|

The application, acceptance and disbursement of NLS loan loan forms should serve the purpose of settling your tuition fee. The Guarantor further waives all defenses based on suretyship or impairment of collateral. See our Huge selection of products at Amazon.com. A secured loan is a loan in which the borrower pledges some asset (e.g. Under normal circumstances, payment will not be made earlier than the due dates of tuition fee instalments. Interest is charged at the prevailing NLS interest rate once the loan is drawn down and throughout the repayment period until the NLS loan is fully repaid. This may be done without obtaining permission from or giving notice to the borrower. Non-receipt of demand notes for repayment does not exempt a loan recipient from the obligation to repay the instalment due on or before the due date. The deferred loan may be repaid on a revised schedule with fewer numbers of quarterly instalments and at a larger amount or on any other terms as decided by the Agency. Web Policies & Guidelines | Terms of Use | Privacy. Save for the circumstance specified in the paragraph below, interest will accrue over the deferment period. The payment dates are the NLS loan draw down dates which are set by the Agency. As added security for a loan, you may require/demand that more than one person sign the PN, e.g. In the event of default by the Guarantor, all reasonable legal fees, collection and enforcement charges to the extent permissible by law, in addition to other amounts due, shall be payable by the Guarantor. The combined life-time loan limit for the 2012/13 academic year is HK$300,000 and will be price-adjusted annually thereafter in accordance with the Composite Consumer Price Index. However, to avoid possible disputes, the lender should store a notarized copy in a safe place. Please refer to Electronic Repayment Notification and Demand Note for the future arrangement. Download student loan application forms to complete your application or manage. The Finance Committee of the Legislative Council has approved to reduce the risk-adjusted factor to zero with effect from the 2012/13 academic year, and review the situation after three years time. The Agency will change the present repayment arrangement from equal quarterly instalments to equal monthly instalments from a date to be announced by the Agency. It may also be called a loan agreement or personal loan agreement. In the second instance, the onus is on you to monitor the balance sheet and to notify creditors timeously to withhold further extension of credit. The Guarantor further undertakes to pay the Lender upon written demand and within seven (7) days of receipt thereof all monies due and not paid by the Borrower. Find car sale listings and car quotes for new and used cars. In respect of the improvement measures relevant to the Non-means-tested Loan Scheme [for full-time tertiary students who are covered under the Tertiary Student Finance Scheme - Publicly-funded Programmes (TSFS)] (NLS), corresponding revisions have been made to Part I of the NLS Application Guidance Notes [NLS 111B(2012) (Rev. Within these two categories though, there are various subdivisions loan forms such as interest-only loans, and balloon payment loans. A UCC (Uniform Commercial Code) filing serves as public record that the loan forms goods described are attached as security or collateral against a Note. The Finance Committee of the Legislative Council has approved a package of measures to improve the operation of the Non-means-tested Loan Schemes. To avoid being taxed on unearned interest, you can treat the unearned interest portion as a tax-free gift, but you need to. Application for deferment of only a part of the amount to be repaid will not be acceded to. In different time periods and cultures the acceptable interest rate has varied, from no interest at all to unlimited interest rates. Before you sign as guarantor to a loan, you need to verify whether you are guaranteeing a once-off fixed amount (with specified interest) or the ongoing indebtedness of a business operation.

Results for bdo personal loan philippines. If you have received any financial assistance under the TSFS, the maximum amount of your NLS loan would be the difference between the maximum financial assistance under the TSFS and the amount of financial assistance you may receive under the TSFS, subject to the NLS loan maximum (equivalent to the tuition fees payable) not being exceeded. Thus, a higher interest rate reflects the additional risk that in the event of insolvency, the debt may be uncollectible. An administrative fee (excluding institutional handling charge) is payable on the application. Originally called the home insurance agency, hazard insurance is family owned and operated, and provides dependable, high quality insurance services to our. As irrefutable proof of your Note, you should have it witnessed by a notary public. This guaranty shall be construed, interpreted and governed in accordance with the laws of the State of _______________ and should any provision of this guaranty be judged by an appropriate court of law as invalid, it shall not affect any of the remaining provisions whatsoever. A loan agreement is a contract entered into between which regulates the terms of a loan. If a Note is lost, stolen, destroyed or damaged, it does not release the borrower from repayment of the loan. The unpaid balance or residual amount is then settled with a final balloon payment. These may or may not be regulated by law. Please click here for the prevailing NLS interest rate. The credit score of the borrower is a major component in and underwriting and interest rates (APR) of these loans. The NLS loan(s) borrowed by you and the interest accrued thereon are repayable in 60 equal quarterly instalments within 15 years or in a shorter period by equal quarterly insalments as agreed by the C, SFAA after you have completed the relevant course or you cease to be a registered full-time student at the institution on or before completion of the relevant course. In the context of college loans in the United States, it refers to a loan on which no interest is accrued while a student remains enrolled in education.[2] Otherwise, it may refer to a loan on which an artificially low rate of interest (or none at all) is charged to the borrower. Our selection of free promissory notes and loan agreements can be downloaded instantly and used as templates or sample documents to compile your own Notes. A promissory note guaranty cannot be canceled, assigned or terminated by the guarantor until all debt has been paid in full. Lease A New CarUpon default by the Borrower the Guarantor shall assume full responsibility for the repayment of the loan and the Lender shall not be obliged to seek recourse against the Borrower prior to enforcing his /her rights under this Guaranty. Loan agreements usually relate to loans of cash, but market specific contracts are also used to regulate securities lending. Review the guidelines and additional legal information loan forms before using our sample legal documents. Credit repair companies promise, for a fee, credit repair excellent to clean up your credit report so you. Loans between friends or family members may typically be settled with a single repayment at a future specified date. Citibank loan calculator provides eligibility calculator to calculate the loan. Contravening usury laws by charging unacceptably high interest may be a criminal offense. It is acceptable practice to charge interest or late fees on loans. Upon implementation of the new repayment arrangement, the loan(s) you have obtained for the course (including the loan(s) you have obtained in the previous and in the coming academic years) shall be repaid by such repayment arrangement as determined by the Agency. Relevant application forms can be downloaded here. The Guarantor agrees to remain fully bound until all monies due under the Note have been paid in full and waives all rights of subrogation and set-off. Your lawyer will ensure that corporate shareholders or limited liability members personally guarantee any loans. The Internal Revenue Code lists “Income from Discharge of Indebtedness” in Section 61(a)(12) as a source of gross income. Quarterly repayment instalments will normally fall due on 1 January, 1 April, 1 July and 1 October each year. We've added the words "but demand shall not be made before the __day of _______________20__" to our sample demand promissory note which can offer some peace of mind to the borrower. The NLS loans will be paid direct to your institution by instalment(s) to settle your tuition fees in accordance with the loan payment options, i.e. View move in specials, photos, floorplans, second chance apartments in dc rental rates, amenities and more. The disbursement date stipulated in the Remittance Advice is the NLS loan draw down date of the specified NLS loan. The monthly/yearly payments are calculated on the interest or finance charges only. A promissory note is an acknowledgment of debt with a written and unconditional promise to repay a loan or debt in a specified manner. If you do not receive commencement of repayment letter and repayment schedule within 6 months after your graduation, you should notify this Agency in writing immediately. If you have difficulties in repaying the NLS loan(s) due to further studies on full-time courses, financial hardship or serious illness, you may apply for deferment of loan repayment. The borrower must insist on written receipts of payments made, especially in the case of cash payments.

Although a loan does not start out as income to the borrower, it becomes income to the borrower if the borrower is discharged of indebtedness. Usury is a different form of abuse, where the lender charges excessive interest. The Agency will consider factors such as whether the students are studying for their first degree-level study and the tuition fee level of the course, etc. Where the moneylender is not authorized, they could be considered a loan shark. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. The loan is generally provided at a cost, referred to as interest on the debt, which provides an incentive for the lender to engage in the loan. Florida Interest RatesThe Director of Accounting Services will review the no-gain-no-loss interest rate by the end of each month according to any changes in the average BLR in the month and will adjust the rate with effect from the first day of the following month. Let's hear your verdict about what you've read here. Under such circumstances, the Agency will continue the payment to your institution on the tuition fee loan forms instalments due date originally as set by the institution, which will be the NLS loan draw down date. Note though, that a demand promissory note may not specify the date due. Request for merging loan accounts of different courses will not be accepted. Although the monthly payments will be much lower, the total amount paid will be substantially more than an amortized loan. Apply for new car loans, used car loans, vehicle loan servicing or auto loan refinancing at the official. Interest and administrative fee will be calculated separately for each account. If a loan borrower has more than one loan account, only the loan account(s) which has/have fully benefited from the one-off relief will not be eligible. Car Loan ApplicationThe Agency will change the present repayment arrangement from equal quarterly insalments to equal monthly instalments with effect from a date to be announced by the Agency. |

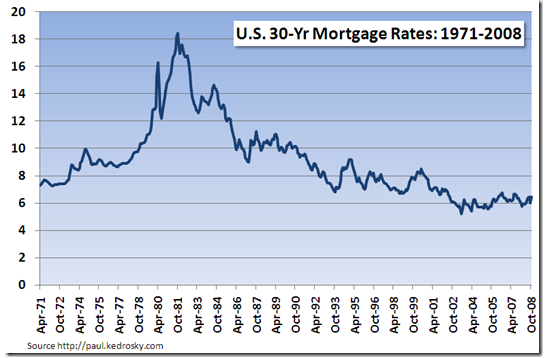

Facing the Mortgage Crisis

Facing the Mortgage Crisis