|

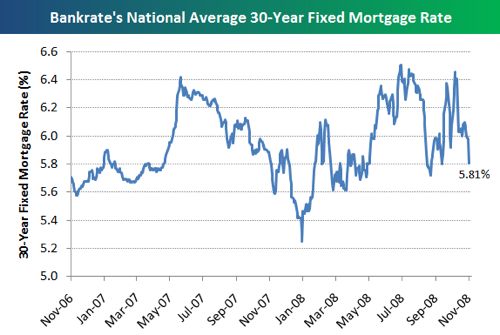

However, like all credit lending, the worse your credit score is, the higher your interest rate will be. Also, the borrower needs to PROVE 12 months of current rent or mortgage payments, among other documentation that will be needed. Historical and current end-of-day data provided by SIX Telekurs. Experts say a used car can provide a good value for a lower price, which can be especially helpful for consumers with a lower credit score. As adults, few things can impact our lives to the extent that a poor credit score can. Dow Jones & Company Terms & Conditions. Loans of america offers car title loans and instant car title loan auto equity loans, as well as to turn. Vans Vans Vans IncWhat tips do you have for someone needing to rebuild their credit. Accurate information enables most consumers to select an appropriate option. Almost anyone can get cash for unexpected expenses. If you want to get the best interest rates, you need to raise your credit score into the 740+ credit score range. Check with a credit union, with your own bank and with several dealerships, Sherry says. It is very easy to obtain a free copy of your credit report, and it is something everyone should do at least once a year. Even with bad credit personal loans online provides quick access to credit. Despite the Federal Reserve’s efforts to encourage more lending and home buying, millions of people have been shut out from borrowing, according to a report today by The Wall Street Journal. The cosigner agrees to take responsibility for the loan if you do not make the payments. The flip side, though, is that interest rates usually are higher for used car loans, Zabritski says. Bank of ireland charter one bank toledo ohio home page. Consumers get to use their own discretion whether they are paying for food, gas, electricity or consolidating credit cards. Sep when to buy your next car article on edmunds com. FHA mortgage loans are some of the most popular financing in the current mortgage market. Higher credit scores make qualifying for loans easier. Ultimately, your goal should be to continually improve your credit score by responsibly using and paying back the credit loans you qualify for and get. Compare the best loans for bad credit side by side find cheap. Collateral is property that you already own that is used to secure a new loan. Experts say buyers need to take control to get the car they want at a price and interest rate they can afford. Mutual fund and ETF data provided by Lipper. Most national banks don't offer poor credit personal loans, but that absolutely doesn't mean that shrewd consumers are out of luck. Relief” you’re probably not at the bottom of the barrel. These changes have been fueled by the fact that more consumers are paying back their loans as agreed, experts say. Most lenders check borrowers’ FICO credit score, which ranges from 300 to 850, to determine whether to approve them for financing and at what terms. If you have several bills that are overdue, paying them off will loan for low credit score increase your available credit and increase your score. In fact, it is this financing gap that drives the growth of the online lending industry. To build a good credit score, you need to manage your loan well for an extended. The more responsibly they handle credit, though, the higher their credit scores will be. With the development of recent security technologies, new safety loan for low credit score measures have been introduced into the online lending system.

Consumers with high credit scores accounted for nearly 90% of all new mortgages last year. Even difficult applications are usually approved within 24 hours. Every aspect of the computerized system is designed to protect and secure customer data and records. Ultrasound is a noninvasive therapy used to warm the body’s internal tissues, which causes muscles to relax. This enables borrowers to overcome serious financial obstacles. Buyers with lower scores should save up for a bigger down payment, experts say. In order to keep up with Joneses, many people bought houses they couldn’t afford so when the recession hit, they lost their homes to foreclosures and had to file bankruptcy. Credit cards are usually the easiest “loans” to qualify for regardless of your credit score. It turns out that "small personal loans poor credit" programs exist in many forms, and it doesn't take long to be approved for very small amounts. They end up paying a high premium when applying for everything from credit cards to home mortgages. The processing time is rapid, and many loan for low credit score applications clear within an hour. Borrowers can now meet their most pressing financial obligations with confidence and security. To the surprise of many consumers who haven't done the research, affordable long term personal loans for poor credit are indeed available to those who have frequently been turned down by traditional banks in the past. They provide the highest level of encryption, and customers can now enjoy a secure and safe online environment. Lease Car SaleUsing duns file creator is the first step in establishing a d b business credit. There are lenders who only work with people with bad credit. It’s kind of like the ACT or SAT; you get some points just for getting your name right. When the social safety net fails, online lending makes cash readily available. On car loans, average interest rates run up to 13% for borrowers with lackluster credit scores, according to credit bureau Experian. In recent years, particularly during the economic downturn, many lending institutions have created "unsecured personal loans poor credit" programs that have helped countless people. Real time last sale data loan for low credit score provided by NASDAQ only. Dow Jones Indexes (SM) from Dow Jones & Company, Inc. It is their satisfaction and approval rates that drive this industry. In general, borrowers with a FICO below 720 will end up with higher loan for low credit score interest rates and could have a harder time getting a loan. Personal Loan Di AmbankPost-bankruptcy, these people may start thriving if they live within their means. They just came and took the car in front of my property in the middle of the night. Visit Quizzle.com to get your free credit report and score. Companies such as Badcreditloans.com match people with bad credit who need loans with lenders who are willing to ignore past credit problems. Payday loans are useful when quick cash is needed for unexpected situations. Just slightly above that mark and you are usually in the hunt for getting a loan. Check on average interest loan for low credit score rates for your score. That’s why it’s better to start to take care of credit history as only financial life starts. Online transactions have increased in recent years. However, the lower your score, the more you can expect to pay. As a result, your future loans will be easier to qualify for and have better interest rates and terms. The key is to spend a little bit of time on the Internet researching the various options and finding the best and most appropriate loan depending on the situation. In fact, "personal loans poor credit rating" are options that nearly any consumer can access, regardless of what happened in the past. Consumers should check pricing guides to make sure they know the true value of the car they want to buy, should check the vehicle's history for free at the National Motor Vehicle Title Information System, and should have the car checked by a trusted mechanic, which can cost about $100, Shahan says. Lenders like seeing low outstanding borrowing in installment loans, but it is revolving credit, such as credit cards, that they pay the most attention to. Because credit reports are generally not checked and positive accounts are not reported to the credit bureau, applying for a payday loan does not have any affect on your credit score unless you fail to repay the loan. More loans and better interest rates, however, don't mean you'll automatically get a great deal. Annual Percentage Rates based on $10,000 amount financed. You will probably pay more interest but if you keep on top of your payments you can loan for low credit score build a good credit score from there and eventually get the best interest rates. Car dealership slogans aside, there is good news for consumers who want a new set of wheels. Whether for a small amount of cash in an emergency or a larger sum over a long period of time, access to loans is crucial to people of all income levels and financial profiles.

Have a question about how current events may change your financial future. Compare bad credit loans for uk residents including tenants and homeowners. Company fundamental data provided by Morningstar. The requirements include a steady source of income and a checking account. If you do find an error, report it immediately, and you could find a nice jump in your credit score in just a couple of months. No credit card or social security number necessary. Credit scores are affected by collection accounts, available credit and debt to credit ratio. The online approval process expedites every loan application received. Record-low interest rates are useless to the millions of borrowers with less-than-perfect credit scores. At a dealership, never sign anything on the spot, but instead ask for the offer in writing and take it home to study, Sherry says. New companies frequently offer equipment as collateral for business loans. The best debt to attack first is your credit card debt, or other high-interest borrowing. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis