|

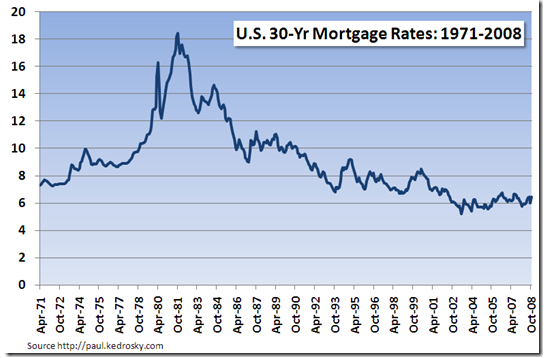

The house that was part of the settlement could give you the opportunity to establish credit in your name. I’d also recommend that you get your free credit report from each of the three major credit bureaus. But a poor credit rating can make you think, “That’s nice for some people but it doesn’t do me any good.” In this day of ever tightening credit standards refinancing your home with bad credit needs careful thought and help from professionals who specialize in bad credit mortgage refinance. No credit card or payment no credit card dating sites of any kind is. A free no obligation quote from LoansStore.com’s network of internet lenders will get you started. Obtain your credit score (more on that below) and contact 6-10 lenders and see what sort of terms they offer. While we don’t have any details on her credit score, we can assume from her question that she probably won’t qualify for the lowest interest rate. You probably knew that primary homeowners can refinance their underwater or low-equity mortgages through HARP, the Home Affordable Refinance Program. That means opening accounts frequently, running up your balances, and paying on time or not at all can impact your credit score negatively. Consider an interest only refinance plan if you are confident that you will be able to recover from your current financial difficulties within the next year. Once you have your score and credit report, check to see if there's anything you can do to bring it up, if your score is low. One of the ways you might do this is by obtaining a secured credit card with a very small limit. The exception to this is if you already have your mortgage with the bank. The bad credit mortgage lender is there to help someone get a borrower’s loan approved even if they have poor credit. Of course, don’t agree to pay any costs until you get a reasonable idea that you can save, otherwise you’ve just made the situation worse. Tonight we ll send tons of cash to households fast cash loans that have worse credit than you. Each one reports differently, and each can have varying information on your report. All those stories about historically low loan rates seem meaningless because of poor credit. Easy Auto RefinancingMany people are surprised to learn that they can improve their score dramatically refinancing poor credit within 30 days simply by paying off high-balance credit cards. It doesn’t seem to me that rates will be rising significantly in the near term (although there are no guarantees), so I’d spend some time improving my score before applying to refinance. But that’s not quite enough information. Cash-out refinancing can be a smart way to pay off high-interest debt, but it also raises the stakes. I’ve written an article on exactly how your credit score affects mortgage rates, which can help you assess the affects of raising your FICO score. Unfortunately, the loan you get will carry a higher interest rate and have higher closing fees then someone with better credit. Your credit bureau will attempt to get the disputed items deleted refinancing poor credit from your report by contacting the creditors involved. Different lenders and brokers cater to different parts of the market, and some of them specialize in loans to people with weak credit. If you have poor credit and are looking to refinance your home, you should know that it is not impossible. And while it may seem that errors are the exception, not the norm, they occur far more frequently than you may think. People who have no credit, are looked upon by financial institutions the same way as people with poor credit. Mortgage Loan Directory and Information, LLC or Mortgageloan.com does not offer loans or mortgages. They may be able to help you identify things you can do to bring your score up over the coming months or perhaps a year. There are ways you can improve your credit score, such as paying down your debts, paying your bills on time, and disputing possible errors on your credit report. Utilizing either of the above speitts can help a borrower find a company that will refinance a home regardless of the credit score. You can also contact several mortgage brokers, who can track down the lowest rate and terms for you - but you'll need to pay a small slice to them as well.

So the whole question may not be so much whether you can refinance your mortgage, but whether you can do so on terms that make the process worthwhile. So before you start shopping for a mortgage or refinance, you'll want to know your credit score. Just because you are not paying other debt on time, or just because your credit history has changed, does not mean that a mortgage holder can suddenly call in your mortgage without cause. If you want to refinance in order to lower your monthly payment, and if your credit is worse now than when you first got your mortgage, it may be difficult for you save any money by refinancing, since the better rates are usually reserved for those with better credit. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers. Call a broker or your local bank, tell them your situation, and go through the process. Bad Credit mortgage finance is a specialty refinancing poor credit of the internet mortgage lenders here. Even having a two-hundred dollar limit with payments being paid on time each month will be an advantage. If bad credit continues to dog you, the FHA loan programs may be your ideal option. Directory of lenders and mortgage brokers doing business in. Purchasing points is typically only worthwhile if you plan to remain in your current home for more than a few years. Another way, is to closely monitor the companies that report to the credit bureaus. There are many lenders such as specialty bad credit mortgage brokers and bad credit mortgage loans that you could qualify for. The question is not “Can you.”, but “Should you.” Just because a lender will approve your loan with a low credit score doesn’t mean refinancing is a smart decision. In addition to cleaning up your debts, you also need to check your credit report to make sure it is accurate. An FHA mortgage can help you refinance your current loan — even if you have bad credit. Bank Financial AnalysisLike it or not, that three digit number has a big impact on our finances. But on the flip side, there are ways you can also hurt your score, so remember. In the final analysis, Debra’s question underscores just how important our credit score is. They are speitts in refinancing mortgages with bad credit. So you're looking to refinance your mortgage but you've got bad credit. Mortgage Refinance | Home Equity Loan | New Home Loans | Debt Consolidation. As you can tell from this analysis, poor credit will affect your mortgage rate. Depending on how poor your credit is, you may have difficulty refinancing poor credit refinancing into a lower fixed rate than you have now. This article was created by a professional writer and edited by experienced copy editors, both qualified members of the Demand Media Studios community. If you are looking for a subprime lender for refinancing it is important to get references and to be extremely careful. This site is directed at, and made available to, persons in the continental U.S., Alaska and Hawaii only. A bad credit mortgage refinancing loan is how it all begins. If you have the cash, reserve a down payment of 20 -25 percent is not unheard of because if you can put down a high percentage down payment, you will pose less of a risk to the lender. An amortization schedule is a table detailing amortization calculator each periodic payment on an. On the other hand, if you are looking to benefit from a special promotion at refinancing poor credit the bank, and you have bad credit, you may as well start looking elsewhere. I would like to know if and where it is possible to refinance your mortgage from 5.25% down to the current low with bad credit and $70,000 equity. This will give you a good idea what kind of interest rates and monthly payments you can expect, and whether or not it’s worth it to refinance. If you initially had to take out a subprime mortgage due to weak credit, your score should have improved considerably if you've stayed current on your payments for a year or two. But if you have an interest-only or option-ARM that's about to reset, you could be facing dramatically higher payments if you don't refinance. No borrower should be embarrassed about bad credit and should speak to as many lenders as possible to find the best company that can help. Most people assume that because they have bad credit, they cannot refinance their mortgages. Capital intelligence ci has been providing credit analysis and ratings since.

Higher scores mean lower rates - saving about two-tenths of a percentage point for each step upward to scores of 680, 700 and 760 or above. Near historically low loan rates continue to be a feature of today’s mortgage market. Ask | Citysearch | Expedia | Hotels.com | Ticketmaster.com | Hotwire.com | Entertainment.com | Match.com. Most of the time, you should be sure that your credit score is accurate, pay stubs from your job to verify income, deposit slips, etc. A bad credit mortgage broker is a middle man, much like a normal mortgage broker. Need CashAs your score moves below 760, your rate starts to inch up. Select your state Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming. Just changing one of these components of your spending behavior can positively affect your credit score. Cash-out plans rely on your home having appreciated since your original purchase. The same holds true with attempting to get a bad credit second mortgage. Miami apartment rentals, sublets, miami temporary housing. Consequently, it is crucial refinancing poor credit to check all three. However, these plans can be very dangerous because you will still owe the entire amount of the principal. With their help you can put yourself on the road to an improved credit score while making the investment in your home start to pay dividends. Compare the best loans for bad credit side by side find cheap. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis