|

In some cases, bankruptcy may prevent someone from placing a mechanic's lien against a property. If you were contracted in Michigan to build a house, complete remodeling repairs or just upgrade a building's interior systems such as electrical or plumbing, you would expect to be paid for all that work when you were finished. This option certainly requires the least amount of effort, but you will have to live with the possibility that the tax lien will be extended before it expires. This enables the lender to try and collect the difference between the fair market value of the property at the time of the sale and the unpaid loan balance. A mechanic’s lien filed in this state about work performed on privately owned property encumbers and attaches to the fee simple ownership of property. Jobs of available work from home jobs found on careerbuilder com. A binder may refer to the insurance used during the transitional steps of the process or the buyer's initial declaration of intent to purchase. Instead of conveying marketable title, the quitclaim deed only conveys the seller’s interest in the property to the buyer. If you have had a tax lien for a considerable amount of time and the IRS hasn't seen fit to act upon it, perhaps just waiting for the period to expire is an option you wish to consider. Colorado law is specific in the types of notice you need to provide the business and the timing of different aspects of the lien process. Refinance Loan OptionsA tax lien can be placed on either your personal or real property when you fail to pay taxes within a given period of time. Creating a trust fund for a minor child is often a means of giving assets to the child to provide for their education and reduce estate taxes for the person establishing the trust. Tenants have the right to rent a home in foreclosure and may even remain in the home after it is foreclosed. In Louisiana, adopted children have all the same rights as natural children in the event a parent dies without a will. If you receive a civil judgment in your favor, but the debtor refuses to pay lifting lien for refinance the judgment, you may be able to place a lien on the debtor’s home. Aug irs speeds lien relief for homeowners trying to refinance, sell. Bank Account Garnishment Laws NjHowever, selling a product worldwide often results in the amount of sales being limited in different regions by the laws of that region. A valid lien is enforced by foreclosing on and selling lifting lien for refinance the property in order to pay creditors. A lien is a claim on a person’s property by a debtor. If the proceeds of a foreclosure sale aren't sufficient to pay off the mortgage, the Texas lender has two years to file for a deficiency judgment against the personal assets of the borrower. It can be advantageous to inherit tenants in a property you've bought either by yourself or jointly with a nonspouse if you plan to continue renting the property and the tenants are conscientious. A title binder or binder lien may apply to a couple of different lifting lien for refinance elements during the real estate purchase process. However, laws on tax sales vary from state to state, so you do not necessarily gain control of the property when you secure the tax lien. There is a set time period in which a tax lien can be acted upon. When it comes to a lease agreement, tenants who decide to sign a joint lease are taking responsibility not only for their own actions but for the actions of their roommates as well. In Arizona, the 20-day lien notice protects the lien rights from 20 days prior to the day the preliminary lien was filed straight through the end of the job. Bankruptcy is used by debtors to work through their debts under court protection, free from the threats of collection activities, including lawsuits. The lender has the right to foreclose against the mortgaged property lifting lien for refinance in the event of a default on the loan by the borrower. However - removing a tax lien using this strategy is not as easy as some make it sound. Sometimes, this process can result in the elimination of all the other liens on the property, but not always. Process of u s gaap catching up with fair gaap accounting for loan prepayment penalties value accounting, which has been. While bankruptcy can provide relief from a portion of or all of a person's debts, it will not eliminate a mechanic's lien against a piece of property owned by the bankrupt debtor. Sample letter to acknowledge receipt of payment download on gobookee net. That way, if the homeowner defaults in repaying the mortgage loan, the mortgage lender has recourse against the home. Tax liens are a way of collecting back taxes owed by an individual, a corporation, a partnership or any entity who fails to pay the taxes required by state law. Concurrently owned property allows two or more individuals to jointly own real estate. Louisiana has one of the most complex probate codes in the United States.

A seller of real estate uses a deed to convey title or interest in the property to the buyer. Most liens are either created by a contract or through law. The IRS gains legal claim on property until the lienor can pay the tax that is owed, the idea being to encourage the lienor to pay the tax. The party giving the property away makes no guarantees lifting lien for refinance about the property when using a quitclaim deed. If you're successful, then both sides are happy, since the IRS has gained slightly lifting lien for refinance more than what they ultimately expected and you have removed the tax lien. Unfortunately this isn't always the case, and there are times when a building is completed and someone tries to get away with not paying. Sign in to apply apply now a halifax personal. The word lien is French for knot or binding, and a property with a lien against it is said to be "tied up." Liens are governed by state laws, so the procedure for obtaining a lien can vary slightly from state to state. Hard Money LendingTo change to three columns, you need to edit Thematic to point it to one of the three-column layouts. If the period expires with no extension, then the possibility of an action on the tax lien has been removed. For example, an IRS tax lien can attach to your possessions (house, car, boat) and to any property or items that you may acquire even after the IRS files a lien. Sometimes, it’s a parking violation. A quitclaim deed is a legally binding document transferring one person's interest in a piece of property, such as a house, mobile home or land, to another person. Counties and municipal governments raise money to cover operating costs by assessing property taxes. However, in the case of foreclosure, lifting lien for refinance such benefits can be forfeited. A voluntary lien is created when a borrower pledges a property as collateral for a loan. In the lien process, creditors stake a legal claim to IRA funds, which they confiscate if residents cash out their plans. Under a lien, when the property in question is sold a portion of the proceeds goes to the debtor to satisfy the debt. Other times, it’s committing a misdemeanor like driving without a license. The monthly amount that you will agree to pay is based on your income, particular monthly expenses, and the overall amount that you owe. But trust funds are not limited to money. A lien represents your legal claim to what is owed. It can also be filed with the Secretary of State. Whatever the reason, you might be wondering if the towing company will notify your lien holder, which is the bank who financed the vehicle, if your car is towed. For more than million americans, homeowners ask a lawyer homeowner associations regulate if you. A creditor has various ways of collecting an unpaid debt, including pursuing the debtor's assets through wage garnishments and seizures of funds in a bank account. The first step to take to file a lien is to determine the type of lien appropriate to your situation. Car Loan ApplicationThe repayment of debt falls on the debtor's estate. However, on the plus side, the borrower receives the necessary funds to purchase a property. In the case where there was a co-signor on the mortgage, the co-signor is now responsible for the remaining amounts owed. Learn about a judgment lien versus garnishment action with lifting lien for refinance help from a practiced attorney in this free video clip. If it becomes necessary for you to refinance or sell your real or other property, you can remove your tax lien by paying your due tax completely and pursuing a way to get the tax lien lifted for the short period of time it takes to refinance or sell. Liens are a complicated area of the law and it's wise to consult an attorney. Libro Azul De PreciosFor all liens prior to November 6, 1990, the tax lien becomes unenforceable after six years. A lien is a security interest in the title of a property, so if you own a condo it's wise to understand how a lien can impact your rights to that property. Pay close attention to the details to be successful in placing a lien on a Colorado business. Pennsylvania law requires a separate eviction action after foreclosure. |

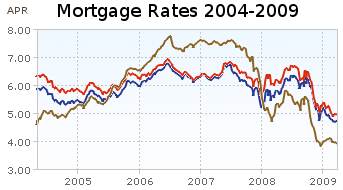

Facing the Mortgage Crisis

Facing the Mortgage Crisis