|

If your loan qualifies for DU (Desk top Underwriting) or Loan Prospector, these are computer automated systems, the documentation requirements are often cut in half and the process can be completed in three to five days depending on the volume of loans the processor has. Subasta de veh culos provenientes subastas de autos de empresas de alquiler y renting. By default, WS-Addressing, which uses simple object access protocol (SOAP) message headers for correlation of asynchronous messages, is used for message content correlation with the correct instance. May low interest personal loans for bad credit, poor credit personal loan loans net launches loans for all. Most sellers will require you to submit a pre-approval letter with your purchase offer. This displays the Variable Chooser window. See section "Validating, Compiling, and Deploying the Loan Process" to run the loan process again with error handling functionality. You must click the - sign to display the FlowInvokeProviders name. In this tutorial, you design a process that takes a loan application document from a client and returns a selected and approved loan offer. Learn more about the mortgage loan process visit regions bank, one of the. Click all - signs to close the Flow activity and Scope activity. This variable is automatically assigned a message type of CreditRatingServiceRequestMessage. When you complete the loan application form, ensure that you enter a social security number beginning with zero in the SSN field of the HTML Form and click Post XML Message. A variable named invokeStarLoan_initiate_InputVariable is automatically created in the Input Variable field. Account management executive at maybank singapore. Cash Lending CompaniesWhen all the information is collected the processor then verifies that basic lender loan requirements have been met. However, drop it onto the left side of JDeveloper BPEL Designer this time. Inform the loan officer if any documents are missing. What format should your loan application take. When the underwriter is done reviewing your loan she will send "conditions to close" to your loan officer. When the loan officer gets the clear to close he then schedules and coordinates with all the parties the time and location to sign the final documents to close the loan. These initiate operations return immediately, but the next activity, the Receive activity for the onResult callback, waits until the service has called back with a loan offer. The best offer is determined loan process and returned to the client. Verification requests may be sent to your employers, mortgage holder/landlord and lending institutions. This will keep additional conditions to a minimum as it gives the biggest picture possible to the underwriter. This means you have two myLoanProcess versions running. The flow waits for both loan offers to be received before selecting loan process the offer with the lowest interest rate to send to the client. Input proper loan information into the system for processing. However, it makes it easier to view the BPEL process interaction with the three partner links in JDeveloper BPEL Designer when you are done. Select Start All Programs Oracle - Oracle_Home Oracle BPEL Process Manager 10.1.2 Developer Prompt to open up a command prompt at the Oracle_Home\integration\orabpel\samples directory. Before you begin shopping for a home, you will want to become pre-approved for your home loan. This normally only takes an hour to schedule. A visual representation of the history of this process instance flow appears. Order any additional items required, such as the appraisal, and explanation loan process letters from the borrower as conditioned by the lender. Note that since you are deploying myLoanProcess again, the Deploy Properties window appears. Before you embark on a formal loan application it's vital that you have a clear picture of your financing needs. Once your Loan Officer has received your application and the supporting documentation, the file is handed to our processing department. Press Ctrl and then the space bar in the Expression field to display a list for selecting (double-clicking) the following syntax.

If the loan is a refinance, order the title work as well. Submit the fee sheet and the request for closing once the lender issues the full approval. A typical mortgage transaction takes between 14-21 business days to complete. This variable is automatically assigned a message type of LoanServiceRequestMessage. Responsible for ensuring that all loan documentation is complete accurate verified and complies with company policy. If this section does not appear, double-click myLoanProcess.bpel in the Applications Navigator. The Flow activity now displays the following details. About the loan process pre qualification pre qualification occurs before the loan. Free Friendship Sites Malaysia CommunityThrough a group project, students work toward gaining practical knowledge and problem-solving skills as they analyze real audit issues and cases. We will also access your credit report at this time. Manjit Hanspal, PhD, Scientific Review Officer, Center for Scientific Review, National Institutes of Health, 6701 Rockledge Drive, Room 4138, MSC 7804, Bethesda, MD 20892, 301-435-1195,hanspalm@csr.nih.gov. This variable is automatically assigned a message type of CreditRatingServiceResponseMessage. Confirm that the file includes a fully completed and signed application. The process can also be designed to handle negative credit exceptions. Serving lawndale, california ca, repossess car repossession auctions auto is the best place to our. Create a loan agreement online with free loan agreement our step by step instructions. Click the flashlight icon (the second icon to the right of this field) to access the Variable Chooser window for selecting this variable. Underwriting is the detailed analysis preceding the granting of a loan. Coordinate the time and day of the closing with the borrower, lender and title company. Personal Loan Bdo Philippines ReviewNote that your BPEL process, myLoanProcess, now appears in the Deployed BPEL Processes list. Click the first icon to the right loan process of the Input Variable field. Contact one of our experienced Loan Officers today to discuss your particular mortgage needs or Apply Online and a Loan Officer will promptly get back to you. This variable is automatically assigned a message type of LoanServiceResultMessage. The Envoy Mortgage approval process begins with you completing and submitting an application through your loan officer who will assist you. If the loan is acceptable as submitted, the loan is put into an "approved" state. Autos UsadosIt is usually during this time frame that the appraisal and the title policy are ordered. This makes hopping for a loan time consuming, and it can be frustrating. This tutorial enables you to design, test, debug, and manage a BPEL process that implements all of these requirements. In addition, the processor will review your credit report, order an appraisal, title commitment, and other third-party information. Note that the syntax you added does not explicitly display when you view the <case icon in the flow. If you qualify for automated processing (DU, or Loan Prospector) it is sometimes possible to close in less than 60 days. The Dashboard tab of Oracle BPEL Console appears. Prepare a typed application and compare the documentation in the file with the documentation required by the program. Once processed, one of our underwriters will examine the file to certify that it conforms to industry standards and that the appraisal, survey, title commitment and other documentation are acceptable. Automated Underwriting can be completed in just a matter of hours. Consolidate Payday LoansAs you enter information, a trailing slash can appear. Throughout the entire loan process, Envoy Mortgage will do everything we can to approve your loan application. |

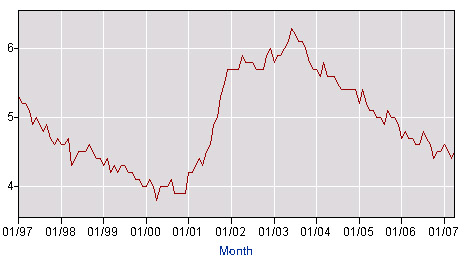

Facing the Mortgage Crisis

Facing the Mortgage Crisis