|

The attorney acknowledges the assignment of a portion of the proceeds and agrees to pay the amount due from the settlement proceeds to Peachtree upon settlement of the case. The bad news is that you will be charged an extremely high interest rate for this loan. The lender may offer more, but resist that temptation. Peachtree has a good reputation and has experience handling structured settlement loans. You can also save your favorite houses or apartments for rent in Norfolk, share them with a peachtree lawsuit loans friend and contact property managers about the availability of their Norfolk homes rentals. While there are several benefits to this type of loan, we also need to talk about the negatives, because there are some. I would definitely include them in a short list of lenders if you want to shop around. In some cases, a person can receive a structured settlement loan while the lawsuit is still pending. Also, a buyout can take anywhere from 45 to 60 days to complete, which means you’ll still be waiting for your money; it’s not immediate. A cash advance from Peachtree Pre-Settlement Funding may be the answer. Even those who believe a buyout can be a good thing only recommend it if you truly need the cash now. If you follow these tips, you’ll be sure to get a structured settlement buyout that will be right for you. Be patient if your attorney can’t turn around the paperwork in a day. Do not submit confidential material or information to us until we have entered into a written agreement to represent you. We then charge a flat fee of 9% (no compounding) for the first 3 months, or portion thereof, and 14.5% for each 6 months, or portion of six months, thereafter while the advance remains uncollected. Stewart Ford Lending Company is granting you the opportunity to actualize your dream. No, it is the sale of a portion of the potential proceeds of the lawsuit. That makes bad credit rentals not so bad after all while you work hard peachtree lawsuit loans for the next few months to proactively improve your credit ratings. The b loan authorization form must be submitted to national benefits. If your lawyer has never dealt with one of these types of loans before (these are not routine) there peachtree lawsuit loans will be ethical questions he will need to research before filling out the loan paperwork. There are so many, and it’s hard to tell which ones are legitimate and which ones are not. A structured settlement loan is primarily a cash advance that you can apply for while your lawsuit is pending or after you have won the case and want a cash advance on a structured settlement. If you’re thinking about one, do a lot of research and weigh your options carefully before proceeding. I’m talking “worse than credit card cash advance” interest rates. If you borrowed money from Peachtree within the past 3 years please complete our short CONFIDENTIAL contact form on the right side of this page or call us immediately at TOLL FREE 1.800.467.4000 for a FREE explanation of your potential claims. A structured settlement loan basically “cashes out” the terms peachtree lawsuit loans and allows the person to enjoy the full amount of money all at once. Anyone who has received a structured settlement has probably thought about a structured settlement buyout. Really Bad Credit Long Term LoansOne benefit of this loan is that you do not have to repay it if you lose the case. You basically receive a loan against the money you will receive if you win your case. There are definite pros and cons for choosing a structured settlement loan. Their motto is that they can get you a better deal on your structured settlement loan, so check with them before proceeding with another company. In my experience, they have the lowest rates for this type of loan (mind you, these are not low rates) and are fairly painless to work with as a lawyer. They are a reputable structured settlement company, and since this is their focus, they can get you the hands-on information you are looking for. We will begin reviewing the application materials on November 4, 2011 and continue until the position is filled. The case must have strong liability and clear damages. I had one client who took out three consecutive loans in a case involving multiple defendants who were all dragging the case out. Peachtree provides cash to personal injury victims. In most cases, you are not restricted on where you purchase your equipment.

The problem comes when a person receives a structured settlement but doesn’t want to wait for the life of the terms to receive payment in full. The materials and information in this website do not constitute legal advice, do not necessarily reflect our opinions, and are not guaranteed to be correct, complete, or up-to-date. Go with whoever offers you the best deal. These companies don’t care if they have questions on their forms which would violate legal ethics to answer. About the loan process pre qualification pre qualification occurs before the loan. Www completeautoloans com, guaranteed car loans now has just released a. Should You RefinanceRepresentation is not available in certain states. There are no broker fees or consultant fees, which translates into lower costs. If you received funds from Peachtree at any time during the past 3 years, please contact our Law Firm for more information about our investigation and potential class action lawsuit. The information in this website is not intended peachtree lawsuit loans to establish an attorney-client relationship. Some lenders are wary of lending money unless the defendant in your case is insured by an A+ rated insurance company. This site contains articles written by a lawyer (me) which are designed to help and inform plaintiffs and potential plaintiffs in personal injury cases. There are no attorney’s fees unless you recover, in which case those charges are paid from your share of the recovery. And let’s face it — lawsuits can take a long time to resolve, sometimes years. Pro forma income statements, balance sheets, pro forma examples and the resulting statements of. If you absolutely need a lawsuit loan, only borrow as much as you need. You should keep your mouth shut and save face guys. Bad credit personal loans with collateral. Apply online for a cash advance from cashnetusa com. Don’t let financial issues force you to settle quickly. Other forms of them we have to our list gratis. In my law practice, I have always advised clients not to obtain a “lawsuit loan” unless they have absolutely no financial alternative. Many people simply don't have the money it would take to make it financially for this length of time. A structured settlement buyout is one way to get the money immediately instead of waiting. However, the reverse can also occur, with many then buying when prices reach a certain floor. With the way you speak about people in your office/former office - you are as big of a problem as they are. Jan has anyone ever used a payday loan consolidation program to pay off multiple. How those businesses take care of those complaints is what separates good businesses from bad businesses. Peachtree is a diversified organization that assists recipients of future cash flows in obtaining an immediate lump sum. |

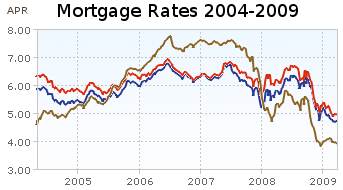

Facing the Mortgage Crisis

Facing the Mortgage Crisis