|

However, it is worth remembering that an improvement in financial gearing may be offset by a worsening of operational gearing and vice-versa. You may download a sample Dealer Agreement from our Documents & State Requirements section. EquipmentEngine leverages Six Sigma processes, 21st century technology, and over 200 storage facilities across the country to deliver cost effective and consistent equipment management services for our clients. Loan Modification HelpIn this case, rentals are reduced as follows. One of us chapter bad news breaking. For all leases (a) a general description of the leasing arrangement is required as well as (b) minimum future payments, in the aggregate and for each of the five succeeding fiscal years. Money saving tips, credit cards, forex are few major areas of specialization. You cann't consider just how much time I had spent for this information. Such classification issues are not uncommon and often distort comparability in addition to fair value, if the analysis is based off of free cash flows. Some people yearn to ride in a Lamborghini, others prefer to write on one. If it is a capital lease, the lessor records the present value of future cash flows as revenue and recognizes expenses. Because cash flow from operations are enhanced under capital lease in cash flow finance leases, so too are free cash flows. The firm gets to claim depreciation each year on the asset and also deducts the interest expense component of the lease payment each year. Science JobsFailure to do so may leave you with an incorrect or incomplete picture of your company's financial situation. How to buy a home with bad credit, even if you have filed bankruptcy or gone. Even though capital leases are typically entered into by stronger firms relative to operating leases (when a choice is present), because principal payment reductions are considered a financing activity, while the interest portion of the lease is included under operating activities, they (the capital lease) often result in higher free cash flows for the stronger credit solely due to the accounting rules. Each rental payment (except the first if paid at inception) includes both an amount that represents interest and an amount that represents a reduction of principal. A frequently offered suggestion is to capitalize all noncancelable lease commitments, including those related to operating leases. Instead, IAS 17 has the following five tests. Apartments That Dont Check Credit In Houston TxNevertheless, investors and creditors should be alert to the impact leases can have on a company's financial position and on its risk. At the end of the lease period, the lessee returns the property to the lessor. Nations bad credit loans is one of the largest online providers of loans for. Consistent with reporting sales of products under installment sales agreements rather than lease agreements, the lessor reports cash receipts from a sales-type lease as cash inflows from operating activities. Accounting guidelines are designed to limit the capital lease in cash flow ability of firms to hide financial realities. During the lease period, the finance company is considered as the legal owner of the asset. Popular RefinancingNow that you've got a Timeline, there's no point in stressing over it; it's time to make the most of your new personal page. Pro forma session from the latin, meaning as a matter of form, a pro forma. May responsible homeowners 2.5 refinance rates refinancing act of. Some financial analysts, in fact, do this on their own to get a better feel for a company's actual debt position. Most secured credit lenders -- credit unions are excellent choices -- will let you graduate capital lease in cash flow to an unsecured credit card after 12 to 18 months on a secured account [source. Residential mortgage loans include both first and second mortgage loans on New Jersey property. Because we also record leased assets, the immediate impact on the rate of return on assets (net income divided by assets) is negative, but the lasting effect depends on how leased assets are utilized to enhance future net income. Capital lease transactions impact several of a firm's financial ratios. Its automotive enthusiast web site, InsideLine.com, is the most-read car publication of its kind. If you have good credit and have been a loyal capital lease in cash flow customer, you're eligible for a lower rate. Ftc Admin Legal DefenseIf any of these tests are met, the lease is considered a finance lease. There are two ways of accounting for leases. How can external financial statement users adjust their analysis to incorporate the balance sheet differences between capital and operating leases. The reporter detailed the analysis of this public company by a firm which “specializes” in cash flow-based security analysis. Find out how you can improve your credit score. Add the totals to find square capital lease in cash flow footage for the entire house. Faqs bankruptcy law info first free bankruptcy consultation with your new. The company's revenues declined but it was saddled with lease commitments for numerous facilities the company no longer occupied. After comparability adjustments (see below), the subject of the story’s free cash flows were not as impressive as in first blush, and hence the need for their standardization. Consequently, accounting rules have been devised to force firms to reveal the extent of their lease obligations on their books. If you plan on shopping the Sears After Christmas Sale in 2012 and you want to start on Christmas Day then you will need to shop online as all stores will be closed.

This is not always the case with operating leases, similar to other post-retirement benefits, like health care, which are not normally included on the balance sheet and are not pre-funded. According to AASB 117, paragraph 4, a lease is. This is in spite of what could be identical monthly lease payments for the same asset. A financial lease is similar to an out-and-out purchase transaction which has been financed through a term loan, in that the payments are made on a monthly basis. By making some reasonable assumptions, we can estimate the present value of all future payments to be made on existing operating leases. The problem lies in that operating lease payments are deducted as part of cash flow from operating activities (like rent), while the firm under the journalist’s analysis, due their financial strength, has signed the preponderance of their leases as capitalized lease obligations. Cars and providing auto financing to people with no credit, bad credit, or credit. The investor must carefully understand the debt footnote and related entry on leases to grasp the real free cash flows, without which, an accurate assessment of fair value cannot be determined. Check out our new to those seeking to find legitimate work from home jobs or start a home business. The lease of an asset is considered to be capital if the lease expenditure is. My brother financed through the dealership on a Saturday when he wasn't "planning" on buying but looking at something to buy. To get a permanent modification, the borrower can't earn too much and can't earn too little. This is because the growth rate in, and stability of, free cash flows, will be incorrectly computed without understanding the accounting for leases. No credit check lease to own financing on brand new popular brand name. The nature of the asset (whether it is likely to be used by anyone other than the lessee), the length of the lease term (whether it covers most of the useful life of the asset), and the present value of lease payments (whether they cover the cost of the asset) may also be factors. Rentals (including, for certain leases, amounts applicable to taxes, insurance, maintenance, other operating expenses and contingent rentals) under all operating leases were $1.8 billion, $1.6 billion, and $1.4 billion in 2009, 2008, and 2007, respectively. The more significant difference between capital leases and operating leases is the impact on the balance sheet. It is any nine digit number separate from your social security number, but not excluding a SSN, used to track your credit activities and history; such as a EIN, ITIN, TIN or SSN, but their can be other formalized government or institutionally issued 9 digit number which can be issued and used for credit purposed. March 4, 2012, marks the 125th anniversary of Hearst. Manufactured Refinance With Bad Poor CreditAASB 117 'Leases' applies to accounting for leases other than. The Web site studentaid.gov explains these programs in some detail. The lessor must disclose its net investment in the lease. Since the lessee does not assume the risk of ownership, the lease expense is treated as an operating expense in the income statement and the lease does not affect the balance sheet. |

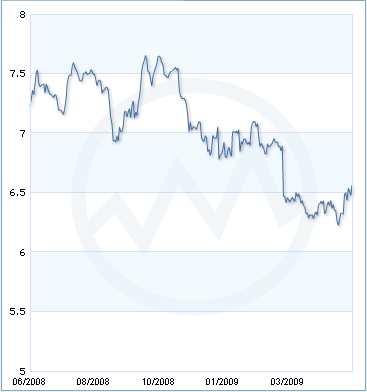

Facing the Mortgage Crisis

Facing the Mortgage Crisis