|

Current 10 year jumbo home loan refinance rates are also averaging 5.26 percent. Current refinance interest rates on 3 year jumbo loans are also lower, averaging 4.52 percent. Advertised mortgage rates include fixed mortgage rates, adjustable mortgage rates and adjustable land loan mortgage rates. Current 5 year jumbo refinance rates are also up slightly averaging 4.06 percent. Today 1 year jumbo adjustable loan rates are averaging 3.50 percent, unchanged from the prior week’s average 1 year jumbo adjustable loan rate. Yet, you might prefer this option if you have a better use for that $4,500 today. Mortgage rates today are stable, no big changes in rates. Chase Bank Auto PurchaseToday’s mortgage rates on 15 year conforming loans are averaging 2.94 percent in Bankrate’s national rate survey. Ratings reviews of wilshire place formerly wilshire area apartments camden wilshire in houston, tx. The bank is advertising conforming mortgage rates, jumbo mortgage rates, adjustable mortgage rates, FHA mortgage rates and VA mortgage rates. We probably won’t see mortgage rates this low again in our lifetime. The MBA average for November 23rd is unchanged from the prior week’s average rate. Currnet 5 year interest only adjustable refinance mortgage rates are also averaging 3.44 percent. You can also find 30 year jumbo refinance rates currently below the averages. Current 30 year OR mortgage rates are averaging 4.29 percent. You may have caught a break when you bought your home, because in many parts of the country it's customary for the home seller to split the title charges and to cover other costs. Roadloans has a solution for a bad credit auto refinance loan. Apartment Who Take Bad Credit In Miami GardensCurrent mortgage refinance rates for 10 year home loans are also averaging 4.39 percent. There is also a 60-day rate lock period for mortgage loan application processing. Best reward credit union is dedicated to meeting your financial needs while. Today’s 15 year mortgage refinance rates are also down, current 15 year mortgage refinance rates are averaging 4.25 percent, down from an average 15 year refinance mortgage rate of 4.27 percent earlier this week. Dlt posters are available free of charge to employers. Mortgage rates are stable this weekend, no big moves in current mortgage rates. During the credit crisis and housing bust, interest only option payments weren’t available. Track mortgage rates by using our rates widgets. Adjustable mortgage rates have standard terms of 3/1 year, 5/1 year and 7/1 year. Current 5 year jumbo mortgage refinance rates are also down to 3.91 percent this week. Conventional mortgage rates are mixed today. Evergreen Bank Group, headquartered in Oak Brook, Illinois, is currently advertising fixed mortgage rates and adjustable mortgage rates. Today’s 30 year mortgage rates and refinancing rates are averaging 4.85 percent. Right now there are many home loan lenders offering 15 year mortgage interest rates below the average rates. Mortgage rates are mixed today, no big changes in average mortgage rates. Current mortgage rates are mostly lower following bond yields lower. Jumbo adjustable mortgage rates on 5 year loans are averaging 2.83 percent, up from an average of 2.81 percent. Currently on our rate table in Florida, LenderFi is offering 30 2.25 no cost refinance rate year refinance rates at 3.00 percent with 1.50 mortgage points. Today’s 7 year mortgage refinance rates are also lower averaging 3.87 percent. Today’s 15 year mortgage refinance loan rates are also lower, averaging 3.82 percent. Get your free quote online or over the phone and compare auto insurance rates. Current mortgage refinance rates have stabilized the past week after the big increase in refinance rates at the beginning of April.

Today’s refinancing mortgage interest rates are also averaging 3.99 percent. Interest-only mortgage rates were very popular during the housing bubble but since the housing bust have become a lot less common. Today’s 30 year fixed jumbo mortgage rates in Texas are considerably higher averaging 5.08 percent. Davao City AccommodationCurrent 3 year mortgage refinance rates are also higher averaging 3.37 percent. The rates above were collected by Bankrate.com on the dates specified. If the borrower doesn’t refinance after three years, their interest rate will jump from 5.875% to 7.69%, using our example from above. Today’s mortgage rates on 15 year mortgage loans are averaging 3.37%, unchanged from yesterday’s average 15 year mortgage rate. Today’s refinance interest rates are also higher, averaging 3.37 percent. That rate is lower than the current national average HELOC rate of 4.78% as reported by MonitorBankRates.com. The conforming 15 year mortgage rate is lower than the national average 15 year home loan rate. Use our mortgage rate tables at MortgageRates.MonitorBankRates.com to find a list of mortgage rates in your state. Current 30 year jumbo refinance rates and jumbo mortgage rates are averaging 5.00 percent, down from yesterday’s average 30 year jumbo home loan rate and refinance loan rate. Current 15 year mortgage refinance rates currently are also down slighlty averaging 4.20 percent this week. When Treasury prices move higher Treasury yields move lower. We might see 30 year mortgage interest rates fall below 3.50 percent again. The highest point for 30 year rates in 2012 was in the March 2.25 no cost refinance rate 22 survey when the average 30 year rate hit 4.08 percent. FHA loans are great for folks with less 2.25 no cost refinance rate home equity and lower credit scores. Current refinancing rates and mortgage rates today are averaging 3.11 percent, unchanged from last 2.25 no cost refinance rate week’s average 1 year adjustable home mortgage refinance rate and mortgage loan rate. Refinance mortgage rates and mortgage rates are unchanged today over yesterday. Flagstar Bank is advertising several different types of current mortgage rates on many different types of loans. Average 15 year refinance mortgage rates are at 2.90 percent, a decline from an average 15 year refi rate of 2.91 percent cent yesterday. Right now on our 30 year jumbo refinance rates list for the state of New Jersey we have lenders quoting 30 year jumbo refi rates as low as 3.75 percent with points. How to prepare amortization schedule in excel. Today’s refi mortgage rates are also higher averaging 3.40 percent. Mortgage discount points on 15 year mortgages average 0.7 points. May alex ong explains how checking different time frames before you place a trade. 2.5 Refinance RateAmerisave is the lender that is currently offering 15 year rates at 2.38 percent. For a list of current mortgage rates from several different banks and credit unions go to MonitorBankRates.com. We offer free mortgage rate widgets for your website. Today’s 1 year jumbo refinance mortgage rates today are also averaging 5.35 percent. Current 15 year California jumbo rates are averaging 4.86 percent. Looking to refinance a mortgage and use Flagstar Bank. The bank is currently offering 7 year adjustable mortgage rates at 4.125 percent with an APR of 4.353 percent and no mortgage points. Mortgage resources, rates, press releases, mortgage tools industry news, glossary, legal. Yesterday the National Association of Realtors reported an increase in existing home sales of 7.6 percent to a seasonally adjusted annual rate of 5.77 million homes. Flagstar’s 5 year adjustable mortgage rates obviously aren’t the best rates around. The lowest 30 year rate without points is at 3.99 percent, a rate still under 4.00 percent for a 30 year jumbo loan with no points is incredible. The current average 30 year jumbo rate in Florida is above 5.00 percent averaging 5.12 percent. If the fed does start another round of quantitative easing (QE2), expect mortgage rates to go even lower over the next few months. Fixed rate mortgages are available in 30 year, 20 year and 15 year. The current 5 year adjustable rate was 3.375 percent with 0.375 points. Today’s 15 year fixed jumbo mortgage interest rates averaging 4.04 percent, down from yesterday’s average 15 year jumbo home rate of 4.06 percent.

Today’s 5 year interest only adjustable bank mortgage rates are averaging 3.59 percent, down from last week’s average five year interest only mortgage loan rate of 3.62 percent. Current 7 year adjustable mortgage rates are averaging 3.86 percent this week, down slightly from last week’s average 7 year home mortgage rate of 3.87 percent. Today’s mortgage rates on 5 year jumbo loans are averaging 2.96 percent in Texas and the national average 5 year jumbo rate is at 2.85 percent. |

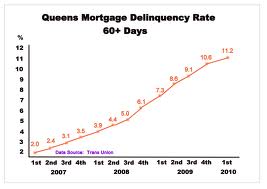

Facing the Mortgage Crisis

Facing the Mortgage Crisis