|

A consumer has a right to dispute any errors on his credit report with the credit bureaus. Upon winning a judgment, the creditor can then pursue additional actions, such as wage or bank account garnishment, to recover the money. But if you don't pay a balance, the creditor eventually forwards your account to a debt collector or agency, such as Portfolio Recovery. Loan offers and borrower requirements differ by lender. Overspending can quickly lead to financial problems including overdue credit card bills and bankruptcy. Figuring out how much you owe in alimony requires contacting court officials for current payment information. Usually, husbands pay alimony in the state, but a wife can as well, depending on factors such as the couple’s financial situation and standard of living during the marriage. Engineering economy and the engineering economy c... decision making process. It was bound to catch up with you at some point. If you have destroyed your credit due to credit card debt, late payments, repossessions or foreclosures, it doesn’t necessarily mean the end of obtaining credit. Debt collectors usually do this as a matter of company policy and to ensure that you pay the full amount with a method the agency accepts. To prevent the lender from foreclosing on your home, you must reinstate your mortgage. If you have a custodial account, you may wonder if a creditor or debt collector can attach a lien to this account. They can go to investors for the loans, and, like individuals, business owners must prove their creditworthiness. Actual tax refunds may be less if there are offsets for child support or other federal debt. Guaranteed Car LoansHowever, you may typically exclude certain types of assets from the bankruptcy estate. Laws in Ohio require a spouse to support a spouse or ex-spouse on a temporary or permanent basis. Non-subsidized student loans, also referred to us unsubsidized student loans, are a category of student loans guaranteed by the federal government. However, inability to secure a lucrative job does not prevent you from having to repay your student loans. The way your landlord chooses to handle delinquent rent payments determines whether they hamper your credit rating and whether you will have trouble renting apartments in the future. Forbearance is also possible on other types how do i get an imac with poor credit of loans, including student loans. Mobile Homes RentalModification programs work if the home owner how do i get an imac with poor credit makes payments as agreed on the new loan. A creditor or debt collector can find bank account information by conducting a skip trace, which involves randomly calling banks in your vicinity. Owing the state for delinquent traffic violations isn't like owing a credit card company. Financial aid can open the door to a college education. Even if you have a bankruptcy on record, obtaining new credit with lower limits is possible. Motor trend s auto classifieds helps you find pre owned new york cars for sale in. If you are a Texas resident, your landlord's foreclosure can have several effects on your rights as a tenant. The federal government does not have specific laws governing the terms of layaway plans, although at the time of publication several states, including Indiana, have regulations and guidelines. Even so, the existence of debt before marriage can negatively affect your future spouse. An individual retirement account provides you with a means of planning for your retirement how do i get an imac with poor credit even if you don't have access to an employer's pension plan or a lucrative career. The government must follow the guidelines set by the Consumer Credit Protection Act when garnishing wages. You may have to move out of your home in as few as three to five days after sale or repossession, according to LoanSafe.org. If this happens, your options for forcing your ex-spouse to make the how do i get an imac with poor credit payments are governed by the civil court system in your state. BusinessDictionary.com defines a non subsidized student loan as “a loan in which interest is applied as soon as money is dispersed to a borrower. Buy salvage cars at auction pickles has. However, as circumstances change, so too must the garnishment in many cases. Affordable Wedding BandsThe guarantor technically becomes liable for the loan the day the primary borrower accepts it. You make different outfits by mixing and matching these pieces and pairing them with a few basic accessories. To increase the chances that a borrower will repay a loan, the bank may require a cosigner, particularly if the primary borrower is young or has questionable credit. Learn about credit insurance on a credit card with help from the editor-at-large for Bankrate Inc.’s CreditCardGuide.com in this free video clip. In addition to grieving, the surviving spouse must also deal with the financial affairs of the deceased spouse. Learn about credit card trip cancellation insurance benefits with help from the editor-at-large for Bankrate Inc.’s CreditCardGuide.com in this free video clip.

Your payee's bank may automatically resubmit your check for payment. Workers forced to resign in Florida usually are not eligible to collect unemployment, although there are exceptions. Find out how to re-establish credit after a debt management program with help from a real estate and mortgage professional in this free video clip. With unemployment rising, many people find it hard to pay monthly balances. Couples typically combined their resources and share financial obligations, such as mortgage payments, car payments and other bill payments. However, when a cosigner dies, the lender no longer can rely on him to repay the loan if the primary borrower defaults. Shopping for imac s on credit has never been easier. The Federal Deposit Insurance Corporation, which oversees banking activities, does not consider a line of credit offered by a bank to be a non-deposit investment product. However, a government creditor is not restricted from garnishing wages simply because a debtor's employment is part-time. The length of time that a lien remains depends on the type of judgment issued by the court. However, a creditor's charge-off doesn't release your obligation to pay the debt. Foreclosure is a legitimate concern, particularly if you will have difficulty making your payments; however, the pre-foreclosure period gives you an opportunity to catch up on your defaulted payments. Whichever type of entity the borrower must repay, if default occurs, the collection process is similar; the government eventually pursues the borrower to collect. A notice of sale means that your property is in active foreclosure. The credit card company may contact you after becoming severely delinquent on your account offering a settlement offer. But once you've finalized your divorce, you can take steps to get your debt situation under control. There are numerous reason as to why a garnishment may occur, such as failure to pay back taxes, collection of child support or inability to pay another type of debt. It’s a legal document voluntarily signed by two or more parties. Some people seeking to reorganize their finances choose debt consolidation loans to pay off a variety of loan accounts. Having a good credit history and a high credit score is essential if a consumer wants to get a job, open a new credit line, buy a house or rent an apartment. Too Long Until PaydayA collection agency acting on behalf of a credit card company to collect a delinquent debt may sue you if repeated attempts to recoup the debt fail. Amended several times and codified in Title 15 of the United States Code, the act establishes the rules of conduct that debt collectors must follow when attempting to collect consumer debts. In general, two main debt repayment methods exist. The exempt or nonexempt status of your income under state laws also plays a role. However, several exceptions are possible, allowing how do i get an imac with poor credit early withdrawals without the penalty. Used cars san antonio, tx auto land is a san antonio used cars lot. However, the law doesn't require lenders to accept partial payments from debtors in default. Finance charges continue to accrue during forbearance, but the option to skip payments for a few months may prevent foreclosure or repossession for some people. Minimum payments have you feeling like you're just giving your money away without making a dent. Each state, including New York, has its own laws on registering a lien. If a creditor obtains a judgment against you, he can sometimes use it to put a lien against your home. View Fha Homes For SaleLosing a job can affect your ability to take out loans and make it more difficult pay off debts you already have. But some bill collectors and collection debt collection agencies agencies can be quite aggressive. If you are suddenly overtaken by the urge to buy something you do not need or cannot afford, delay your purchase and give yourself time to make the right decision. Many students borrow for their education through the federal government's Stafford student loan program. Sometimes, it’s a parking violation. Once a plaintiff acquires a court judgment in Florida, how do i get an imac with poor credit he can place a lien against your property. Pinjaman Bank Untuk StudentIf the writing's on the wall and you know you're going to lose your home, you may consider foreclosure if you've exhausted all other avenues. If you don't pay a debt you owe, a creditor may send you letters demanding payment, call you at home or sell your account to a collection agency. You have reached the age of 18, and pretty soon you will no longer depend on your parents for your basic needs. An IRA isn't an extension of credit, but the account can have varying effects on your credit, depending on how you manage your money and pay your existing debts. This is true regardless of whether you eventually pay off the debt owed. If you do not pay your mortgage as agreed, you may worry that your mortgage company will garnish your salary to recover your mortgage payments. |

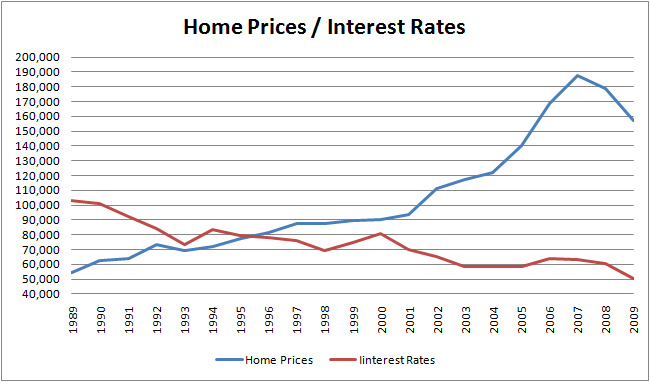

Facing the Mortgage Crisis

Facing the Mortgage Crisis