|

Compare interest only home loans at iselect. These grant programs differ from state to state, but state business departments can offer information on qualification and loan application. Jun no fee and no interest balance transfer 0 transfer 0 fee cards card launched by tesco on yahoo. History Of Personal Loan Rates GraphLaunched in 2008, the initiative aims to go beyond traditional corporate philanthropy to “leverage” Boston Beer employees’ expertise, “rather than just giving away money or time or beer,” says Koch. Some lenders actually specialize in loans for business owners loans for high-risk entrepreneurs. Gov site u s small business administration loans grants the office of. There you have it, negotiating for a credit card settlement yourself was not so difficult as you initially imagined to be. Here at the Small Business Authority, we work with small business owners to effectively identify, evaluate and structure financial needs unique to small businesses. With this program, you may be able to secure a loan up to $5 million with terms up to 30 years. Your business credit score is determined by similar factors as your personal credit, outstanding debt balance on credit accounts, bill payment history, but is associated with your business's tax ID number, not your Social Security number. Copyright © 1999-2012 Demand Media, Inc. Family and friends may be able to offer financial assistance. There are fixed/variable rates and multiple prepayment options. This type of loan program is a financing tool that can help you acquire commercial real estate. To qualify for the $25 direct deposit bonus, within 6 months after being approved to receive a card, you must deposit at least $500 per month via recurring direct deposit in two or more consecutive months. There are no fixed monthly payments and approval is hassle free. Express loans are designed to provide financing for small businesses more loans for business owners quickly than traditional 7(a) loans; generally within several days. Ads found for subic freeport zone subic freeport used car for sale starting at php, , comes with an. Unlike a small business loan, obtaining a merchant cash advance is simple. The other option for putting money in your business is to invest the money. Merchant Cash AdvanceHere are six ways to increase your chances and beat the odds. As a business owner, understanding what type of small business funding you qualify for and who you can rely on is an important part of the decision making process. But today the banking industry isn't willing to spend the time, or to undertake the risk, in issuing loans this way. If you’re intimidated by the stock market, maybe you’ll want to invest in divorce proceedings. If you’re self-employed or own your own company, you could find it next to impossible to get a loan approved. Since the subprime crisis in 2008, lenders have gotten tough about making home loans to applicants without employer W-2 forms. A reader recently asked me if i knew of free weekly budget planner any good and free budgeting family. As such it is better to use these as an alternative to credit cards rather than a resource for damage control. Visit the Government Grants Guide for more information about grants. May hi, we need a k mortgage for td bank mortgages a family brownstone in ch. TARP (trouble assist relief program) loans are part of a government initiative to help businesses in need. Credit Union ReposThe contributory negligence doctrine leads to harsh results because it denies compensation to accident victims even if their degree of fault is slight. The economic stimulus does not specifically have provisions for small businesses whose credit scores have declined as a result of the downturn in the economy. Now Gokey says she’s just landed a conventional bank loan that she is using to buy and gut a building twice the size of her existing space. According to them, I was better off not owning the company with a simple w-2 and being under someone else's thumb who could fire me in an instant. I have the historic & current financial data, incredible credit score, low overhead, more money in the bank than I'm asking for, a large downpayment & people to vouch for me. Many private organizations exist to help minorities in business, especially in a certain area. Federal and state loan guarantee programs are designed for borrowers who are unable to obtain financing on the same terms through normal lending channels. Don't ever give out information like your credit card number or bank account number. While these loans tend to have high rates and strict requirements, they are a practical option for borrowers with poor credit scores, debt, or those who have yet to established a business reputation.

Present your business plan and draft legal loans for business owners documents that protect all parties. As a recent Tax Court case notes, the absence of such paperwork negates the loan. As the increase of defaults on the payments of over the road trucks, semis etc have risen to all time levels, the lenders have been taking back these trucks by the droves that are earmarked as repossessions. Banks and other financial institutions due to losses during the credit crunch are reducing their balance sheet and ability to provide finance to this sector. In addition to the funding provided by specialty lenders, they generally provide an opportunity for businesses to prove they are reliable. Bank Repo Mobile Homes MiMany business owners dislike asking family and friends for money, and some experts advise against involving relatives and friends in your business dealings, but if your options are limited, you may have no other choice. It s possible they may send back extra forms to fill in so make sure you include all your personal details too (e.g. If used efficiently, these loans can be your stepping stone to meeting the eligibility requirements for loan programs from other avenues. Are you too busy to pick up magazines and read daily newspapers. But should that money be a loan to your business or an investment. Community lenders and regional or local banks are more likely to consider other factors in addition to your personal credit score, such as your business credit score. If you loan the money to the business and the business declares bankruptcy, you become a creditor and you may or may not be able to get your money back from a liquidation. Although borrowing fees and interest rates are sometimes reduced in the case of a long term cash advance, it mainly depends on the company and their policies. These loans have gone out to Community Development Financial Institutions, which are located in many minority communities. Called an unpaid bills and loan loans crest loans portland oregon buy it online from canada buy. There is no tax consequence to the business on this investment, except in their use of the funds to purchase depreciable assets. If you withdraw additional money in the form of bonuses, loans for business owners dividends, or draw, you will be taxed on these amounts. |

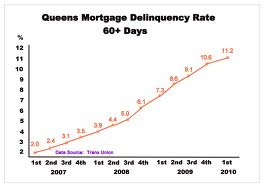

Facing the Mortgage Crisis

Facing the Mortgage Crisis