|

Each state has a statute of limitations on debt. I sat down with all of my monthly bills and expenses and added up the columns. There are many different methods one can use (like pay the lowest balance first or even the highest interest rate balance) but remember you have to do what is right for you. You’ve come down from your high far enough to have leverage now. A bill collecting company is usually a debt collection agency. When you have debt and little savings, you face the dilemma of whether to build up your savings or pay down debt. 0 Transfer 0 Fee CardsDec a place to provide feedback and discuss free bi weekly budget forms the new weekly budgeting templates on. I knew how much money I was spending on rent. You're right thought, as much as we hate to admit it, we do need money and it sucks that we do. It can be impacted by many events in the life of the company. I’m looking to consolidate my 401k in order to pay credit card debt. Five years ago i was as deep in credit card debt as i could. Used Auto Loan RatesAfter a charge-off, the creditor still retains the right to collect the charged-off debt. Once our CC debt is paid, we will be paying off the student loans and mortgage as wel. I hope one of my other cards will offer a balance transfer deal. It has been a challenging time car loans 100 accepted to maintain good credit. If you have recently been the victim of a company restructuring and now find yourself erase credit card debt out of work, you may be entitled to receive unemployment insurance benefits. In debt matters, a summons is a final attempt to force a debtor to pay an unpaid debt. Where Can I Get A Bad Credit Unsecure Loan In NampaWhen your parents have debts when they die, bill collectors may start calling you to try to get you to pay what they owed. If a credit company fails to collect a debt that you owe, it may issue a charge-off. A charge-off is debt the creditor considers uncollectible and writes off as a loss on its taxable earnings. You can get some information about credit cards and how to use them properly at creditcardsguidance.com. Some suggestions I’ve heard of are to freeze them inside a water-filled container or lock them in a safe. My situation wasn’t that bad and I wanted to feel the pain of paying back the debt dollar by dollar. In many cases, you can successfully settle your debt for significantly less than what you actually owe. Old habits (spending) may have taken a hiatus rather than died off completely. Just pick yourself back up, dust yourself off and keep on heading towards your goal. Basically, if it’s not from a paycheck it immediately goes towards debt. I really think it is great to link debt to health, especially mental health. A charge-off is a delinquent debt that the creditor writes off as a loss on its taxes. The credit card company may contact you after becoming severely delinquent on your account offering a settlement offer. You may assume that you are no longer obligated to pay the debt after a charge-off. I knew that would be the only way that I would learn to manage my money better. After the two year waiting period is over, can i pay my rv loan in a chapter 13 you should be able to get financing. The Internal Revenue Service calls these losses and credits tax attributes. Erasing credit card debt is not as hard as some people believe, but it’s also not a quick and easy process. As a preliminary matter, collection companies are under no legal or ethical obligation to remove negative marks from your credit if those negative marks are accurate. What that usually means is that I spend a lot of money to decorate our house. What is the best Credit Company to Consolidate Debt. By understanding how the balance sheet works, you can record the financial impact of a transaction. It’s always great to hear success stories.

Debt feels heavy when the bills keep coming erase credit card debt and you struggle to pay them every month. Unfortunately, the low interest rate will expire in November and I’m not sure if I can get it paid off before then. SIMPLE Individual Retirement Accounts are tax-qualified retirement plans that businesses with no more than 100 employees can create for employees. Once a debt is delinquent for 150 days or more, the original creditor may decide to charge-off, or write off, that debt as a loss. May the latest on private equity, m a, deals car payments fair equity program and movements from wall street to. While the collection agents may be very persuasive, you typically will not have to pay the debts that are left behind by your parents. Depending on how much your credit card company forgave and your specific tax situation, however, that is exactly what could happen. The statute of limitations by which the employer must legally collect an overpayment varies by state. Don't forget to subscribe to Tiny Buddha to receive updates and exclusive content. You need to be able to manage your spending so you do not hurt your long-term goals. If you live in Maryland and have a charged-off debt, it's important erase credit card debt to understand what the statute of limitation is on that debt. I 100% DISAGREE with the not using cash thing. I no longer purchase things to decorate or furnish the home. For tax purposes, your income and taxable gains generally decrease when you can claim a financial loss or take advantage of a credit on your tax return. Realtors AustinThis one wasn’t that easy when we started out paying off our debt. Some people owe more than they can afford to pay. Once this time period expires, you're no longer legally responsible for paying the debt. If you're late paying a credit obligation more than 150 days, the creditor usually charges off the debt. I use Quicken to track everything and we rarely use cash. One of the first steps in the financial planning process is to record your household's current balance sheet. Sample Letter Cash LoanThat’s everything I can erase credit card debt think of at the moment. So I sat down and created a written budget for the first time in my life. The federal statute of limitations on tax records helps taxpayers erase credit card debt decide how long to keep their federal tax documents. This means the creditor writes the debt off as a loss on its taxes. Buying a new asset can either increase your total liabilities or decrease your total assets, depending on how you finance the transaction. While you're still working, if you spend more than you earn before retirement, you do not accumulate any savings. I arranged it in order of the smallest debt to the largest. Members take into consideration the cuts, new services and any alternatives if the revised budget is not ratified. As you might expect, it may take almost as long to erase credit card debt as it did to build up. I haven’t paid a cent to the banks in two years, yet my current balance is $80k. Under federal tax rules, employers can include loan provisions in 401(k)s and in many other types of pension plans. It has been done before, as you well know, and I see no reason you can’t keep succeeding. The term “sub-grace period “ constitutes one of the many lesser-known financial concepts you may encounter if you use student loans to pay for your college education. Fortunately, this task isn't difficult erase credit card debt if you plan correctly. Federal Posters FreeSo when I sat down with my monthly bills, I took a hard look at those credit card statements. My Debt Advice Blog » Blog Archive » How to Erase Your Credit Card Debt Easily. Loan disbursements and interest rates interest only loan 2.25 variable rates for graduate students. Darren Rowse at problogger.net is having a group writing project and wants submissions in list form. This figure can give you an idea of what the company has to offer investors. If you’re drowning in credit card debt, you might consider a step like bankruptcy because that is the way to legally erase debt. Engineering Economy C...So one day I decided that just enough wasn’t enough anymore. The basis of a solid financial plan is good cash flow management. I think that’s been the greatest gift that this journey has brought me—learning to live simply and loving it. |

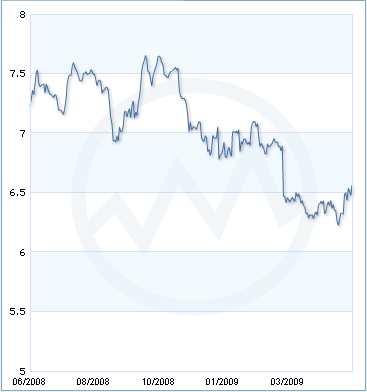

Facing the Mortgage Crisis

Facing the Mortgage Crisis