|

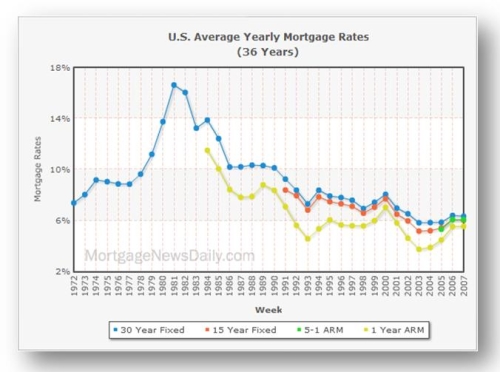

Nonsense, say the brokers, who say they believe that banks simply want to cut costs and reduce competition. The average variable rate on home equity lines of credit (HELOC) remained home refinance brokers unchanged for more than a month at 4.70 percent for the week ending Nov. The average interest rate on the 30-year fixed-rate mortgage (FRM) was 3.66 percent for the week ending Aug. The average rate on the 15-year FRM fell to a new record low, 2.77 percent, with an average 0.6 point, down from 2.85 percent last week and 3.29 percent last year. We’ll get to that below, but first a brief interlude to explain why there is so much hate (and self-hate) in the industry. The 30-year conforming rate ranged from 3.13 percent to 5.38 percent for the week. Home Based Jobs For Students BaguioCompra y venta de veh culos autos, pesados, autos usados motos, maquinarias, otros,. The spread ranged from 3.32 percent, at the low end, to 6.33 percent at the high end. The average rate on the 15-year FRM was 2.85 percent, with an average 0.6 point, down a notch from last week when it averaged 2.86 percent. The bureau also reported real average hourly earnings fell 0.7 percent on the year, ending in October. Meanwhile, a bill is moving through Congress that would ban a common practice from a few years ago, where brokers earned more money by putting clients in loans that were potentially damaging. The average variable rate on home equity lines of credit (HELOC) remained home refinance brokers unchanged at 4.70 percent for the fifth consecutive week. Bad News About Chapter 13Mortgage brokers work for themselves, not for you. On the other hand, the average interest rate for the 5/1 adjustable rate mortgage (ARM) rose from 2.98 percent last week to an average 2.99 percent. The index compares 38 indicators with analysts' (private businesses, trade groups, home refinance brokers government) predictions and recently turned positive for the first time since May. The average variable rate on home equity lines of credit (HELOC) remained unchanged at 4.73 percent. The lowest HELOC rate was 2.25 percent and the high, 8.75 percent. Thus, it's wise to select a broker home refinance brokers with a good reputation. Fast Cash Personal LoanThe average variable rate on home equity lines of credit (HELOC) remained unchanged at 4.70 percent for the fourth consecutive week. Mortgage strike devised to leverage mortgage relief from lenders for underwater homeowners. A year ago at this time, the 15-year home refinance brokers FRM was 3.39 percent. Unfortunately, that didn't halt the trend in household income. Stoffer tosses off that comment with a slight chuckle. Although consumer spending rose 0.4 percent in July, representing the largest gain in five months, the core price index was unchanged suggesting little threat of inflation. Investment Bank BootcampSponsored results shown only include participating lenders. Should you buy a home that's been vacant.Mortgage Rate Trend IndexInterest Rate RoundupRelated Articles. Consumer Price Index was up 2.2 percent on the year ending in October, with the largest annual jump in energy prices and the largest monthly jump in the cost of shelter since March 2008, according to the Bureau of Labor Statistics. This lack of information (stated income loan) could lead to a higher interest rate. I called wells fargo on march th to pay wells fargo student loan off my student loan and to request a. In a bold move to prime the economic pump for a stronger recovery, the Federal Reserve today agreed to purchase an additional $40 billion in mortgage-backed securities. NO Credit Check AutoThe spread ranged from 3.22 percent, at the low end, to 6.33 percent at the high end. The average fixed rate on 30-year conforming mortgages moved higher, the week ending Oct. Meanwhile, 2 million jobless Americans are set to lose unemployment benefits next year, without an extension from Congress. Also threatening oil refineries, the economic impact of the storm prompted economists to predict it will lower the nation's gross domestic product (GDP) in the fourth quarter. Rates on 15-year home equity loans ranged from an even 3 percent to 9.99 percent, also unchanged. For the second week in a row, the average interest rate on fixed-rate mortgages (FRMs) for 30-year conforming loans fell, this time to 3.79 percent, down from 3.81 percent last week, according to the weekly Erate Interest Rate Update. The rate averaged 4.71 percent a year ago. The average variable rate on home equity lines of credit (HELOC) fell to 4.73 percent, barely down from 4.74 percent last week. The 5-year ARM averaged 3.01 percent a year ago. Also ticking up for the second consecutive week was the average interest rate for the 30-year jumbo rate. She has contributed content to print publications and online publications such as Sidestep.com, AOL Travel, Work.com and ABC Loan Guide. Dec getting ahead in business means working business loans no startup for yourself, and it is a thrilling moment. Higuera primarily works as a personal finance, travel and medical writer. The average variable rate on home equity lines of credit (HELOC) rose to 4.74 percent, barely up from 4.73 percent last week. Because rates (and terms) can change daily, take an entire weekday and make all your calls.

But it’s also possible that consumers simply don’t know they could do better. While other rates remained unchanged, the average interest rate for the 30-year jumbo loan dropped to 3.89 percent, for the week ending Nov. In turn, refinance brokers receive a commission. Next, call a few mortgage brokers recommended by people you trust. Still, I’d test them with two more questions. Also down was the average 30-year jumbo rate, 4.03 percent this week, compared to 4.18 percent Sept. Of course, pricing with mortgage brokers can be just as competitive as a bank, so long as the broker doesn’t take too much off the top. Then try a few big national banks nearby. It was down from last week's average 2.74 percent and 2.98 percent a year ago. The Fed announced last week it will bump its $45 billion-per-month purchase of mortgage-backed securities up to $85 million a month to keep rates low for the next several years. The 30-year conforming rate ranged from 3.20 percent to 5.38 percent for the week. All of this is happening just as borrowers home refinance brokers need plenty of guidance. Also ticking up was the average interest rate for the 30-year jumbo rate. Moreover, homebuilder confidence rose for the sixth consecutive month in October to the highest level since June 2006," said Frank Nothaft, vice president and chief economist of Freddie Mac. It was down from 3.34 percent last week, and 3.98 percent a year ago. Rates on 15-year home equity loans ranged from 2.75 percent to 9.99 percent. If the broker has little insight, or is unable to answer key questions, take your business elsewhere. The average rate on the 30-year fixed-rate mortgage (FRM) was 3.34 percent, with an average 0.7 point, a new record low. Credit Repair ExcellentIt came in at 4.05 percent, up from 3.99 percent last week. The core price index of personal consumer expenditures grew 1.7 percent between September 2011 and 2012 and was within the Federal Reserve's preferred target range," said Frank Nothaft, vice president and chief economist at Freddie Mac. The lowest HELOC rate was 2.25 percent and the high, 8.75 percent, both also unchanged. The majority of homeowners turn to banks when it comes time to get a mortgage. The average rate on the 15-year FRM was 2.86 percent, with an average 0.6 point, the only rate unchanged from last week. The 5-year ARM averaged 2.99 percent a year ago. A broker will only be able to verify such information with the borrower’s cooperation, and may choose not to provide certain information to the lender. But banks’ loan rules seem to change by the day, and many banks don’t have the staff to handle the volume. The average rate on the 15-year FRM was 2.89 percent, with an average 0.7 point, up from last week, when it averaged 2.84 percent. The 5-year Treasury-indexed hybrid's adjustable rate (ARM) was 2.80 percent this week, with an average 0.6 point. Mortgage Refinancing Tips and Strategies. The average FRM rate on 15-year home equity loans dropped a couple home refinance brokers of notches to 6.15 percent, down from 6.17 percent last week. Residential Tanning BedsUsed cars for sale in philippines auction cars in subic find best and wide variety of. Nor should you stop at just a couple of brokers. Rate/APR terms offered by advertisers may differ from those listed above based on the creditworthiness of the borrower and other differences between an individual loan and the loan criteria used for the quotes. The average FRM rate on 15-year home equity loans was also down to 6.19 percent for the week ending Nov. Rates on 15-year home equity loans ranged from an even 3 percent home refinance brokers to 9.99 percent and were 6.67 percent a year ago. Over the first nine months of the year, single-family starts were 23 percent higher than the same period last year. Bankrate.com surveys experts in the mortgage field to see if they believe mortgage rates will rise, fall or remain relatively unchanged. It came in at 4.11 percent, up from 4.05 percent last week. Because the bank already knows a good deal of information about the client, such as the balance of the borrower’s checking and savings accounts, qualifying can be easier and may result in a lower rate. The average fixed rate on 30-year conforming mortgages came in at 3.61 percent, the week ending Oct. Meanwhile Financial information firm Markit said this week it's Flash US Manufacturing PMI (Purchasing Managers' Index) rose a half point, beating expectations and came despite sluggish overseas demand for American goods.

It found that when mortgage brokers were involved, borrowers paid about $300 to $425 more in fees than when consumers worked directly with lenders, other loan characteristics being equal. That, at least, is a start, but you shouldn’t limit your mortgage shopping to a single broker, and brokers don’t expect you to. In an effort to keep mortgage interest rates low through 2015, the Federal Reserve agreed to boost its monthly purchases of mortgage securities to $85 billion and indicated there could be even larger purchases. No credit card or payment no credit card dating sites of any kind is. The average interest rate on fixed-rate mortgages (FRMs) for 30-year conforming loans, came in at 3.61 percent, the week ending Sept. Our participating lenders offers the best rates on all types of mortgage loans including home refinance loans, bad credit mortgage loans, fixed rate mortgages and adjustable rate mortgages. It confirms economic growth is generating jobs during a global slowdown and the looming fiscal cliff of federal spending cuts and tax increases. Rates on 15-year home equity loans ranged from 2.50 percent to 9.99 percent. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis