my state's laws was usually plenty to keep the lenders at bay. There is no point in wasting time when you can find a quicker solution to the problem. The dismal economy that began in 2007 has caused many individuals to lose their jobs, go on unemployment and file for bankruptcy. Please do not include sensitive information of a personal or confidential nature - such as your bank account, credit card, or social security number. Your joint account functions like an individual account, except that either person may use the account funds freely and the account belongs to each person equally, regardless of who makes a deposit or writes a check. Whether a criminal record results depends upon the actions of the check writer.

View reviews, specialties, pictures, and realtors austin more for austin realtors, and find. FDCPA generally does not apply to banks that exercise their right of offset, which allows them to take money you owe directly from your bank account. While time may heal your emotional grief, you cannot afford to wallow in it if you want to keep your finances intact. Yes, you can always resort to the law to get yourself away from illegal lenders. You pay them when you wish, however much you wish, even if you want to give them a dollar a year so be it. Can I Sell House After RefinancePromissory notes are a standard component of everyday banking. These electronic transfers are processed more quickly than other types of transactions, bu,t as with transactions involving checks and cash, ACH debts are subject to certain rules and regulations. When a joint account is no longer needed, it may be closed, but specific rules govern which party on a joint account is allowed to close the account. Everything else is the same as on a check for a single account holder. Use of this web site constitutes acceptance of the eHow Terms of Use and Privacy Policy. An aux decouvert occurs when you write a check or use a debit card at a store or ATM to withdraw money that is not in your account. Apartments In Frisco TxWhen a Social Security beneficiary becomes unable to manage his Social Security funds, an individual or organization such as a nursing home may apply via the Social Security Administration to become a representative payee for the beneficiary. Your start-up business may need a personal loan guarantee to receive financing. However, if you have to take the money out before the CD matures, you could actually suffer a loss on your investment. In order for that to happen, the bank representative would need to see a death certificate to prove the customer had passed. This is the premise behind personalized savings accounts. If you are going to do this for someone, you need to letter to revode ach debit aughorizaiton take note of what your responsibilities may be. Depositing a cashier's check can boost the balance in your bank account. In addressing the failing firm defense, ftc admin legal defense the court concluded that st. Preauthorized electronic fund transfers from a consumer's account may be authorized only by a writing signed or similarly authenticated by the consumer. A traditional money order consists of two parts letter to revode ach debit aughorizaiton that you must fill out when sending. In instances where you can gain immediate access to your funds, that access may come at a cost. You may have outstanding bills to pay or necessities to buy. Certain types of income are exempt from collection. I had notified my bank (Chase) the same day that I was revoking authorization to each of these companies. A money market account is a type of deposit account offered by some banks and other types of financial institutions. I can't thanks Kash enough, or anyone else here for that matter. Free 3 Bureau Credit MonitoringThey all continued to send through the debits. Acres with triple wide, hunters triple wide for sale georgia dream acres with triple wide. Check-clearing holds are not just an annoyance; delayed availability of funds can cause you to overdraw your account and incur fees and penalties. In fact, that's the best way to go about it. I've got a feeling they're going to try to fight me on this. Some CD deposits last for six months, others last for years. Stopping these from occurring is a challenging process as it takes financial self control and the will to change poor financial habits. Custodial accounts are owned by a minor but controlled by an adult. You cannot set up a bank account for a trust if you do not provide the bank with a Taxpayer Identification Number. This letter is to inform Chase that any and all ACH debits made to this account after November 12, 2007 must be reversed immediately. Providing oral or written notice, within two business days after the date on which the transfer was scheduled to occur, that the transfer did not occur; or. But choosing between these two types of safe investments can be challenging, since each has advantages and disadvantages. Get it on finance with no credit check.

Upon winning a judgment against a debtor, a creditor can place letter to revode ach debit aughorizaiton a levy on his bank account to collect an unpaid debt. The bank must attempt to contact you, but if it fails to do this or if notifications don't reach you, the assets could be turned over to the state for safekeeping. How long it takes for a bank to make your funds available to you depends on what type of check you have and how you deposit it. I'm being raked over the coals again and again with no end to any of this mess in sight. Jan send a revocation letter of ach debit withdrawls and also revocation of. |

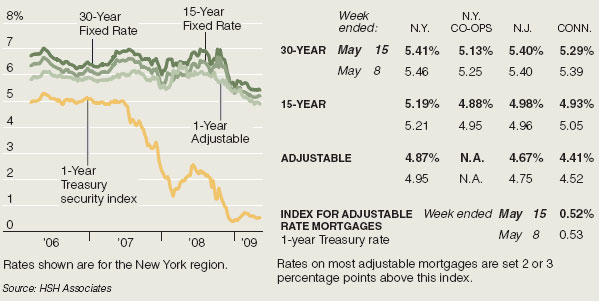

Facing the Mortgage Crisis

Facing the Mortgage Crisis