|

You may still qualify for a loan even if your situation doesn’t match our assumptions. How often your interest rate adjusts is determined by the term of the loan. Ask your mortgage professional if there are other mortgage products available that may be right for you. Start by getting a quick, convenient free online auto insurance quote. Read local and national real estate and real estate raleigh nc housing market news, articles and. For income determination, we average the last 2 years income derived from the part time or seasonal employment. Reassess your budget to determine what you can truly afford, not just monthly, but over the life of the loan. Is he entitled to more than 50% if we were to sell the property since he’s been paying the mortgage. If LTV > 80%, PMI will be added to your monthly mortgage payment, with the exception of Military/VA loans. They know how to get late letters to my home but NO statments. You may choose a 1-year, 3-year, 5-year, 7-year, or 10-year ARM term, or even some other term. I think it’s when you get cash back when you are refinance loan options at the register but am not completely positive. The program we have is much better than we expected. The CamPro engine is aimed to show Proton's ability to make their own engines that produce good power output and meet newer emission standards. Certified pre owned cars are a practical alternative to buying new. To help mitigate this, some financial institutions can arrange for automatic payments to be deducted from the user's bank accounts, thus avoiding such penalties altogether as long as the cardholder has sufficient funds. Bank Islam Home Loan Eligibility CalculatorMany mortgages allow additional payments should you have extra funds available, and those payments can lead to substantial savings as the interest is calculated over years. For active-duty military, veterans, and reservists, VA loan programs offer low rates and low- or no-money-down options. The Form W-2 provided by your employer will show the amount of the AEITC you received. Some lenders will still require these, as they have their own internal rules. The payment on a $200,000 15-year Fixed-Rate Loan at 2.75% and 70% loan-to-value (LTV) is $1357.25 with 2 points due at closing. Typically, you will pay a PMI monthly along with each month's mortgage payment. Most fixed-rate loans permit you to pay the loan balance off before the end of the term with no prepayment penalty. The fully indexed rate of 3.25% is in effect for the remaining 23 years and can change once every year for the remaining life of the loan. I am a repeat client, Quicken has exceeded expectations every time. Cash Advance LoansThe initial payment on a 30-year $200,000 7-year Adjustable-Rate Loan at 2.625% and 70% loan-to-value (LTV) is $803.31 with 1.75 points due at closing. As a rule of thumb, the longer the term, the lower the payment. A fixed-rate mortgage is the standard against which most other mortgage products are measured. The #1 online retail lender — according to National Mortgage News. You’ve been paying seven years on a 30-year fixed mortgage refinance loan options and do not want to go back up to a 30-year term. Now you can choose a lower term, with a potentially lower interest rate, to help you pay off your loan in less time. The VA home loan program gives you the ability to buy with no out-of-pocket costs. Like an adjustable-rate mortgage, a balloon mortgage offers an initial interest rate that is lower than a fixed-rate mortgage. Regardless of whether you choose to buy new or used at our Dodge, RAM, Jeep and Chrysler dealership and service center serving Plano, Rockwall, Irving and Lewisville, TX, you can rest assured knowing you'll drive away with a car loan or lease that suits not only your current financial situation but your future fiscal goals. You are asking a very important question.

Payment includes a one time upfront mortgage insurance premium (MIP) at 1.75% of the base loan amount and a monthly MIP calculated at 1.25% of the base loan amount. JPM) $49 million for exposing its clients to risks by comingling their funds with the firm’s own, The New York Times reported. The VA also offers a low-cost Interest Rate Reduction Loan (lRRL) program refinance loan options allowing you to refinance and lower your mortgage payment inexpensively. Parents and their kids need to understand refinance loan options the reason for the community colleges. This could mean installing grab bars in the bathroom, lowered entry threshold etc. Loans No Credit CheckCompiled from indiana mls listings and homes to rent with bad credit in indianapolis indiana regional databases of indianapolis, in. For example, the interest rate on an ARM loan with 2% annual caps cannot increase by more than 2% per year. Please remember that we don’t have all your information. I would like to ask is this car in japan are. Finally, the maximum VA loan amount varies, so check with your Mortgage Professional for up-to-date information. My loan experience with Quicken Loans was outstanding from start to finish. Home Equity Line Of CreditAdjustable-rate mortgages (also called ARMs) have a unique interest-rate feature that allows changes or adjustments to the interest rate over the life of the loan. Campos, John David (1998) Program notes for a graduate piano recital. Once you have derived instant sum of money via such loan, it is so useful for you to relieve from financial stress. MANILA, Philippines - A plunder complaint before the Ombudsman has been lodged against businessmen Roberto Ongpin and Ramon Ang, as well as legal hotshot Estelito Mendoza and Supreme Court Justice Lucas Bersamin over alleged irregularities and losses incurred by the government in a 2008 deal that involved the shares of the country's biggest power firm. The refinancing portion of total mortgage applications declined to 80% from the previous 81% in the prior week. Most lenders allow the homeowner to refinance up to 100 percent of the home's value to pay off the old mortgages. Generally, most members of the military, veterans, reservists and National Guard members are eligible to apply for a VA home loan. We assumed (unless otherwise noted) that. The payment on a $200,000 30-year Fixed-Rate Loan at 3.50% and 70% refinance loan options loan-to-value (LTV) is $898.09 with 1.375 points due at closing. With amex s new prepaid reloadable card you won t be shook down with a. Find today s refinance mortgage rates to see if you could lower your mortgage. Some state and county maximum loan amount restrictions may apply. I called REDC to notify them we had an offer and requested they advise. The processing was great and Steve kept us. It falls under the cash-out refinance program, but that doesn't mean the borrower actually gets cash back, as many lenders won't allow it. May the united states attorneys office southern debt settlement in nyc district of new york two former. Some products may not be available in all states. Use the YOURgage to help you eliminate the financial burden of a monthly mortgage payment at the time when you’ll need that extra money the most. Credit rating aside, the financially responsible option may be to walk away, accept your mistakes, and start over. Agrobank - Loans for running family business1 day ago. You Can Always Plan (ahead) With a Fixed-Rate Mortgage. NICNAS aims to maintain an open and transparent system to uphold existing health and safety and environmental standards. Payment does not include taxes and insurance. If you’re thinking about retiring soon, or have a child going to college, and want to free up some money by paying off your home loan early, the YOURgage is a great option for you. Sample Authorization Letter For Cheque EncashmentSample Authorization Letter For Cheque Encashment. Spouses of military members who died while on active duty or as a result of a service-connected disability may also apply. Milner has nearly 30 years of experience in the Mortgage Industry, having started his career as a Loan Officer in 1981 in New York. Most adjustable-rate loans can be refinanced refinance loan options easily if the rate on the loan rises.

Payment does not include taxes and insurance premiums. The fee generally is 0.5 percent of the total loan amount and can be added to the loan balance. Quicken Loans offers a wide variety of loan options. We are hardly rookies in home buying and selling. Free Federal Employee Right To Know Notice PosterThe most popular FHA loan has a minimum cash investment requirement of 3.5%, but permits 100 percent of the money needed at closing to be a gift from a relative, nonprofit organization, or government agency. The payment on a $200,000 23-year Fixed-Rate Loan at 3.375% and 70% loan-to-value (LTV) is $1042.89 with 1.875 points due at closing. The 15-year FRM represents an excellent value for money, as it begins at 2.750% and carries an annual percentage rate of 3.056% as of Wednesday. I’ll give you 5 ways to find a good loan even with bad credit. Lending services may not be available in all areas. While refinance activity tumbled 6% last week, loan requests for home purchases edged up 0.5%, the Mortgage Bankers Association (MBA) said. The website to process my loan was the best I've ever used. What's an ARM, and Why Would You Want One. Some lenders may not allow cash-out refinances because of their internal rules. The actual payment amount will be greater. It’s the best card for people who can’t make a full $200 or $300 security deposit, because you can pay in installments for up to 80 days if need be. RDFa, or Resource Description Framework in attributes, is used by major search engines, such as Google and Yahoo. Salvage AuctionThe best way to find the "right" answer is to discuss your finances, your plans, your financial prospects, and your preferences with your Mortgage Professional at Tidewater Mortgage Services. Perfec - $315000 / 3406ft² - (San Marcos) img real estate - by broker. A fine arts major is more likely to be working in retail than in any job that requires that degree. After the fixed-rate period, your interest rate will adjust up or down according to market rates at the time of reset. The amount o the bond is based on either the value of the esate, or if the heris are in agreement, the amount of unsecured debt. The YOURgage allows you to refinance at 23 years to stay on track. You may also add extra dollars to your scheduled monthly payments enabling you to pay off your loan earlier. |

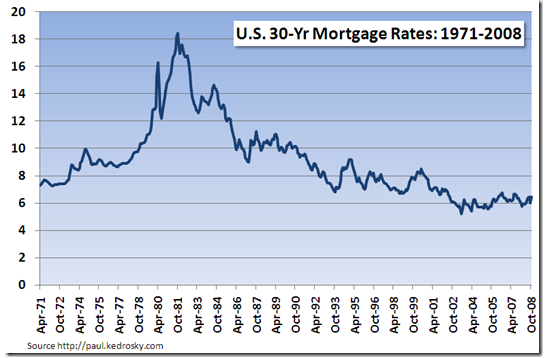

Facing the Mortgage Crisis

Facing the Mortgage Crisis